Auto logout in seconds.

Continue LogoutBy Deirdre Saulet and Ashley Riley

In our Trending Now in Cancer Care survey, we asked over 290 respondents representing 209 cancer programs and independent practices about threats to cancer program growth, marketplace competition, and partnerships with other cancer programs and physicians.

Keep reading to see what we learned and how programs differ based on their facility type and location.

Top threats to cancer program growth differ by facility type

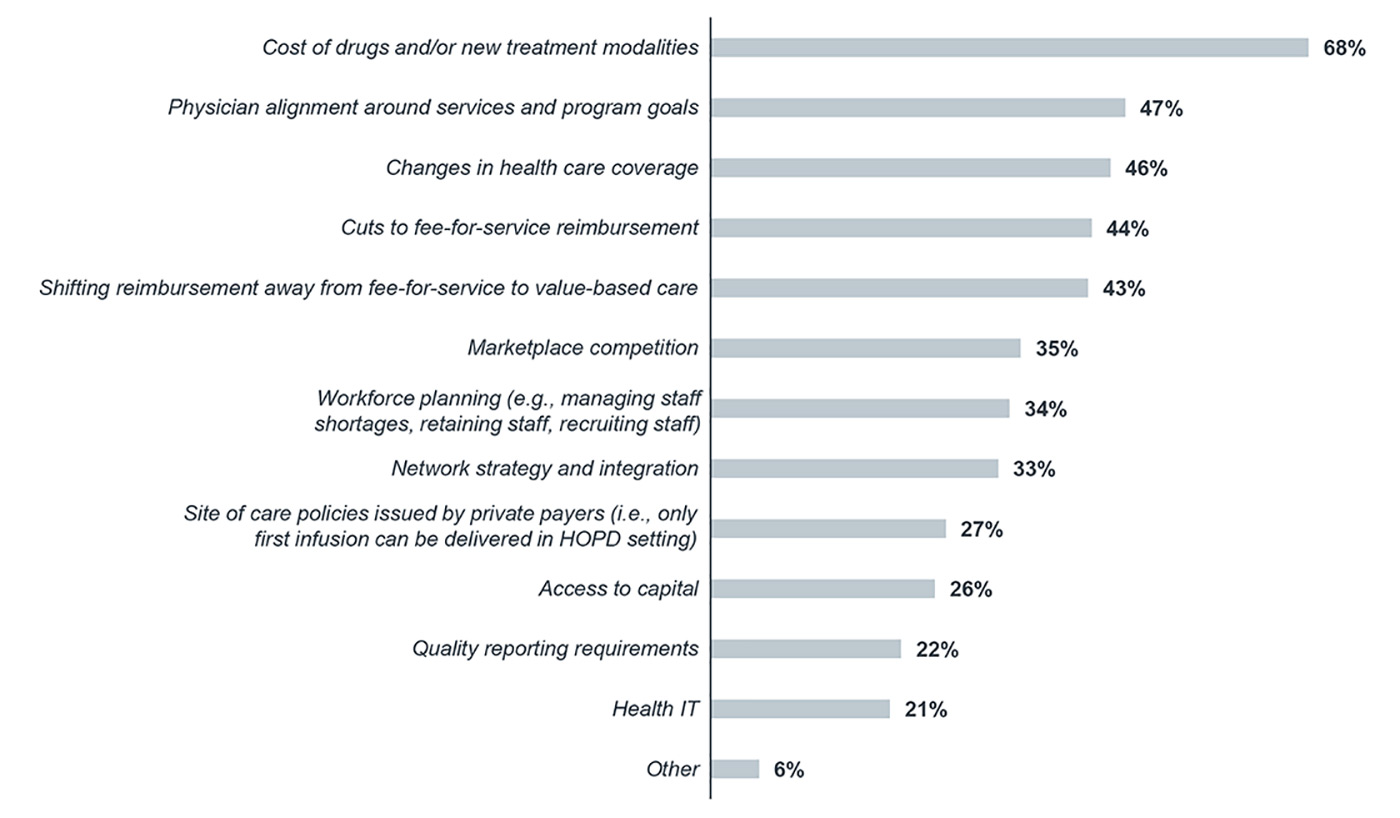

The cost of drugs and/or new treatment modalities was the most commonly identified threat to future cancer program growth across academic medical centers (AMCs), teaching hospitals, non-teaching hospitals, independent physician practices, and freestanding cancer centers. This is not surprising given the rising cost of oncology drugs, particularly newer classes of drugs, such as immunotherapies.

Which of the following are the biggest threats to future cancer program growth at your organization?1

Percentage of respondents that ranked threat in top five, 2017

n=234

1) Respondents were asked to select the top five threats.

