Auto logout in seconds.

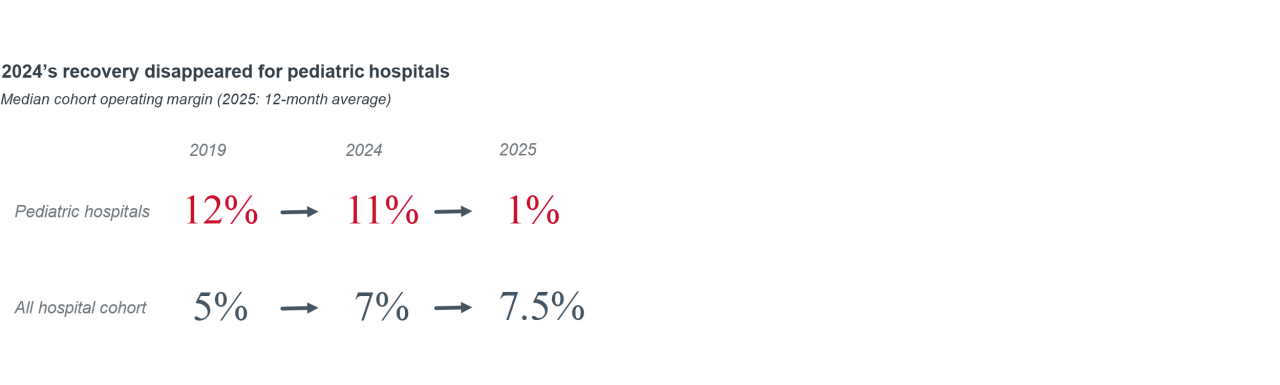

Continue LogoutWhile freestanding pediatric hospitals make up roughly 5% of total hospitals, they face unique challenges as the One Big Beautiful Bill Act (OBBBA) comes into effect.

All told, pediatric hospitals are in a similar situation to their adult peers in that they must plan across the near- and long-term using potentially divergent strategies. However, pediatric facilities face unique challenges due to their greater dependency on public payers and faster pace of outpatient shift.

This briefing captures Advisory Board’s analysis of the financial impact on pediatric hospitals as well as insights gleaned from an inaugural roundtable on pediatric hospitals, spearheaded by Optum Advisory.

Data sources

This report was developed using data from Syntellis Market Insights, which is sourced directly from business systems at more than 1,300 hospitals. Unless specifically noted, all data in this report comes from Syntellis Market Insights.

We used a rolling 12-month year to include the most recent available data ending in September 2025. For provider segments, we used existing Syntellis Market Insights presets and designations for provider type. The sample sizes for various hospital populations and parameters ranged from 600 to 21.

A challenging road ahead for our pediatric hospitals

The One Big Beautiful Bill Act (OBBBA) potentially reduces Medicaid spending by $910B and is projected to increase our nation’s uninsured population of 14M individuals. Over time, pediatric hospitals, with a higher proportion of Medicaid funded care, are vulnerable to fewer planned presentations (because of coverage reversal) and higher rates of uncompensated care.

Below are our key insights from financial analyses and discussion in our 2025 Pediatric Hospital Roundtable.

When we dug into the data, we found that the pace of outpatient shift, when measured by share of revenue, is more dramatic for pediatric hospitals than their adult peers. Our benchmarking found that outpatient-generated revenue for pediatric hospitals increased eight percentage points from 44% of gross revenue in 2019 to 52% in 2025. For comparison, across the same period adult hospitals went from 64% to 67%. Pediatric hospitals, while starting from a lower baseline, increased their reliance on outpatient revenue at more than double the rate of their adult peers.

Analysis using our Market Scenario Planner, found the following service lines had the highest shift to outpatient when adjusting for the pediatric population:

- Endocrinology (31%): largely driven by the rising incidences of diabetes

- Physical therapy/rehab (17%): involving physio-therapy diagnostics and activity

- Psychiatry (15%): Driven by psychotherapy services

Of all the insights we shared in our pediatric roundtable, this observation resonated almost universally. And the strategic implication for pediatric hospitals tracks with their adult peers: Over time, the future of care delivery is outpatient. To accurately pace that shift, all hospitals, including pediatric ones, are going to have to conduct deeper data-driven analysis of sub-service line shifts.

From a financial standpoint, rising outpatient revenue means that every care interaction is generating less revenue than an inpatient one. And if we expect this trend to continue, and we do, pediatric hospitals can only rely on inpatient volume growth for so long.

Forward-thinking pediatric providers might be inclined to embrace the future, even in a moment of financial tightening. For those institutions, our recent research on ambulatory network design should hold true for pediatric hospitals. The core insight being that pediatric hospitals should be thinking about their ambulatory network strategy through the lens of capabilities instead of sites.

