Auto logout in seconds.

Continue LogoutCMS is ending two of its value-based primary care models earlier than planned. Below, we unpack what happened, why this matters, what options executives have, and what to do now.

What happened

CMS announced two primary care models within the Centers for Medicare and Medicaid Innovation (CMMI) will be shut down by the end of 2025, earlier than originally scheduled:

- The Primary Care First (PCF) model, which was designed to improve advanced primary care, particularly for patients who do not routinely see primary care providers. Launched in 2021, the original end date for PCF was 2026.

- The Making Care Primary (MCP) model, which was designed to improve coordination and care management between primary care providers, specialists, and community resources. Launched in 2024, the original end date for MCP was 2034.

Though some leaders question what these models ending early means for value-based care (VBC) in general, this does not mean CMS is abandoning VBC in primary care as a core strategy. CMS specifically said: “The early termination of Primary Care First and Making Care Primary does not signal a retreat from the Center’s support of primary care providers, but rather a need to focus on different approaches that are consistent with the CMS Innovation Center’s statutory mandate and produce savings.”1 Despite the models’ early cessation, VBC is here to stay.

Why this matters

The PCF and MCP models boosted primary care providers’ revenue, enabling them to make population health investments with limited downside risks. Without these models, participants will see significant reductions in revenue — an estimated 36% for Making Care Primary participants2 and 33% for Primary Care First participants.3

Making Care Primary provided up-front payments for care management infrastructure without penalties for poor performance. Primary Care First guaranteed population-based payments with potential bonuses for high quality. Even when participants faced penalties from high or out-of-network utilization, they still came out ahead compared to fee-fer-service rates due to the large population-based payments. Without the financial support these models provided, it will be harder for primary care-focused organizations to succeed in VBC — and maybe even stay financially solvent or independent.

What comes next

The next step for participants is to decide which risk model – if any – would be right for them. Click "see risk model options" below to view a table of the main choices.4,5

| Option | Basic payment structure | Pros | Cons |

| MSSP A/B | Upside-only model with 40-75% savings rate, capped at 10% of benchmark |

|

|

| MSSP Enhanced | Two-sided risk model with up to 75% savings rate and 75% loss rate with upside capped at 20% of benchmark and downside capped at 15% of benchmark |

|

|

| ACO REACH | Professional track is 50% capitated payment for primary care services and global track is 100% capitation for either primary care services or total cost of care (TCOC) |

|

|

| Medicare Advantage risk contract | Determined by contract between provider and health plan |

|

|

How to decide

Primary care providers should consider four questions when deciding what to do next.