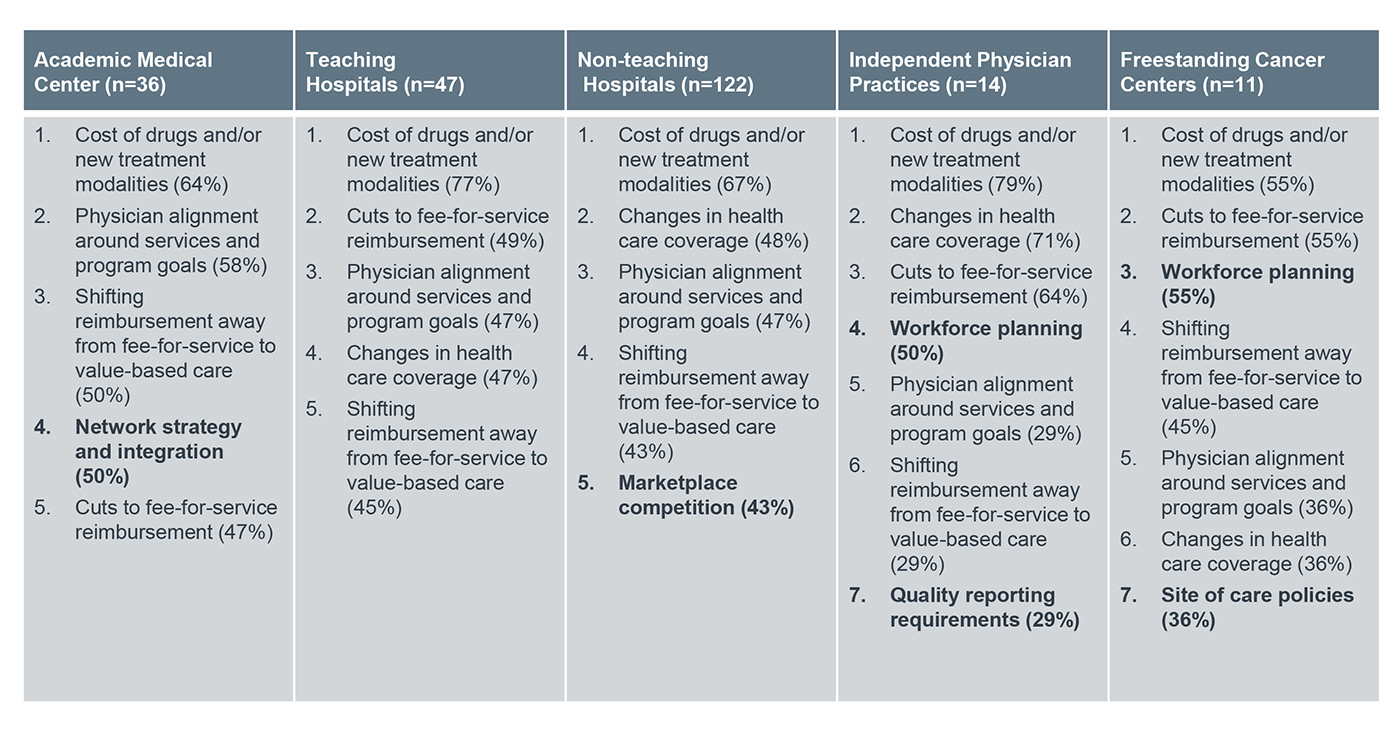

However, there was some variation among facility types in which threats were most commonly reported behind drug costs. AMCs were the only group of respondents for which network strategy and integration was one of the five most commonly reported threats. Marketplace competition was only a top threat for non-teaching hospitals. Independent practices and freestanding cancer centers were the only groups of respondents to report workforce planning as one of their top threats.

Quality reporting requirements was only a top threat for independent practices, and site of care policies issued by private payers was only a top threat for freestanding cancer centers. The latter was surprising to us because most site of care