Auto logout in seconds.

Continue LogoutAs employers grapple with a changing cost landscape driven by factors like inflation, hospital consolidation, high-cost claims, and innovative drugs, they are taking steps to attract and retain employees while managing their annual spend. Before partnering with self-funded employers, stakeholders should understand the top-of-mind strategies these employers are using to provide employees with attractive, cost-effective health benefits.

What’s the priority?

High-cost claims are at the top of employers’ minds — and for good reason. In many cases, 1% of employees account for almost 30% of an employer’s annual medical spend.

Self-funded employers see high-cost claims as a threat to their bottom line. But, since these claims are so large, there is opportunity here for cost savings. Currently, 94% of employers are utilizing or considering strategies for high-cost claims management.

Why is it relevant now?

While high-cost claims are an evergreen priority for employers, the drivers of high-cost claims have changed, with cancer, prenatal and neonatal care, COVID-19, and long COVID claiming the top spots. As of 2022, cancer has overtaken musculoskeletal disorders as the top condition driving cost in employer-sponsored insurance (ESI).

The delays in care that occurred during the COVID-19 pandemic increased the prevalence of late-stage cancer, which has higher treatment costs than early-stage cancer. As the U.S. population continues to age and expand, CDC projects the total number of cancer cases to increase by almost 50% by 2050. Moving forward, employers should expect cancer to remain a top driver of cost that will increasingly stress their budgets. In addition to seeing more expensive claims than ever before — at a higher frequency — we're also seeing more high-cost claims from younger individuals who remain on ESI plans for years.

Implications for stakeholders

- Employers need to better understand their high-cost claims. Plans can use data to help employers better understand their costs and future cost projections. In particular, stakeholders should prioritize early detection of high-cost claimants before they have a significant impact.

- Employers need to reevaluate the risks of self-funding. Self-funding offers several benefits. However, plans and brokers should have candid conversations outlining the pros and cons of becoming a self-funded employer — especially given the potential rise in high-cost claims in the current economy. Employers should consider whether level-funding or fully-funding would be more beneficial.

increase in multimillion-dollar claims among self-funded employers from 2022 to 2023

What’s the priority?

Specialty drugs garner a lot of attention. When we speak with employers, high-cost specialty drugs are almost always what’s keeping them up at night.

In 2021, pharmacy accounted for 21% of employers’ healthcare costs — and over half of those costs came from specialty drugs. With a slew of new specialty drugs posed to hit the market in the coming years, employers anticipate potentially monumental pharmacy cost increases.

Why is it relevant now?

The influx of ultra-high-cost drugs (UHCDs) could have a significant impact on employers’ bottom lines. Currently, most UHCDs on the market are gene and cell therapies — not pricey recurring drugs, like oncological treatments. While these drugs tend to be curative, some of them have multimillion-dollar price tags and pose a significant threat to self-funded employers' bottom lines.

By 2030, between 54 and 74 new cell and gene therapies are forecasted to hit the market. Between 2020 and 2035, an estimated 1.09 million patients are expected to be treated by gene therapy, with an estimated annual spend of $25.3 billion in 2026, the peak between 2020 and 2035.

Implications for stakeholders

- Employers largely have a wait-and-see mentality. Many employers are unsure how to prepare for a future of high-cost specialty drugs. Before employers start to take actions, they want to see how large costs could grow. In fact, many employers are hoping the problem will somehow resolve itself through policy or regulatory changes.

- Plans and brokers should proactively discuss possible solutions and action plans. Employers who implement a wait-and-see strategy could be fine. However, they could also see potentially massive cost increases and find themselves out of the market for stop-loss insurance. Plans and brokers can help employers create a proactive plan that eliminates this gamble.

of employers are concerned or very concerned about pharmacy cost trends

of employers say specialty drugs are a threat to employer-sponsored insurance coverage

What’s the priority?