Comparison of revenue and composition

| Provider category | Year-over-year change in NPSR | Year-over-year change IP revenue | Year-over-year change OP revenue |

|---|---|---|---|

| Pediatric | 3.67% | 6.88% | 11.7% |

| 100–199 bed hospital | 3.48% | 5.20% | 7.9% |

| All hospitals | 5.58% | 5.87% | 8.5% |

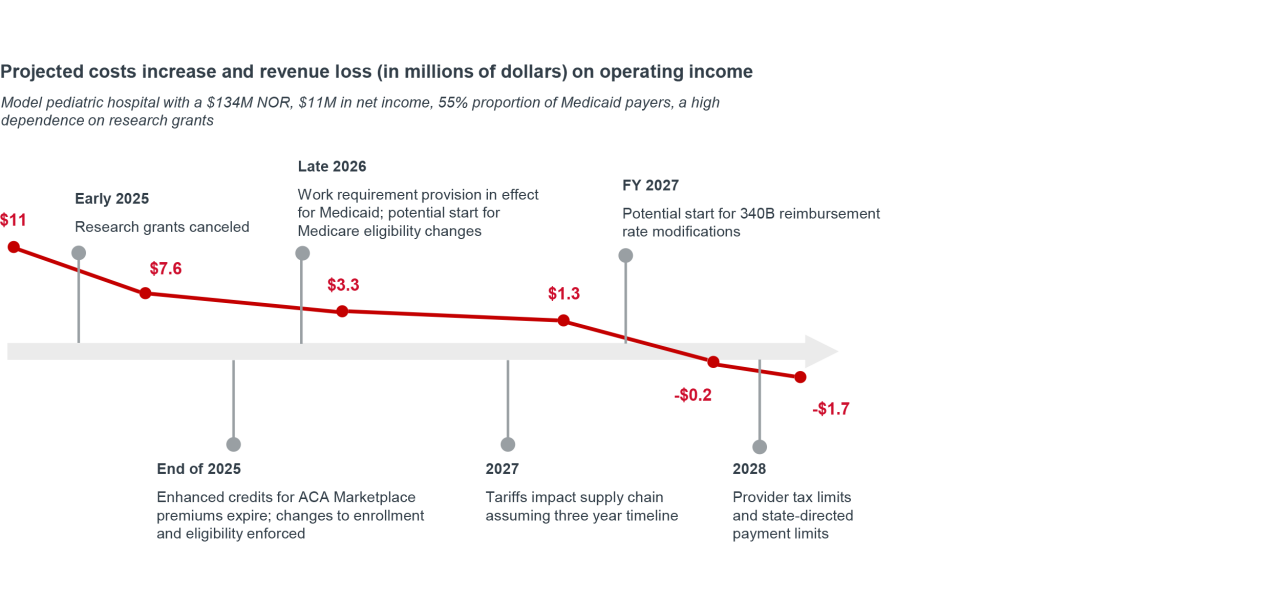

Using Advisory Board’s baseline OBBBA policy calculator, we adjusted the underlying assumptions to reflect the pediatric-specific dynamics. We used the same financial benchmarks for the pediatric cohort to establish median operating income of $11M for pediatric hospitals. We assumed a 55% Medicaid payer mix and median benchmarks on drug and supply spend. Lastly, to model the impact of administrative burden on children enrollment in Medicaid, we used a 6% drop rate as established in a 2023 National Bureau of Economic Research1 working paper on the subject.

We also include additional impacts related to reductions in funding for research grants (already in place in 2025) plus a 35% increase in drug acquisition costs related to the changes assumed to the 340B program.

We conclude that if all provisions of OBBBA go into effect, this simulated pediatric hospital will see its $11M income surplus drop to a $1.7M deficit in three years.

All caveats around extrapolating from median performance hold true here. And this analysis should be considered one of many inputs hospitals should be taking into consideration when planning. Additionally, this analysis excluded any pediatric-specific impacts from changes to coverage through the exchanges.

Into 2026, pediatric provider are likely to share their modeling with state and federal legislatures to find time and options to mitigate the worst of these impacts. Additionally, throughput and access improvement initiatives are key places to start as pediatric hospitals look to build their cash cushion.

For pediatric hospitals and their partners looking for financial sustainability, no single solution alone will make the difference. Instead, multiple approaches across both growth and cost management are key.

Our default is to ‘apply universal margin improvement practices to the pediatric setting’, but without accounting for structural and operational nuances of providing care for children and their families, we risk blunting our efforts with suboptimal applications.