policies attempt to move patient treatment from the hospital setting to the freestanding setting, which payers see as a lower-cost care setting. We’d expect this to contribute to freestanding cancer center growth, not impede it.

Top Five Most Commonly Reported Threats to Cancer Program Growth by Facility Type

Percentage of respondents, 2017

Trends in marketplace competition over the past two years varied by region

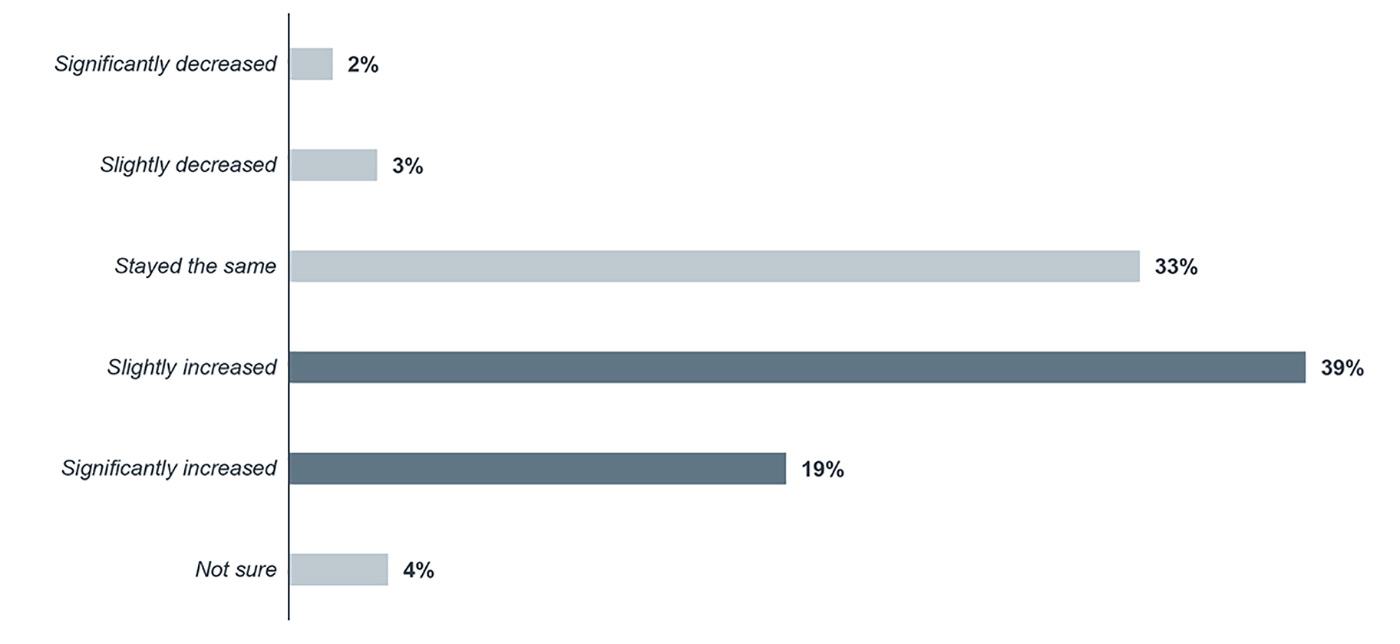

Although only 35% of all respondents reported marketplace competition as one of the top five threats to their cancer program’s growth, more than half of all respondents (58.2%) reported that the level of competition in their market has slightly or significantly increased over the past two years.

