Auto logout in seconds.

Continue LogoutEmployers are balancing whole-employee health with cost containment

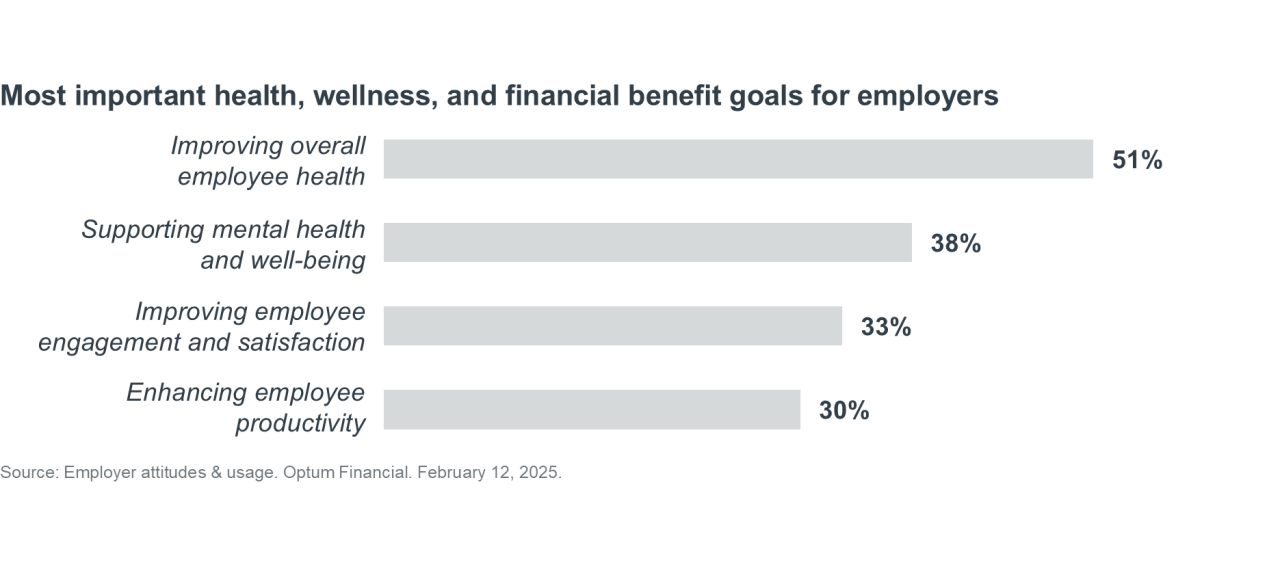

Increasingly, employee health and wellness are interconnected with core business goals. As a result, employers are rethinking benefits to support whole-employee health — including reducing financial stress, helping employees save for retirement, and encouraging healthier habits. The goal: Enhance well-being, job satisfaction, and productivity.

To balance the need to offer a variety of benefits in a competitive market with the need to contain costs, some employers are adopting Lifestyle Spending Accounts (LSAs). Building on traditional offerings like medical and retirement benefits, LSAs give employees the choice to opt into the benefits that work best for them, such as fitness and wellness, educational assistance, mental health, or meals and nutrition.

By tailoring benefits to employee needs, LSAs will potentially boost employees’ physical, mental, and financial health — and help employers meet productivity, job satisfaction, and retention goals. Also, LSAs can help reduce costs for employers by consolidating or bundling underused benefits, making them a cost-effective solution for enhancing employee well-being.

