Auto logout in seconds.

Continue LogoutWhat is TEAM?

The Centers for Medicare & Medicaid Services (CMS) is launching the Transforming Episode Accountability Model (TEAM) on January 1, 2026. TEAM is a bundled payment model focused on five high-cost procedural episodes: hip and femur fractures, major bowel procedures, coronary artery bypass grafts (CABG), spinal fusion, and lower extremity joint replacements. TEAM uses risk-adjusted benchmarks to evaluate total Medicare spending across a 30-day episode of care, including inpatient and outpatient services, post-acute care, durable medical equipment (DME), and other related costs.

TEAM introduces mandatory participation for hospitals in designated geographies, while offering optional participation to others. The financial implications are immediate and substantial. There is no mandatory downside risk for 2026, which means providers can take a “wait and see” approach for a few more months, but downside risk will start in 2027.

Optum Advisory1 analysis shows that 56% of mandatory participants are projected to lose money under current criteria unless they meaningfully improve performance. These losses average $1.2 million per facility. Additionally, 50% of optional participants could see an estimated net savings of $429,000 per facility if they choose to participate and perform well.

With upside risk doubling in year two and CMS signaling future expansion into specialty bundles, hospitals should begin preparing now — whether participation is required or optional.

How to estimate your risk — and what data participants should have from CMS

To evaluate your organization’s exposure under TEAM, you’ll need a structured risk analysis. CMS sets target prices for each episode using a regional, risk-adjusted benchmark. Replicating this internally requires two key data sets:

1. Regional benchmarking data

Start by identifying the risk-adjusted target price for each episode. CMS will provide:

- Medicare spending per episode average for all providers in your region.

- Your facility risk scoring normalization factor. Because CMS’s risk-adjustment model includes both clinical and social factors, it’s important to understand how your patient population compares to peers in your region. While CMS hasn’t released the coefficients to calculate your risk score, it has provided the normalization factor relative to your regional peers.

These inputs allow you to estimate the benchmark CMS will use to evaluate your performance.

2. Historical performance data

Using your historical performance, you can estimate expected performance under the model. You’ll receive patient-level detail at your facilities that give you two years of history showing:

- Total episode spending for all patients treated in eligible Medicare Severity Diagnosis Related Groups (MS-DRGs) over the past several years.

