Auto logout in seconds.

Continue LogoutEditor's note: This story was updated on September 14, 2018.

2017 was the first year of MACRA's Quality Payment Program (QPP), and the results on how providers fared are in.

To recap, providers in the Merit Based Incentive Payment System (MIPS) reported on quality measures, improvement activities, and EHR use measures. Providers' performance in 2017 translated to a MIPS score from 0 to 100, which then converted to a percentage increase, decrease, or neutral (zero) adjustment that will apply to their Medicare Part B reimbursement in 2019. CMS must adjust the maximum amount it pays "winners" to match the total penalties for providers who failed to report (i.e., "budget neutrality").

How providers fared in 2017—and how it affects their 2019 reimbursement

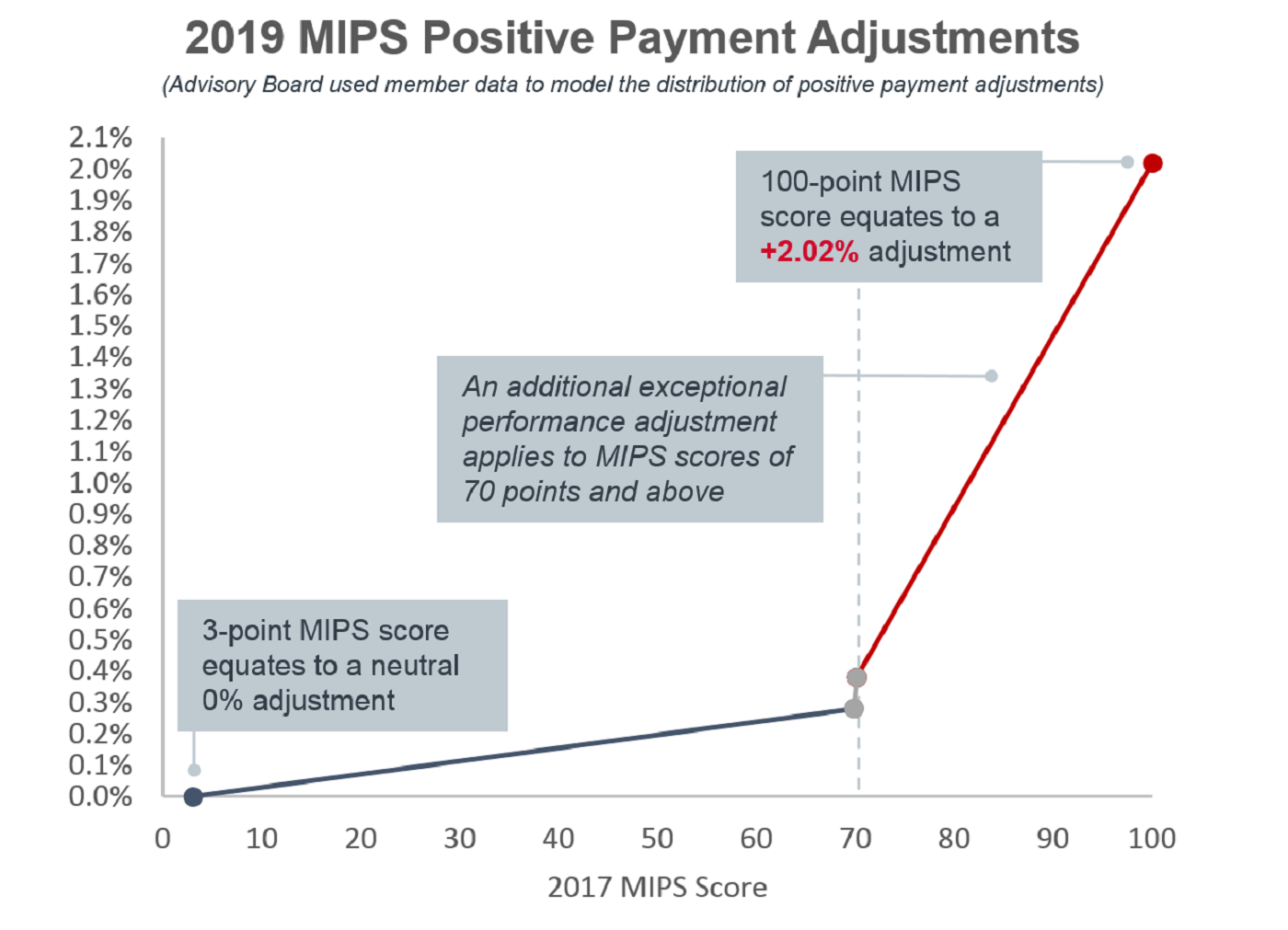

Providers who earned 0 (zero) points receive a negative 4% adjustment. We used member data to model the distribution of positive payment adjustment rates (i.e., for MIPS scores of 3 points and above). The graph below shows that the gain in payment adjustment increases only very slightly for each additional point earned, until a provider reaches the exceptional performance threshold (i.e., 70 points). The distribution of adjustments shown reflects the initial CMS performance feedback from July 2018, see the Editor's Note below for updated maximum adjustment information.