Usage, not offerings, drives the impact of individual benefits

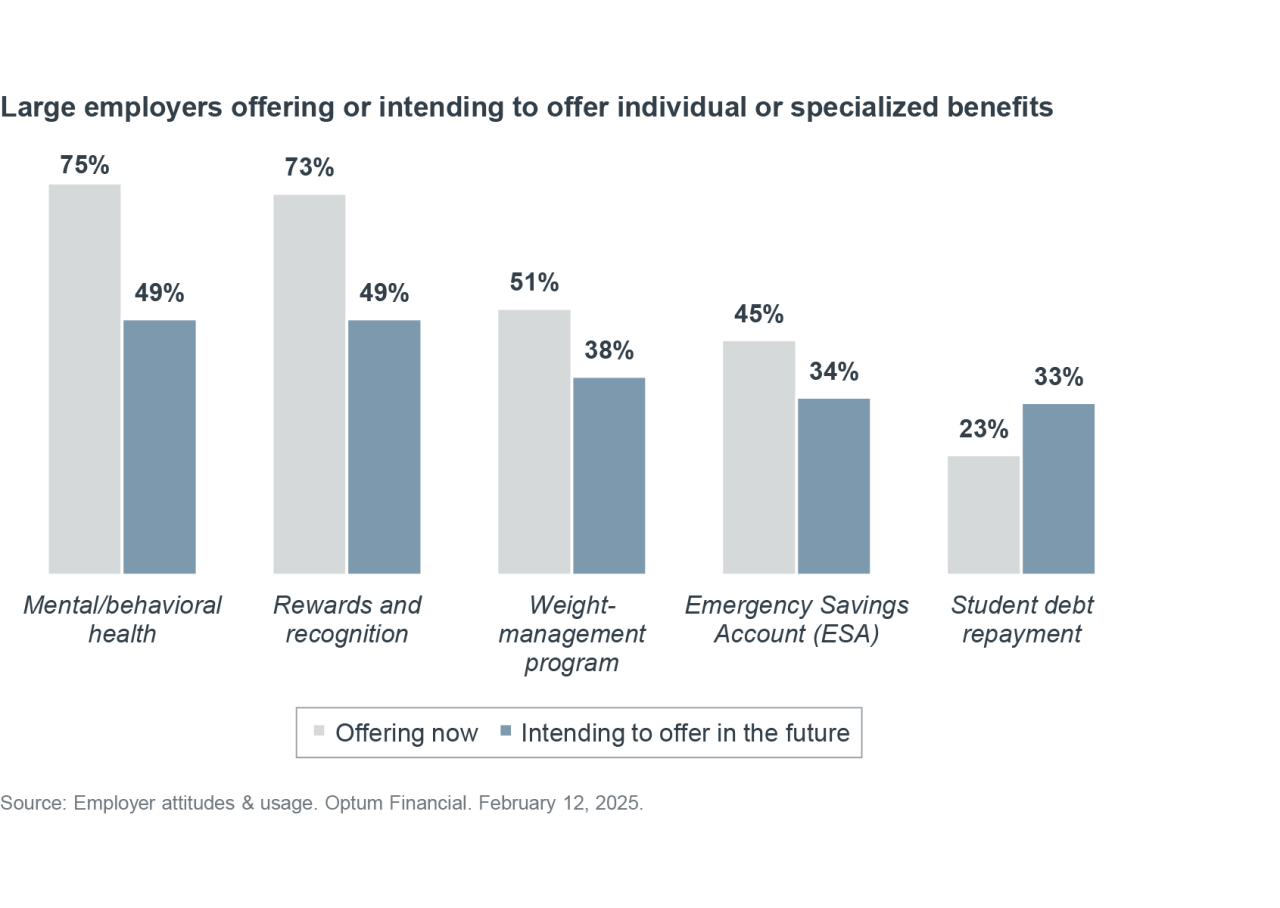

In addition to anchor benefits like medical, dental, pensions, and defined contribution 401K retirement plans, employers of all sizes are offering or intend to offer individual benefits and specialized services to boost whole-employee health. Examples include mental or behavioral health, rewards and recognition, and emergency savings accounts.

But the positive impacts of these offerings depend on employee use. Each specialized offering, such as education or fertility assistance, will not apply to every employee and uptake will vary — limiting any single program’s impact on employee wellness, productivity, and job satisfaction.

For example, one benefits company reported 27.5% participation their customers’ student loan repayment programs — mirroring rates of employees who had taken out loans to pursue an education.1 On the other hand, while between 64% and 81% of organizations offer supplemental mental and behavioral health benefits,2 usage remains relatively low. A UK study found that only between 10% and 12% of employees in higher stress industries like finance or manufacturing use employee assistance programs (EAP). For lower-stress industries, employee use drops to just over 4%.3

Employers should regularly audit their individual and specialized services to ensure that they are impacting employee wellness.