Over the past 24 months, how has the level of competition in your market changed?

Percentage of respondents, 2017

n=235

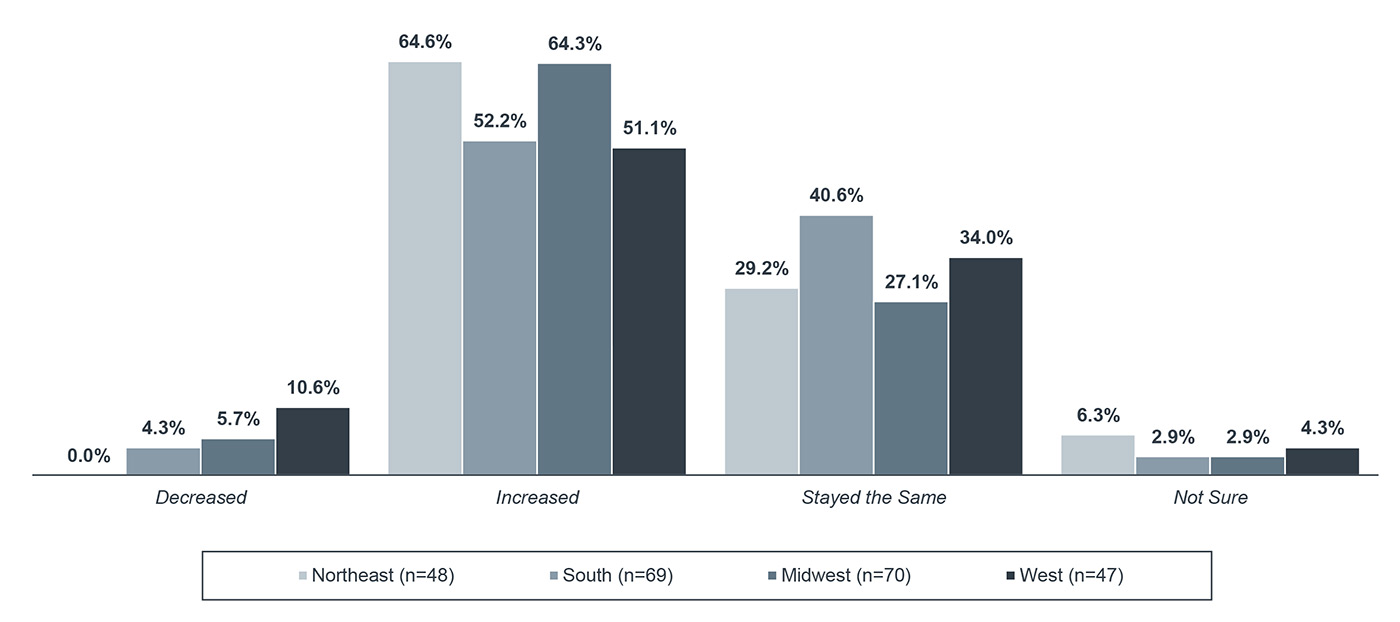

The magnitude of the change in marketplace competition varied by region. The Northeast and Midwest had the highest number of reports of increased competition over the past two years (64.6% and 64.3%, respectively). The Northeast was also the only region with no respondents citing seeing a decrease in competition. The West had the highest percentage of respondents reporting decreased competition in their market (10.6%), and the South had the highest number of respondents experiencing no change in marketplace competition (40.6%).