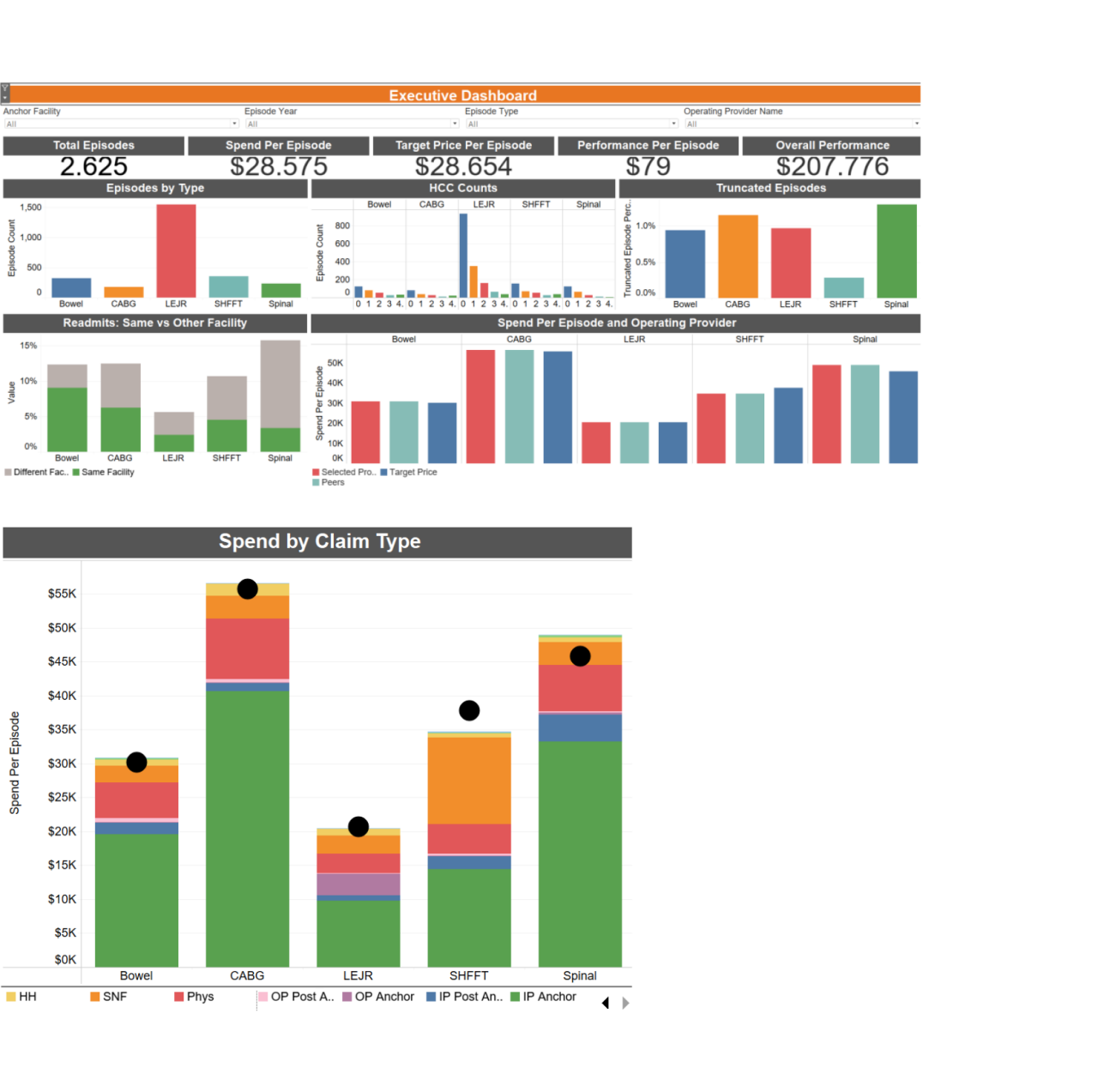

- Patient-level data including age bands, social needs, and Hierarchical Condition Category (HCC) codes, details on each episode around who is the operating physician, episode spend by overall claim category IP (both anchor and other), OP (both anchor and other), physician, SNF, home health, DME, hospice.

Comparing your historical spend to the regional benchmark allows you to estimate your financial exposure. If your adjusted spend exceeds the benchmark, multiply the difference by your episode volume to project potential losses. If it’s below, you may be positioned for gains. Even if you are positioned for gains, improvements by other providers in your region could affect your actual experience in 2026 and beyond.

Below, we've included two sample dashboards created by the Optum Advisory team to show the kind of data you will need to track.

Where you can make the most impact

Once financial exposure is sized, hospitals must dive deeper into episode-level performance. TEAM includes all Medicare spending within a 30-day window, encompassing inpatient admissions, readmissions, post-acute care, DME, drug spending, and more. Hospitals should identify which categories are driving overspending relative to their cohort. This granular analysis reveals where operational changes are needed. Analyzing data grouped by operating physician may reveal insights into who needs to be educated about the program and differences in practice patterns regarding post-acute space.

Risk adjustment also plays a critical role. Facilities must ensure they are accurately capturing all relevant patient risk factors, especially HCCs and social determinants of health. Optum Advisory’s analysis of one facility found that two-thirds of episodes had zero HCCs coded, suggesting a major opportunity to improve documentation and coding practices. Because CMS’s model uses HCC counts rather than scores, timely and comprehensive coding prior to episode initiation is essential.

Next steps for hospital leaders

TEAM is set to reshape how hospitals manage cost and quality across key procedural episodes — and the financial impact will be felt quickly. With downside risk increasing in year two and CMS signaling further expansion into specialty bundles, now is the time to act. If you’re looking for a practical starting point, this guide to sizing your risk walks through how to replicate CMS’s pricing methodology internally. And for a broader look at how the TEAM payment model works and what it means for hospitals, this overview breaks down the structure, scope, and strategic implications.

1 Advisory Board is a subsidiary of Optum, a division of UnitedHealth Group. All Advisory Board research, expert perspectives, and recommendations remain independent.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.