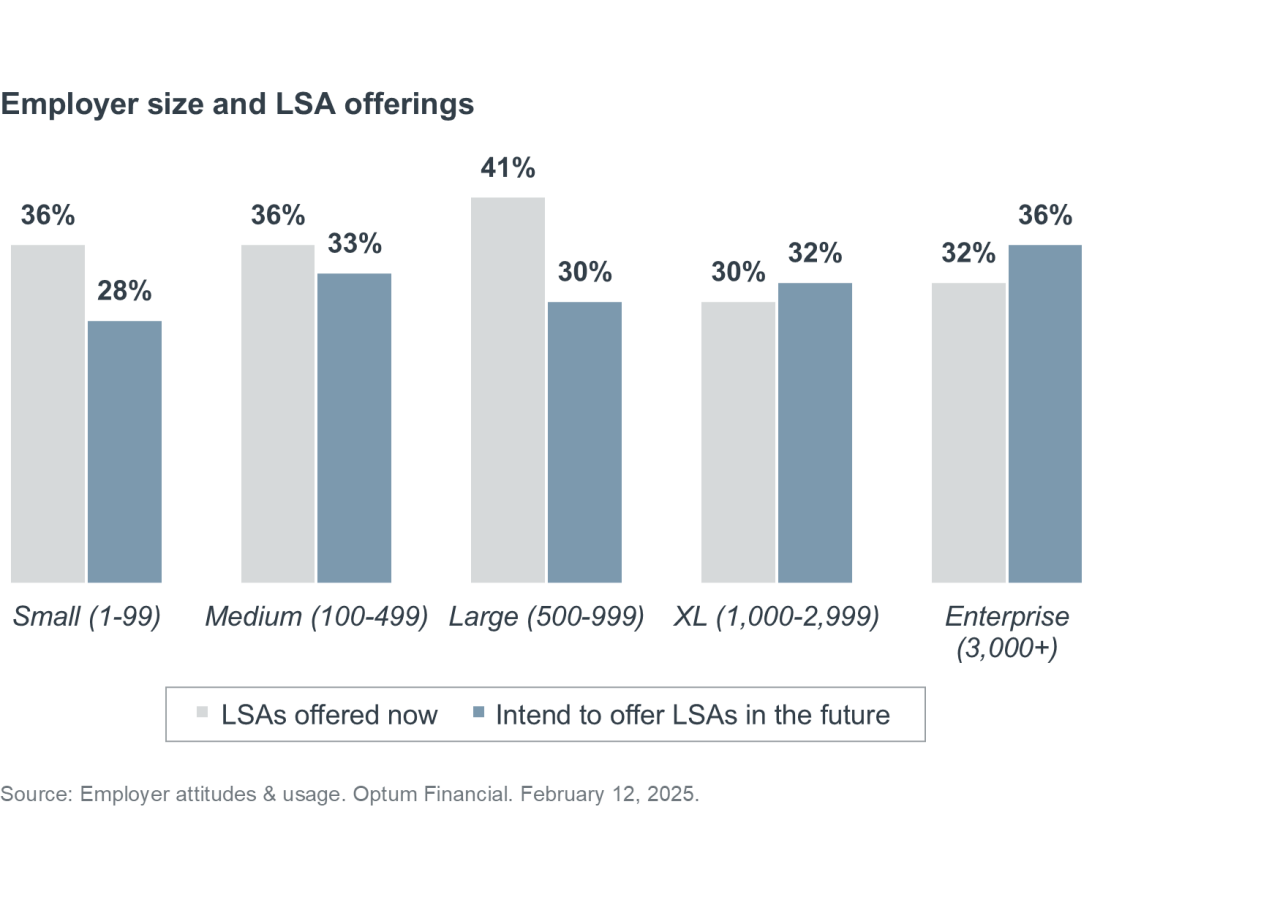

LSA offerings indicate strong growth potential among larger employers

Employer size plays a major role in offering new benefits, and LSAs are relatively new on the marketplace.4 While smaller, more agile companies have been willing to experiment with new benefit structures, extra-large and enterprise employers may have been slower to adopt LSAs: Highly complex organizations are less likely to be early adopters of new services and technologies, because they juggle a wider variety of risks, operational and administrative hurdles, and existing benefit structures.