Change in Marketplace Competition Over the Past 24 Months by Region

Percentage of respondents, 2017

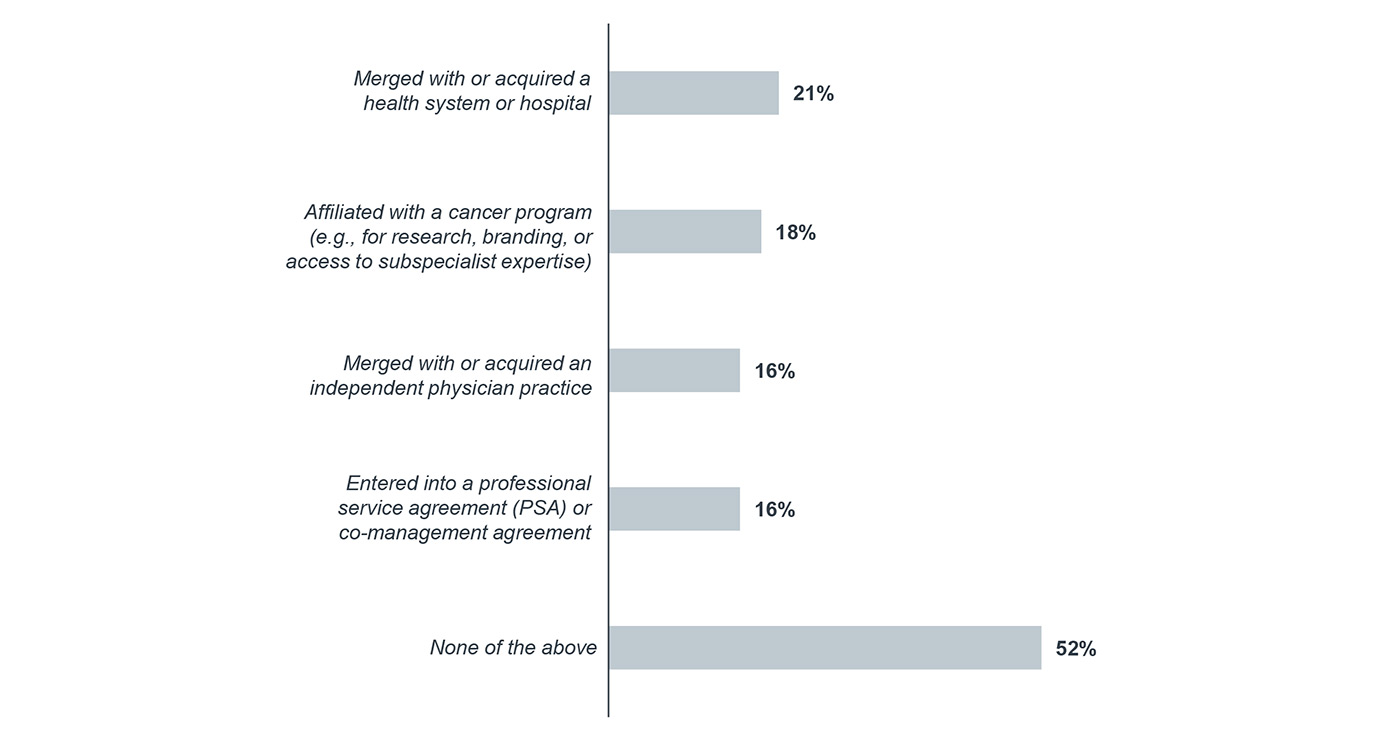

Almost half of respondents partnered with another program or practice in the past two years

One way to combat increasing market competition is to form partnerships with other programs. Therefore, it’s no surprise that almost half of respondents (48%) indicated that their cancer program entered into some form of partnership with another cancer program or practice.

