Auto logout in seconds.

Continue LogoutSpecialty drugs are a broad category of high-cost, complex therapies that may be administered by patients or providers and are covered under either the pharmacy or medical benefit. For more detail on what makes a drug a specialty product, specialty medication glossary.

Growing utilization and a robust pipeline have led to ballooning spending on specialty drugs in recent years. With specialty drugs making up 75% of the drug pipeline in 2024, high drug spend is likely to remain healthcare’s new normal.1

Using data from Optum Pharmacy Advisory Services' Health Technology Pipeline Tool, we identified three major trends shaping the specialty drug pipeline. These trends have and will continue to influence health plan, health system, and pharmacy benefit manager strategies within the specialty pharmacy market.

Pipeline trend: Surge in high-spend disease categories, including cell and gene therapies

The specialty drug pipeline continues to expand, with rare diseases and oncology leading the way. Between 2025 and 2027, over 80 specialty drugs for rare diseases are expected to launch across over 70 conditions with the average annual costs ranging from $6,000 to $3.2 million.2 Notably, a quarter of this spend is attributable to cell and gene therapies (CGTs).

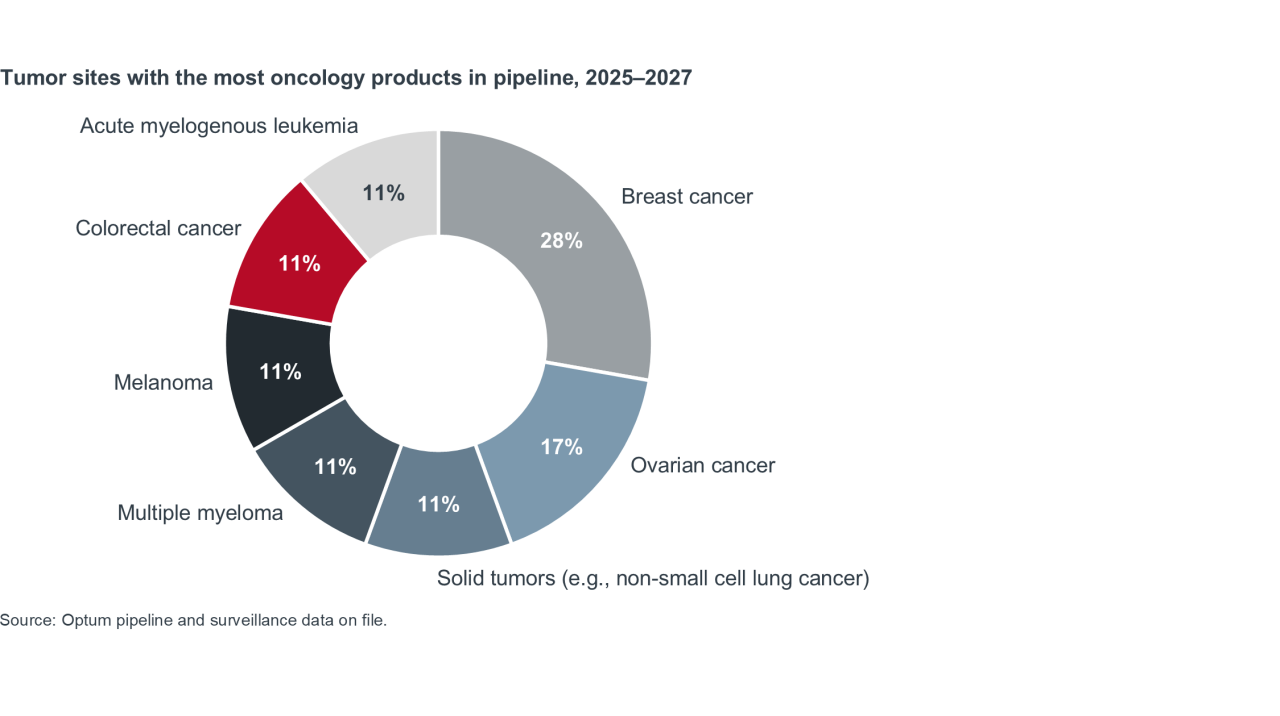

Oncology is also seeing a surge, with pipeline activity concentrated across six main forms of cancer, with breast and ovarian cancers in the lead. Optum Pharmacy Advisory actuaries estimate that per-member-per-month oncology spend will double between 2025 and 2027, ranging from about $8.24 to $15.24.2

Together, these trends intensify the pressure on health plans to evolve their specialty drug management strategies.