| Margin domain | Universal place to start | Pediatric-specific considerations |

|---|---|---|

| Commercial patient acquisition | Expanding physician availability through workflow redesign instead of adding more appointment slots to the provider calendar. | More granular analysis of outpatient and sub-service line trends to match rising clinical complexity and the push to outpatient care delivery. |

| Workforce optimization | Unbundling workflows into tasks and allocating tasks to a wider team of clinical and nonclinical personnel. | Balancing workflow and task mix optimization with pipeline development for future talent — with the recognition that pediatric clinicians are paid less. |

| Clinical operations improvement | Increasing percentage of patients that have hit an expected date of discharge. | Scaling care standardization across clinical units and facilities. |

| Supply cost management | Deepening physician coordination on preference items and consolidating of volumes to fewer contracts. | Narrower consortia of pediatric provider purchasers to account for smaller volume and unique supply needs. |

| Patient and family financial experience | Estimating early and transparently on patient experience and financial obligations. | Building a multi-stakeholder experience that accounts for needs of pediatric patients and their families. |

| Service line, market growth | Evaluating service line position with a lens for differentiation and comparative advantage. | Interrogating markets and clinical programs to understand referral patterns, access gaps, the ideal destination for patient care. |

| Value-based care | Deepening experience with downside risk, care model maturation for target populations. | Actuarial analysis from external partners and datasets to craft tailored contracts and key performance indicators. |

| EHR integration / optimization | Treating electronic health record as a living, strategic asset with investment and operations guided by business objectives. | Expanding access to information acknowledging that multiple stakeholders play a role in pediatric care. |

| Medicaid | Ambulatory deployment to match acuity and cost to resource intensity. | Augmented eligibility support to ensure coverage continuity. |

In Advisory Board’s 2025 State of the Industry, we highlighted that health systems needed to manage two imperatives at the exact same time: Ensuring the immediate term capture and delivery of surgical volumes to shore up income while preparing for a future where elective care will be a smaller proportion of the volume you treat.

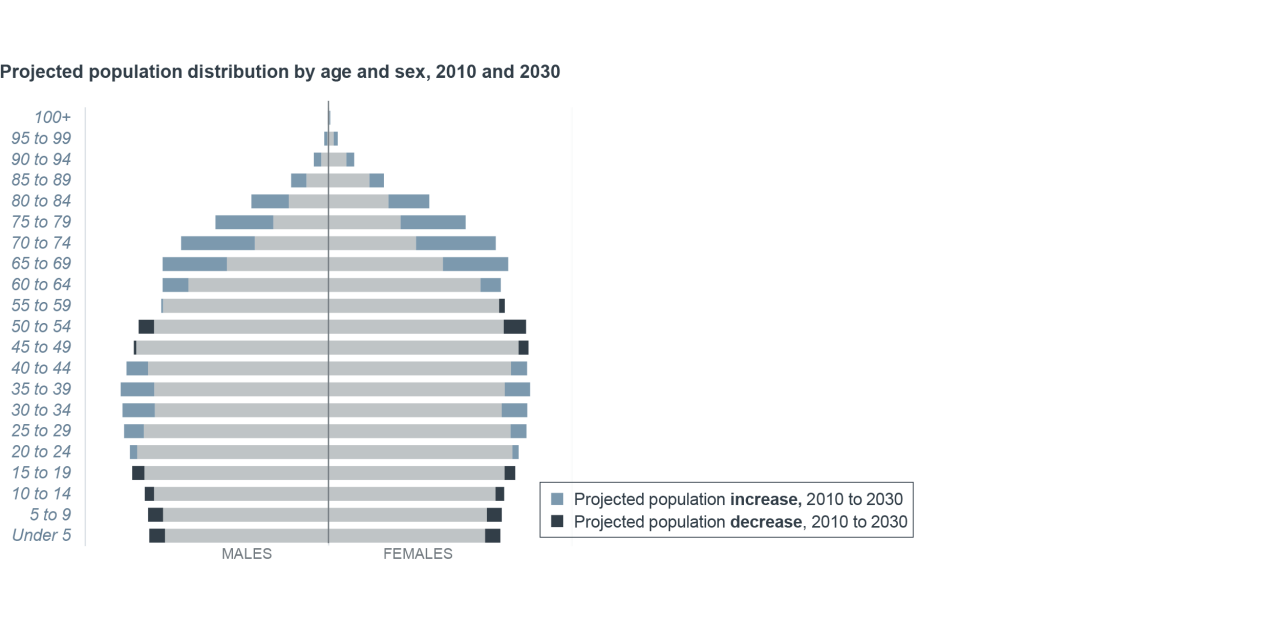

Pediatric hospitals face a similar two-speed problem but with a twist. In the immediate term they’re positioning to max out on commercially insured patient volumes, while preparing a long-standing demographic transition that comes from declining birth rates.

Put another way, pediatric hospitals need to be prepared for a future where there will be fewer pediatric patients.

Barring a reversal in birth rates or a rapid expansion in immigration, two core approaches are appropriate for this two-time horizon strategy:

- Accelerating on the patient flow, throughput, and referrals strategy ensures that pediatric providers are making the most of their existing capacity without overcommitting to inpatient capacity that may be obsolete for future need.

- Continuing to pace and harness the site-of-care shift in the pediatric space affords pediatric providers with the opportunity to smartly right-size their footprint for future demand.

The future of pediatric hospitals is multifaceted. There is continued need for care for the pediatric population, even as payment and demographic changes make the environment more challenging for pediatric hospitals. Advisory Board is committed to continuing to see you through the shifts.

1 Arbogast I, Chorniy A, Currie J.Administrative Burdens and Child Medicaid Enrollments. NBER working paper series, September 2023.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.