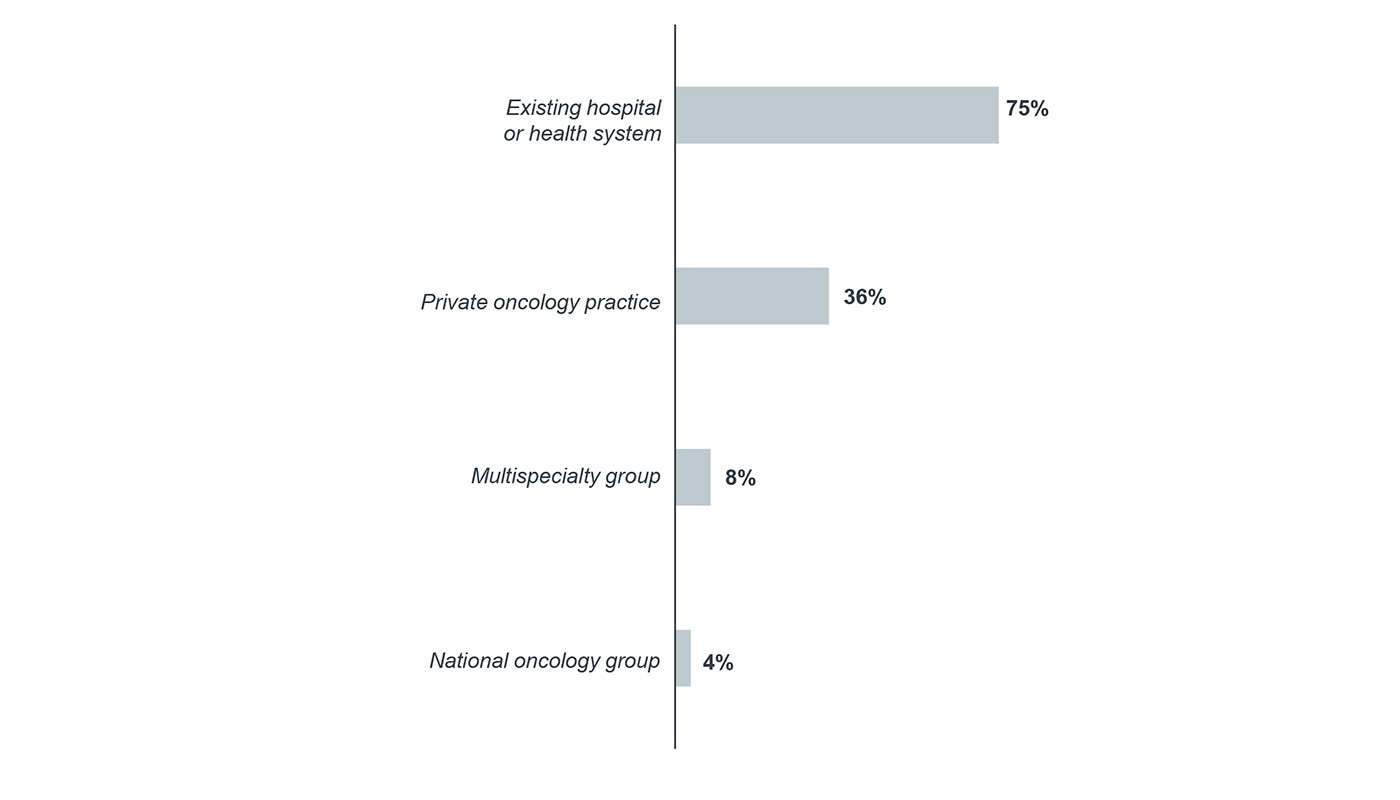

Although there’s no clear frontrunner in terms of the type of partnerships programs formed (i.e., merger, affiliation, professional service agreement (PSA) or co-management agreement), cancer programs most commonly partnered with an existing hospital or health system (75%).

Which of the following actions has your cancer program or practice taken in the past 24 months?

Percentage of respondents, 2017

n=233

What type of group has your cancer program or practice decided to partner with?1,2

Percentage of respondents, 2017

n=109

1) Respondents were only asked this question if they indicated that they formed a partnership with another group in the past 24 months.

2) Respondents were asked to select all that apply.