Stakeholder impact: Health plans

When it comes to managing CGT costs, health plans mainly rely on stop-loss insurance.3 However, as stop-loss premiums keep rising, it may be harder for health plans to rely on this strategy long-term.4

There is growing interest in more experimental approaches to management, but uptake is low. Only 3% of plans use a standalone CGT financial solution, and 60% of health plans did not participate in CGT risk sharing financial programs with manufacturers.3

Plans have also expressed interest in cross-benefit management for specialty drugs, but operational barriers contribute to low adoption rates. Plans can typically track healthcare costs for members who use specialty medications, and many already have processes in place to manage the specialty formulary across both pharmacy and medical benefits.3 However, it’s still a challenge to assess how individual medications influence the total cost of care, which can inhibit a cross-benefit strategy.3

To learn about how stakeholders, including health systems, are preparing for the upcoming cell and gene therapy pipeline, see our playbook: Cell and gene therapy programs: How to launch, optimize, and deliver CGTs sustainably.

Pipeline trend: Self-administered therapies are expected to outpace infusion growth by 2027

The pipeline includes a rising number of self-administered specialty therapies, projected to outpace infusion growth by 2027. Some of this shift is due to new formulations of previously existing infusion drugs.5

Another driver are novel drugs for conditions that have only had infusion treatment options — there are multiple oral drugs in the pipeline for Alzheimer's, for example. Lastly, there is sustained investment in conditions that have typically been treated via self-administered therapies, such as MS, HIV, and some inflammatory diseases.2

Stakeholder impact: Health systems

Health systems have been investing in building out health system-owned specialty pharmacies (HSSPs) for years, and HSSPs continue to grow in volume. The proportion of hospitals that operate a specialty pharmacy tripled from 9% in 2015 to 27% in 2019, and in 2023 HSSPs made up nearly a quarter of the total specialty pharmacies operating in the United States.6

Percentage of hospitals operating specialty pharmacies in 2019

The financial upside of HSSPs is evident. The pipeline for self-administered therapies is robust, the industry has a high projected growth rate, and estimates indicate that HSSPs generate approximately 10% of large health system net patient revenue. But health systems have started to realize that HSSPs can do more than drive revenue.7