1. How would we perform in each respective risk model option today?

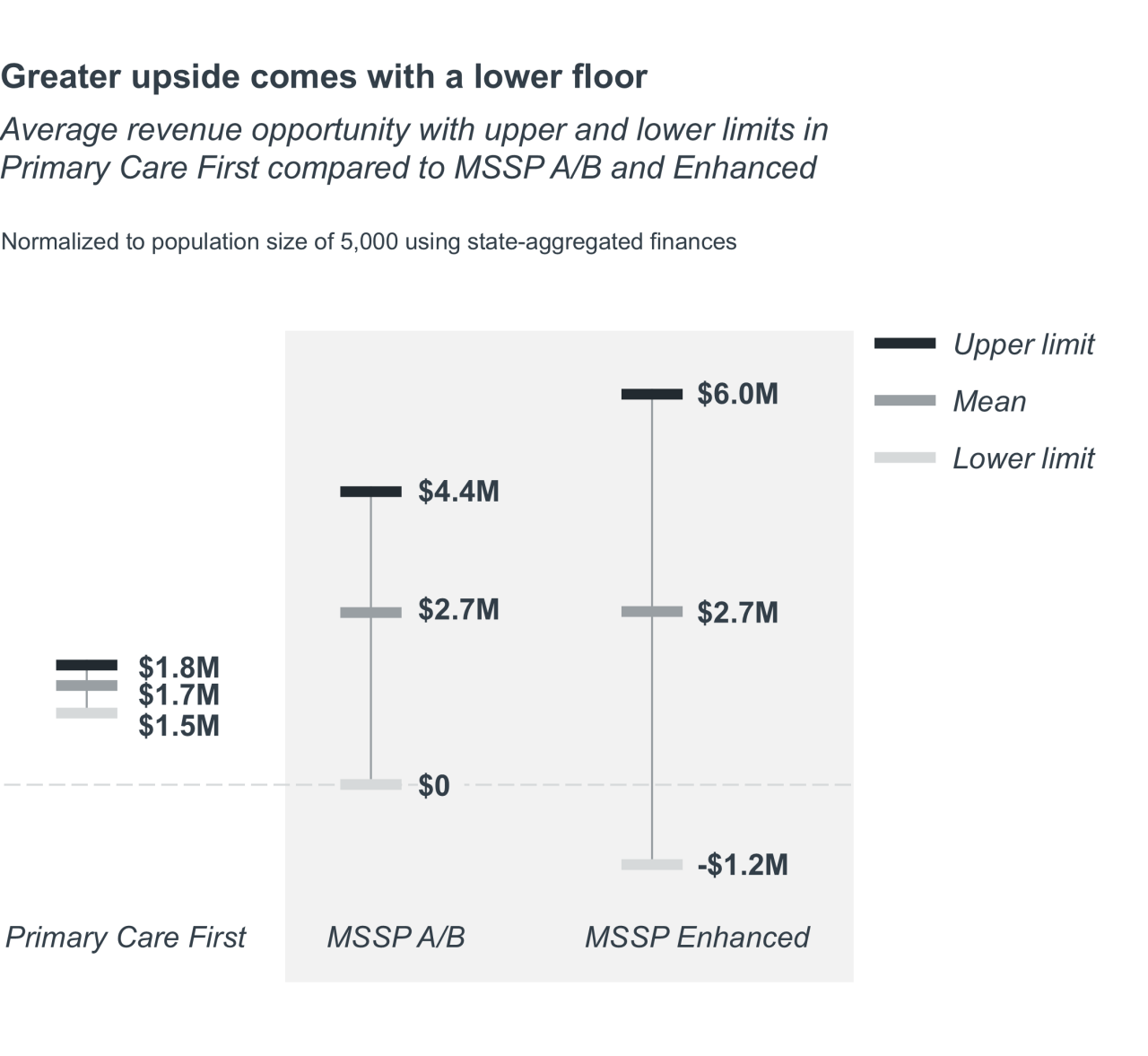

Organizations performing well in Primary Care First and Making Care Primary should capitalize on their success by pursuing two-sided risk models. The chart below highlights estimated revenue opportunities for Medicare Shared Savings Program (MSSP) A/B and MSSP Enhanced compared to Primary Care First.6 This analysis used average revenue state-aggregated finances normalized to a population size of 5,000, which is roughly average among Primary Care First participants.

The good news? MSSP A/B and MSSP Enhanced offer higher revenue, on average, than Primary Care First. And with increasing risk comes a higher upper limit to that revenue. The upper limit for MSSP Enhanced is nearly three times the upper limit of Primary Care First, and the upper limit for MSSP A/B is nearly double the limit for PCF. A provider organization pursuing two-sided risk in Medicare Advantage (MA) would see a similar trend. The bad news? All have greater accountability and a lower floor.

2. What’s the risk of divesting your population health infrastructure?

Can you evaluate the tax identification numbers (TINs) in your network? Is your risk adjustment program established and performing well? Can you target the right populations for your total cost of care strategies? Those are useful capabilities. Don’t underestimate them.

In the Primary Care First and Making Care Primary models, provider organizations made key investments in technologies, analytics, care management, and risk-adjustment operations. A return to fee-for-service would mean taking a big step back from that infrastructure. Organizations that have already invested in primary care models need to decide whether to capitalize on these investments or consider them as losses.

3. What is our leadership team’s appetite for risk?

The actual work of changing financial and clinical models in the complex healthcare industry is difficult. Organizations need agreed-upon objectives and leaders (especially CEO and CFO) who are all on the same page. This leadership alignment is the foundation for successfully synchronizing the clinical and financial transformation.

Organizations that do this right take on enough risk to learn and build momentum without compromising themselves or ending up in pilot purgatory. But, they don’t take on so much that they are the first through the wall — after all, data from the Medicare Shared Savings Program shows us that organizations with more experience in VBC typically do better.

4. What is our market’s readiness for risk?

There is no perfect calculation for moving into increased levels of at-risk payments. But we know that when VBC becomes a reality in a market, it happens fast. We recommend looking at:

- Current risk adoption: You can't afford to be the laggard but you're just as likely to make a mistake as an early adopter. An immature market in VBC can present a key opportunity in MSSP. Less mature VBC markets have easier MSSP benchmarks, making it easier to achieve early success.

- MA penetration: Evaluate the balance between MA and traditional Medicare beneficiaries in your market and analyze trends over time. As any actuary would tell you, a large, stable, or growing population is critical for effectively spreading financial risk. Ensure your population size is sufficient before assuming risk.

- Health plan partners: A risk arrangement in MA requires the plan and provider to formally align incentives related to quality and cost goals. Do you have a viable health plan partnership? You’ll need it.

One no-brainer: Don’t miss out on Advanced Primary Care Management (APCM) codes

For provider organizations participating in risk arrangements, there is one no-brainer: APCM codes.

CMS introduced APCM codes in the 2025 Medicare Physician Fee Schedule (before announcing the early end of Primary Care First and Making Care Primary). APCM codes offer a streamlined approach to care management billing with simpler time requirements and availability to all Medicare patients, albeit with a 10% lower reimbursement rate compared to the fee-for-service care management codes.

APCM codes provide flexibility and efficiency by shifting over 50 codes to three monthly bundle options that don't have the same time constraints. This allows practices to leverage their population health and care management infrastructure investments from Primary Care First and Making Care Primary. But while these codes offer easier short-term implementation, they make sense only when paired with a two-sided risk model that incentivizes care management at scale.

What participants should do now

There’s a lot happening in healthcare right now. This is an important moment to get your leadership team aligned on the right next step for your organization. In our extensive research and engagements with providers, we’ve found the key to success in these VBC primary care models is leadership alignment. It’s the foundation for fully synchronizing clinical and financial transformation.

If you need help evaluating your options, get in touch.

1 CMS Innovation Center Announces Model Portfolio Changes to Better Protect Taxpayers and Help Americans Life Healthier Lives. CMS. March 12, 2025.

2 Making Care Primary (MCP) Model Example Revenues Factsheet. CMS. Accessed June 4, 2025.

3 Schurrer J, et al. Evaluation of the Primary Care First Model: Second Annual Report. CMS. February 2024.

4 Shared Savings Program Participation Options for Performance Year 2024. CMS. March 2023.

5 ACO REACH. CMS. Accessed June 12, 2025.

6 Making Care Primary performance data was not available.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.