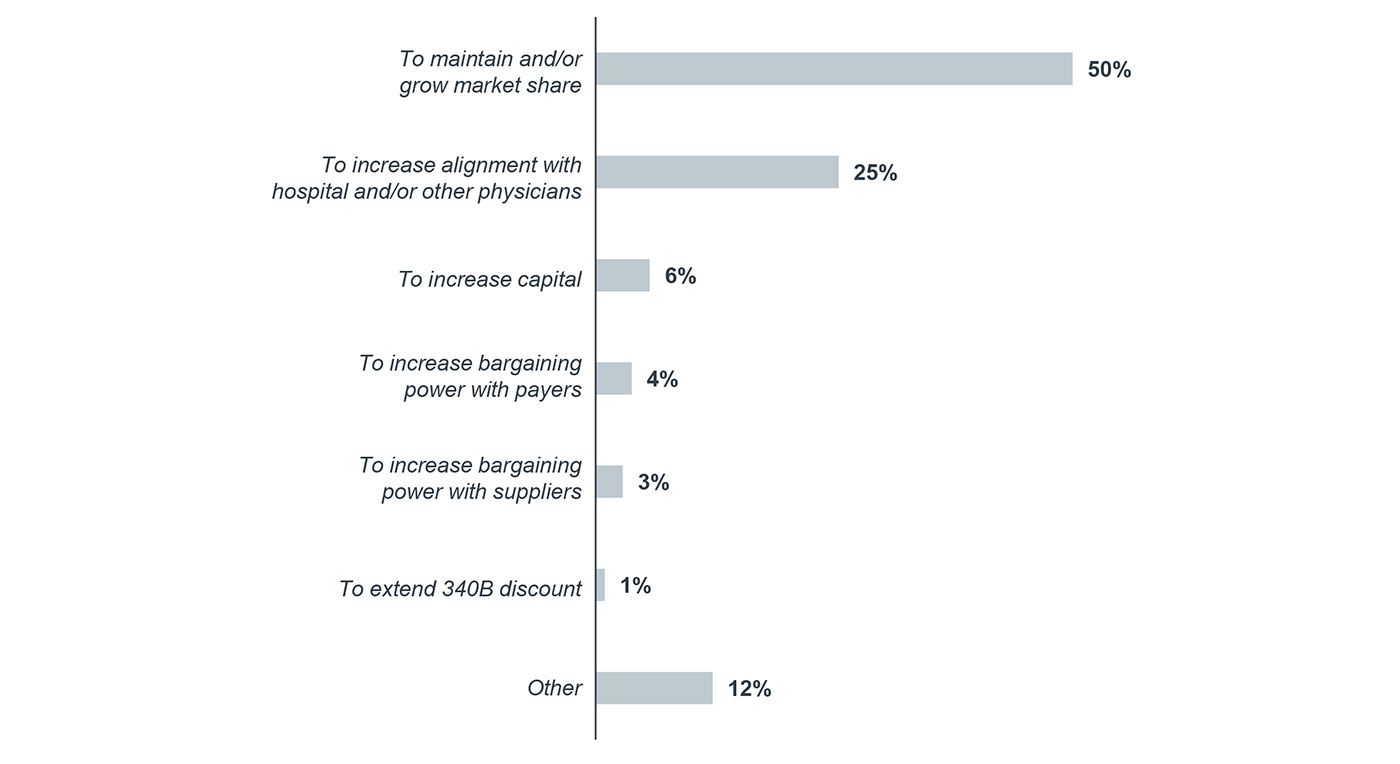

The most frequently reported reason for developing these partnerships was to maintain and/or grow market share, with half of respondents citing this as their top reason. Increasing alignment with hospital and/or other physicians was the second most common reason for deciding to partner with a hospital, medical group, or practice (25%).

What was the top reason for deciding to partner with another hospital, medical group, or practice?1

Percentage of respondents, 2017

n=107

1) Respondents were only asked this question if they indicated that they formed a partnership with another group in the past 24 months.