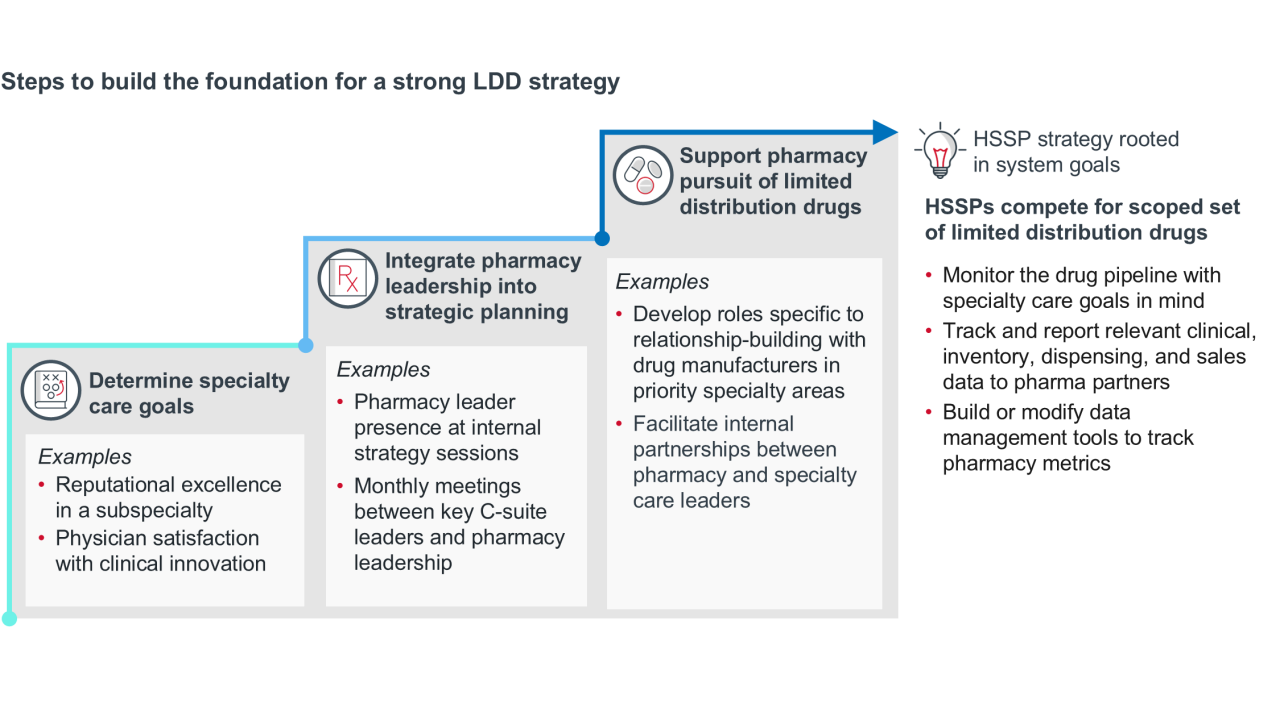

As the pipeline evolves, health systems can align HSSP strategy to support service line growth. One example of this is developing a targeted strategy to secure limited distribution drug (LDD) contracts. LDDs are common for rare disease, neurology, oncology, and immunology — all categories that have a strong pipeline, and many of which have self-administered formulations that HSSPs could dispense.

Pipeline trend: The biosimilar pipeline is growing

Biosimilars and specialty generics are often viewed as cost-saving solutions in the specialty drug market. While their overall impact on spend has been limited to date the pipeline is expanding rapidly. At least 10 major molecules will face biosimilar competition by 2027, with more than 40 individual biosimilars expected to launch for 15 reference products between 2025 and 2027.8

The growing number of biosimilars can mean new opportunities to contain pharmacy spend.

More than 40 individual biosimilars are expected to launch by 2027

Stakeholder impact: Pharmacy benefit managers (PBMs)

The largest three PBMs are part of corporate entities that own private label distributors that can procure biosimilars.9 The combination of PBM-owned private labelers and PBM formulary design can drive uptake of biosimilars.