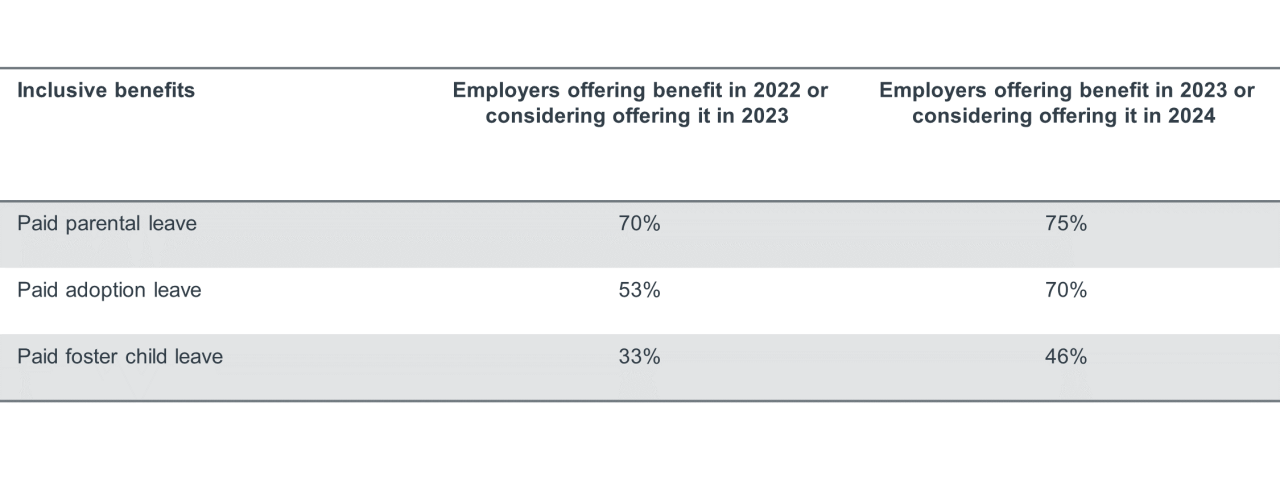

Employers increasingly acknowledge their role in supporting health equity, and many are implementing more inclusive healthcare benefits to support health equity initiatives. In fact, 78% of employers are taking action to improve health equity, and 10% are planning to develop a health equity strategy. For example, some employers are embracing more inclusive fertility and family planning benefits.

Why is it relevant now?

Social equity and health equity have gained increasing attention over the past few years. Social justice protests and media attention regarding the disproportionate impact COVID-19 on communities of color represent larger movements and shifts in culture. These shifts spill over into employer-sponsored insurance. Additionally, Millennials and Gen Z make up an increasing percentage of the workforce. Research shows these employees seek socially minded employers focused on diversity, equity, and inclusion. Inclusive benefits are not an afterthought for these employees — they are determining factors in retention and recruitment.

Implications for stakeholders

- Employers are perennially balancing benefit costs with retention and recruitment efforts. Employers will need to factor inclusive benefits into that math. Which benefits mean the most to their employees? How do those benefits affect their bottom line and ability to offer other healthcare benefits?

- Health plans can help employers understand claims data and the ROI of inclusive benefits. Plans can also integrate inclusive benefits into existing offerings and promote them to employers.

What’s the priority?

Employers view expanding access to behavioral health services as a top priority. In fact, the nation’s largest employers listed expanding behavioral health access as their number one priority for their benefit programs. Almost all employers are utilizing or considering strategies to boost quality and access to mental health and substance abuse resources.

Why is it relevant now?

While access to mental health resources is a long-standing challenge, the COVID-19 pandemic brought a stark increase in the number of U.S. adults experiencing symptoms of anxiety and depression. Employers responded by offering more mental health benefits, adding employee assistance programs, and implementing workplace mental health training and education.

However, the end of the public health emergency did not bring an end to this priority. The United States is currently experiencing an unprecedented need for behavioral health resources. In June 2022, 33% of adults reported symptoms of anxiety or depression, a significant increase from 11% in June 2019.

Employees have come to expect behavioral health support from their employers, and employers have embraced the productivity and cost benefits of supporting behavioral health.

Implications for stakeholders

- Employers are prioritizing virtual options. While employers have embraced a wide range of behavioral health benefits and supports, they remain focused on virtual behavioral healthcare. In fact, more than half of large employers will offer virtual behavioral health care next year.