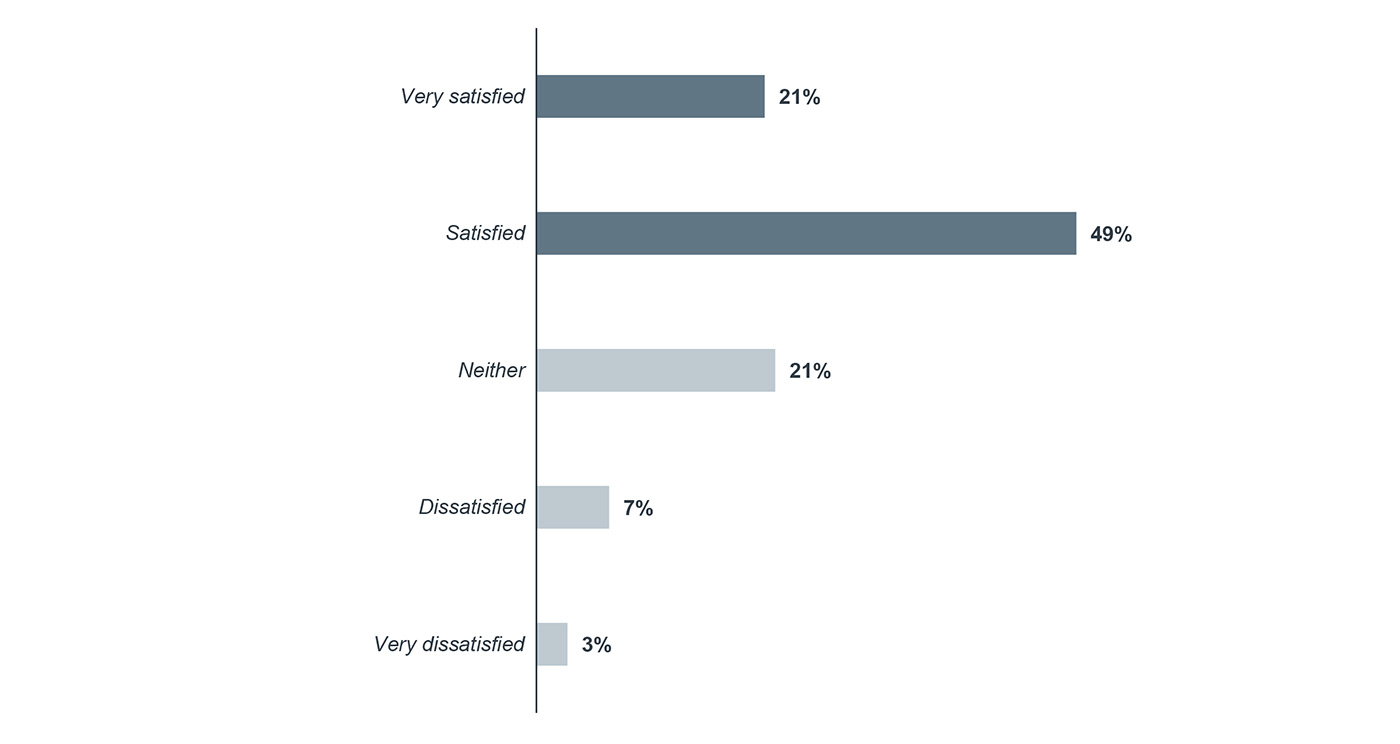

Cancer programs and practices that merged, affiliated, or entered into a PSA or co-management agreement with another program or practice were overwhelmingly satisfied with their partnership (70%).

How satisfied has your organization been with this merger, acquisition, affiliation, PSA, or co-management agreement?1

Percentage of respondents, 2017

n=107

1) Respondents were only asked this question if they indicated that they formed a partnership with another group in the past 24 months.

To see what cancer programs told us about other aspects of the oncology market landscape, you can access the full survey results.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.