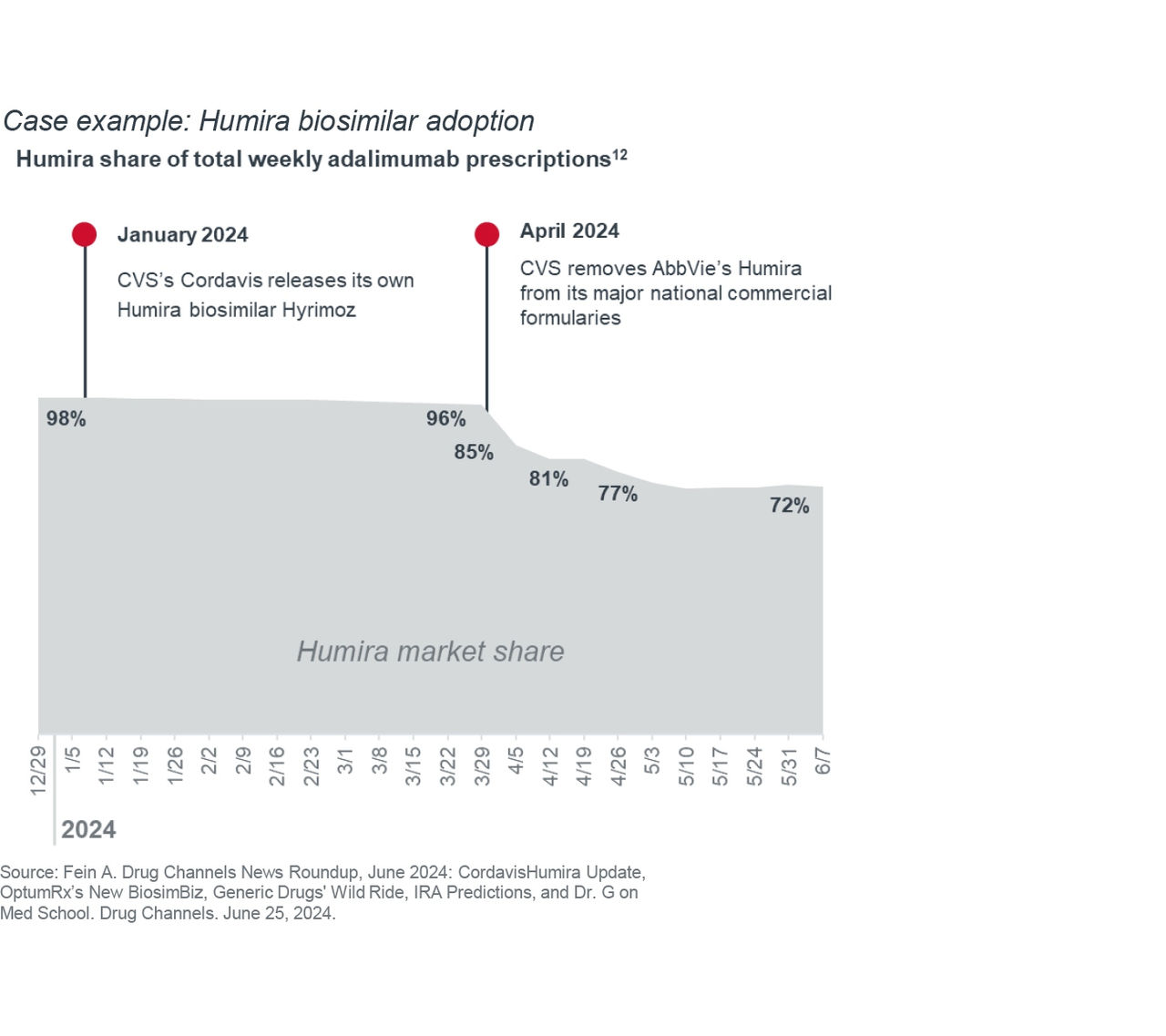

AbbVie, the manufacturer of Humira, had market exclusivity of the drug for over 20 years. In 2023, biosimilars entered the U.S. market, but their overall share remained low due to PBM formulary placement and physician reluctance to move patients to a new product.

Even when CVS’s private label distributor Cordavis introduced its own biosimilar, Humira market share remained high because CVS Caremark still covered the reference product at a preferred tier. When CVS Caremark pulled Humira from its biggest formulary in April 2024, biosimilar adoption rapidly increased, with more patients switching to biosimilar version of Humira in 3 weeks than in the prior 15 months.10

Other PBMs like OptumRx and Express Scripts are following suit. Both have their own private labeling organizations and will be distributing and promoting their own biosimilars. This growing PBM support may contribute to more attractive market conditions for manufacturers to develop other biosimilars.

What to watch next

Specialty pharmacy growth is the new industry normal. The robust specialty drug pipeline means we’re going to see a continued wave of high-cost specialty drugs hit the market, driving increased utilization and spend.

To manage this effectively:

- Health systems will need to prepare for a care delivery environment with greater emphasis on drugs and medication management.

- PBMs must be able to navigate policy pressure and find new ways to drive value for clients, with biosimilars as an example.

- Health plans need to hone existing utilization management strategies and experiment with ways to tie drug costs to value.

1 Szczotka A. Navigating the Rapid Growth of Specialty Drugs: Opportunities, Challenges, and the Path Ahead. Pharmacy Times. September 2, 2024.

2 Optum pipeline & surveillance data on file.

3 Pharmaceutical Strategies Group. Trends in Specialty Benefit Design. February 2025.

4 Lambright M, Adams C. Key Healthcare Stop-Loss Insurer Market Drivers and Trends. OliverWyman. Accessed August 7, 2024. Medical Stop-Loss Coverage: Premiums Up 8% for 2021. Segal. April 22, 2021. Medical Stop-Loss Premiums Up Nearly 10% for 2022. Segal. August 19, 2022. Medical Stop-Loss Premiums Increase by More Than 8%. Segal. August 16, 2023. Medical Stop-Loss Premiums Increase by More Than 9%. Segal. July 18, 2024.

5 Amgen Licenses XeriJect Technology from Xeris Biopharma for Subcutaneous Tepezza Development. Fineline Insights, Pharma Clarity. January 11, 2024. HFMA. September 18, 2024.

6 ASHP Survey Finds Growth, Opportunities for Health-System Specialty Pharmacy Services. ASHP. January 26, 2024. Fein A.J. The Top 15 Specialty Pharmacies of 2023: Market Shares and Revenues at the Biggest PBMs, Health Plans, and Independents. Drug Channels Institute. April 16, 2024.

7 Myers, B. Expert Q&A: Expanding the Health System Specialty Pharmacy to Boost Your Health System's Revenue. McKesson. Accessed March 25, 2025. Singhal S, Patel N. What to expect in US healthcare in 2025 and beyond. McKesson. January 10, 2025.

8 Biosimilar timeline. Cardinal Health. Accessed September 2025.

9 Pharmacy Benefit Managers: The Powerful Middlemen Inflating Drug Costs and Squeezing Main Street Pharmacies. U.S. Federal Trade Commission Office of Policy Planning. July 2024.

10 Walker, L. Gorenstein D. AbbVie's blockbuster drug Humira finally loses its 20-year, $200 billion monopoly. NPR. January 31, 2023. Fein A. Drug Channels News Roundup, June 2024: Cordavis Humira Update, OptumRx’s New Biosim Biz, Generic Drugs' Wild Ride, IRA Predictions, and Dr. G on Med School. Drug Channels. June 25, 2024.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.