- Moving forward, employers will continue to look for high-quality, integrated partners to support their behavioral health programs. Plans should take steps to understand the behavioral health needs and wants for employers and employees. In addition, they should consider having in-house or third-party partners vetted and ready to provide behavioral health services.

of employers are utilizing or considering strategies to boost quality of and access to mental health and substance abuse resources

What’s the priority?

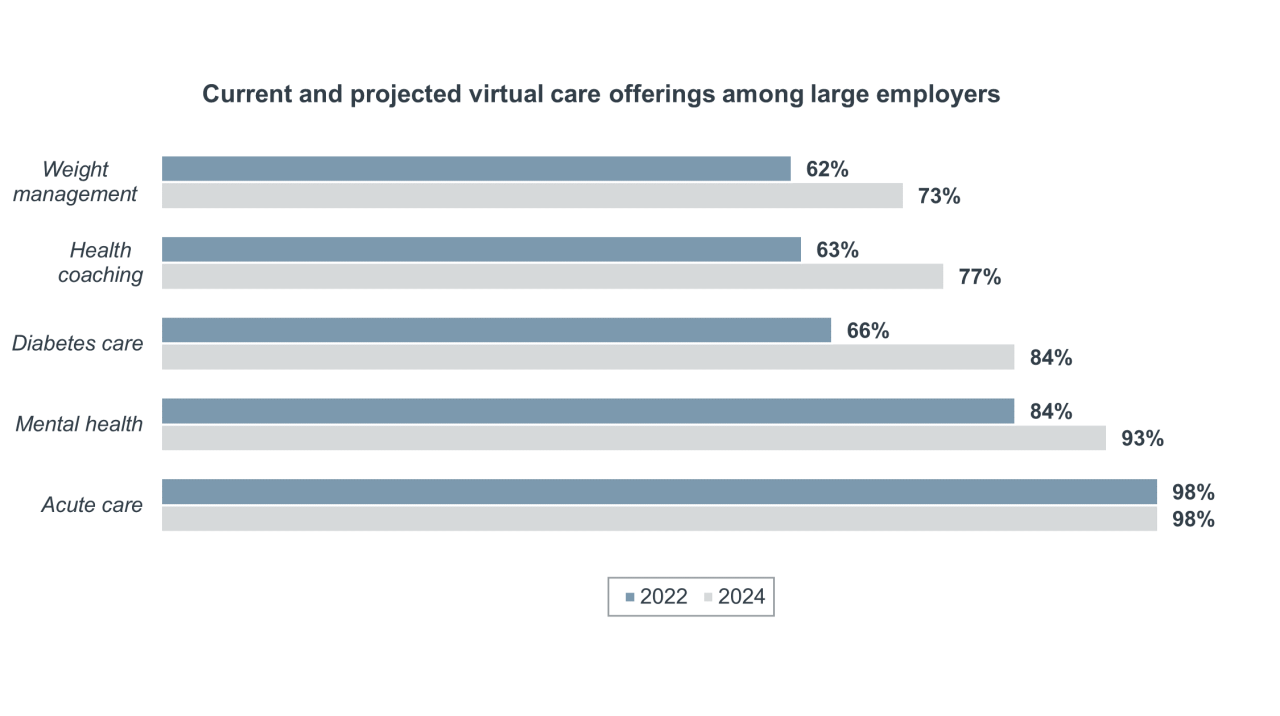

Virtual healthcare has been taken the spotlight in recent years, largely due to its potential for care navigation and cost savings. In 2021, employees typically used virtual healthcare to refill prescriptions, receive routine care for chronic illness, and complete annual physicals or preventive services. However, 64% of employers are now expanding virtual care beyond these traditional services.

Why is it relevant now?

The COVID-19 pandemic accelerated adoption of virtual care among health systems and consumers. While virtual care usage has leveled off, it is here to stay. In recent years, we've seen virtual healthcare expand to include offerings like virtual-first health plans and care navigation tools. Employees have recognized the potential convenience of virtual care, and employers have seen the potential for cost savings if virtual care is implemented effectively.

Implications for stakeholders

- Employers must be strategic when choosing virtual healthcare partners and options. Options abound, but employers will need to integrate their offerings and ensure that employees want — and use — the benefits.

- Plans must help employers integrate virtual care into their other plan offerings. When surveyed, employers rely on their plans for this integration more than any other healthcare stakeholder.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.