For providers who achieved the maximum score of 100, this correlates to a 2.02% increase to their 2019 reimbursement. Many providers are wondering why the maximum adjustment is so low. It’s because few providers received negative payment adjustments given how low the bar (i.e., 3 out of 100) was set to avoid a negative adjustment.

Editor's note: On September 13, 2018, CMS re-calculated the maximum adjustment due to several scoring logic issues. The maximum score of 100 now correlates to a 1.88% increase.

Looking ahead

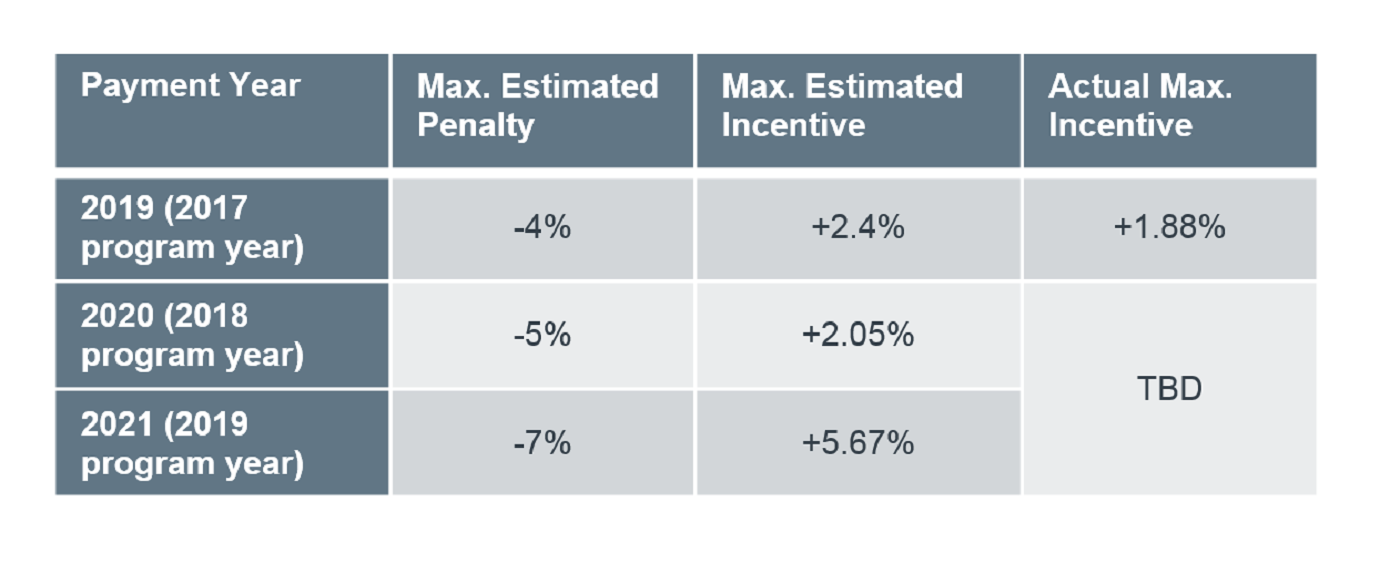

How might providers fare in the following years? Here is a chart to summarize the required penalties and estimated MIPS incentives by year:

Earlier in July, the 2019 proposed QPP policies were released in the public inspection document of the 2019 Medicare Physician Fee Schedule proposal. Here are a few highlights from the QPP payment perspective:

- May include new provider types (i.e., Physical Therapists, Occupational Therapists, Clinical Social Workers, and Clinical Psychologists). This means more types of providers can earn incentives (or face penalties);

- Plans to add another low Medicare volume exclusion criterion that may lead to more providers excused from MIPS all together; and

- Intends to allow a new "opt-in" policy for certain providers who qualify for some but not all of the low-volume criteria (which may offset the above policy).

Along with further developments of QPP's Advanced APM track, a lot is up in the air for Year 3 of the QPP. Find out how it may impact reporting requirements and future reimbursement when we unpack the 2019 MACRA proposal.

Learn more: Register for two upcoming webconferences on QPP

Want to learn more about this year's MACRA requirements and those proposed for 2019 in the QPP? Join us for two upcoming webconferences on QPP.

On August 2, we'll cover the 2018 MIPS Cost category requirements and explore how data on cost performance will be incorporated into the final MIPS scores.

On August 16, we'll take a deeper dive into the 2019 QPP proposal and relay the implications of the most important changes.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.