Employers of different sizes also approach LSAs differently. Smaller companies might offer LSAs to offer employee maximum support with fewer resources, while large companies may use LSAs to expand their suite of benefit offerings.4

As LSAs are becoming more common, they are gaining growth potential among extra-large and enterprise employers. For example, while only 32% of enterprise employers offer LSAs now — compared to 36 to 41% of small, medium, and large employers — 36% plan to offer LSAs in the future, compared to 28-33% of smaller organizations.2

LSA adoption strategies vary by industry and strategic goals

Tech companies adopted LSAs early, and 41% offer LSAs — outpacing sectors like financial services (11%), healthcare and life sciences (9%), and consumer products (8%). Although individual adoption rates for LSAs are lower, as a group non-technical sectors outpace tech companies in offering LSAs (59%).5

All-encompassing LSAs that support emotional, financial, and social well-being remain popular across all industries (66%).5 However, dedicated spending LSAs are on the rise, because they can help employers target specific employee needs.4 Fitness and wellness, professional development, and home office setup are common LSA offerings across all industries, but the focus of dedicated spending LSAs vary depending on strategic goals. For example:

- Technology firms are more likely to fund home office setups within dedicated spending LSAs than other industries, at a median of $870 per person in annual funding (compared to $510 in healthcare and life sciences and $280 in financial services).5 That’s because computer and IT services remain most likely to allow completely remote work, whereas financial services and healthcare may offer a smaller amount to maintain operational continuity between home and office.6

- Healthcare and life sciences companies, which are more likely than other industries to require continuing education credits and clinical certifications, offer a median of $1,380 professional development per person in annual funding.5 Industries that focus on on-the-job learning, such as technology or manufacturing companies, offer less in this category.

- Retail and hospitality companies offer generous fitness and wellness components in their LSAs, a median of $2,530 per person in annual funding (compared to $490 in healthcare and life sciences and $890 in technology).5 In this physically and mentally demanding industry, employees often experience fatigue and burnout, leading to absenteeism and high turnover rates. Employee access to wellness programs can mitigate these effects and improve job satisfaction.7

Employers can contain costs by rethinking specialty benefits, assessing whether they can be replaced with flexible, higher-usage LSAs

Employers are facing volatile cost changes due to inflation, hospital consolidation, an increase in high-cost claimants, and increasing drug spend. 60% of employers expect per-employee spending on health, wellness, and financial benefits to increase over the next five years, and 43% expect an increase next year.2

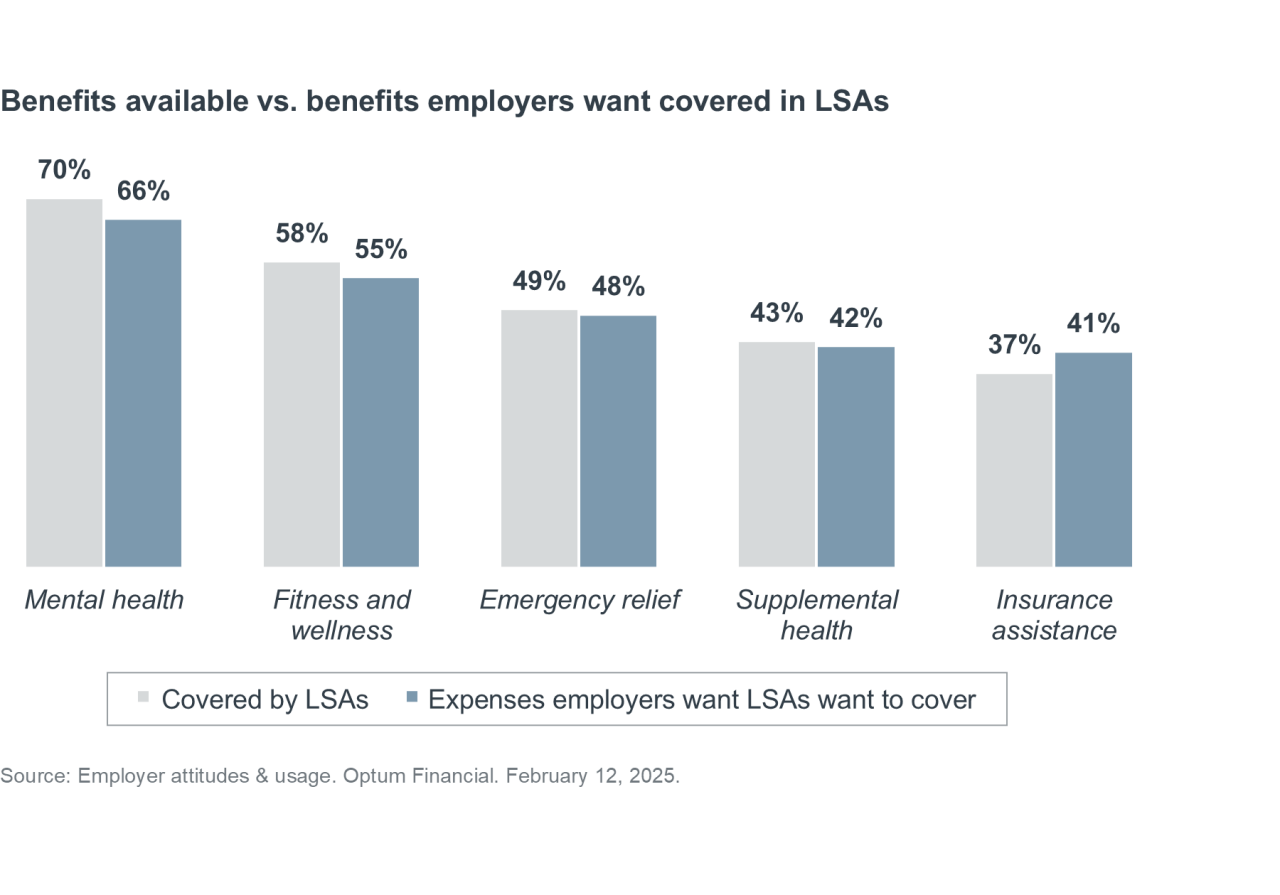

LSAs may help employers contain costs while maximizing the impact of benefits on employees. LSA benefits often align with the expenses employers want to cover — such as mental health, fitness and wellness, and emergency relief funding. Consolidating individual benefits and specialized services into an LSA saves the cost of setting up separate accounts. Additionally, due to low employee uptake, some of those benefits and services aren’t achieving the desired impact on employee job satisfaction, retention, productivity, and overall well-being.

Employers should review usage data for individual benefits and specialized services to identify where to make the highest impact on employees. Resources freed from those low-usage benefits can be reallocated to fund LSAs.8,9

1 The Highway Team. Insights on the impact of a student loan repayment benefit in 2023. Highway. May 20, 2025.

2 Employer Attitudes & Usage. Optum Financial. February 12, 2025.

3 Franco D. Employee Assistance Programs Statistics and Utilization Rates. Meditopia. September 10, 2025.

4 Benepass. U.S. Study on Workplace Benefits Sees 14% Bump in Adoption of Lifestyle Spending Accounts to Meet Needs of Increasingly Diverse Workforce. PR Newswire. August 14, 2023.

5 2025 Lifestyle Spending Accounts (LSAs) benchmark report. Forma Research. August 4, 2025.

6 Haan K. Top Remote Work Statistics and Trends. Forbes. June 12, 2023.

7 Chapman L. Thriving in Retail: Wellness Solutions to Empower Employees and Boost Productivity. Larry’s Blog. January 13, 2025.

8 Mayer K. Behind the Growing Interest in Lifestyle Spending Accounts. SHRM. April 9, 2024.

9 Fortingo A, et al. Lifestyle Spending Accounts: New Frontier or Fad? Brown & Brown. August 24, 2023.

Optum Financial is a leading healthcare FinTech company dedicated to transforming the way care is financed and paid for. By driving innovation, they support the quadruple aim of affordability, accessibility, experience, and outcomes. Optum Financial offers end-to-end integrated financing and payment solutions embedded within the healthcare ecosystem, simplifying financial transactions and making them more efficient, so they can pursue their mission of "paying health forward."

Learn more about Optum Financial

This report is sponsored by Optum Financial, an Advisory Board member organization. Representatives of Optum Financial helped select the topics and issues addressed. Advisory Board experts wrote the report, maintained final editorial approval, and conducted the underlying research independently and objectively. Advisory Board does not endorse any company, organization, product or brand mentioned herein.

To learn more, view our editorial guidelines.

This report is sponsored by Optum Financial®. Advisory Board experts conducted the research and maintained final editorial approval.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.