Auto logout in seconds.

Continue LogoutTelehealth seemed to be near a tipping point for widespread adoption at the beginning of 2020—just as it seemed to be near this same tipping point at the beginning of 2019. And 2018. And each of the previous five years.

The reality of telehealth before Covid-19 was unfulfilled promise at the national level. Two out of three consumers said they were interested in telehealth services, but fewer than one in ten had ever used them. Only about one in five physicians had ever done a virtual visit. A hospital telehealth program with annual visits in the hundreds—that is, one or two telehealth visits per day—could reasonably have been described as “robust,” relative to the average hospital.

All stakeholders encountered significant obstacles to telehealth. Consumers were unaware of the availability of telehealth services from their providers. Clinicians worried that they wouldn’t be reimbursed adequately for telehealth and that telehealth might not be an appropriate way to deliver care. Payers and purchasers were afraid that telehealth would turn out to be an ineffective alternative to in-person care that would ultimately increase overall utilization and total cost of care.

Covid-19 has pushed the health care industry to cram years of progress on telehealth adoption into a few weeks. This “trial by fire” has overcome pre-Covid-19 obstacles of consumer use and clinician adoption, and it has set the stage for potentially transformative integration of telehealth across the care continuum.

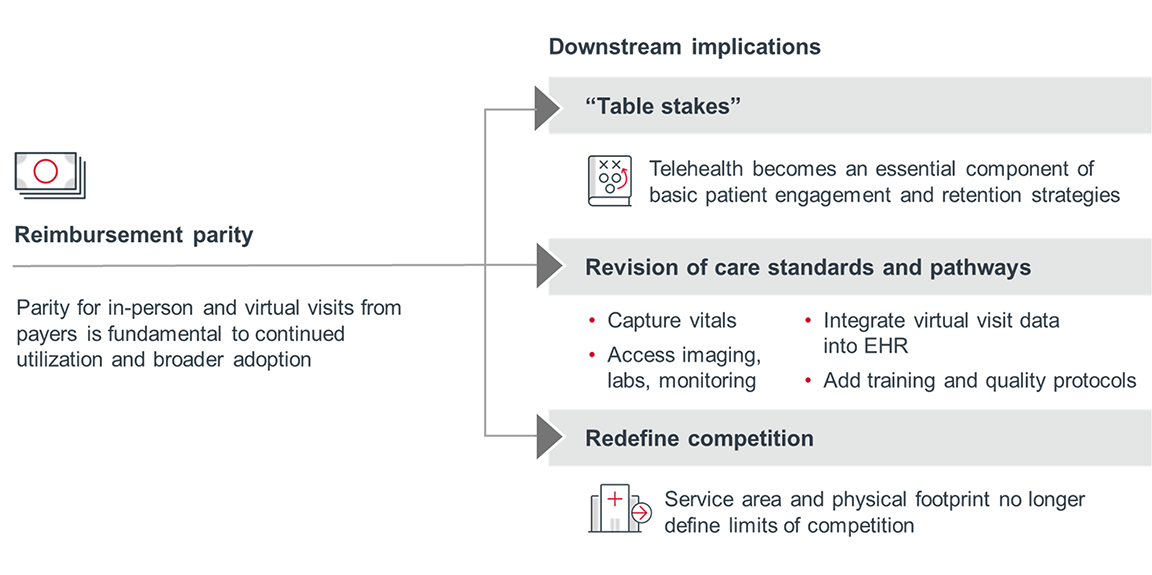

Consumer experience with telehealth will lead to increased demand for telehealth services. Clinician familiarity with telehealth will lead to greater openness to and creativity with providing care remotely. Data on patient experience and outcomes will enhance understanding about which telehealth applications work and which don’t. Reimbursement parity will be essential to unlocking and sustaining widespread telehealth adoption.

The future of telehealth could turn out to be the future of medicine.

Covid-19 has provided a national demonstration case for telehealth that would never have been possible otherwise. Sustained and expanded adoption will depend on aligning around shared goals of generating value and transforming care delivery.

In response to the Covid-19 pandemic, Medicare has abandoned many longstanding restrictions on telehealth reimbursement. The most significant change? CMS has reimbursed providers for telehealth visits at the same rate as in-person visits for more than 80 kinds of interactions. Some plans have followed suit, largely for visits related to Covid-19, but also for other acute and routine visits.

If payers retrench after Covid-19 to limited use and lower reimbursement for telehealth, the industry will find itself right back where it was before Covid-19— but with greater patient demand for a service that undercuts in-person provider reimbursement rates. That could push providers to different payment models, including per-member-per-month arrangements with plans; subscription revenue (from internal and external clients); services to schools, prisons, or short-staffed provider organizations; and grants.

One way to overcome obstacles to reimbursement will be to demonstrate that telehealth is a viable means of care delivery in its own right, rather than a compromise or convenience measure. Payers worry that telehealth will increase in-person utilization rather than replace it. Providers will have to be able to connect patients to all of the downstream services and interventions they need— such as labs and referrals—without a subsequent in-person visit.

CMS administrator Seema Verma recently hinted at an openness to consider a broader role for telehealth in the future, saying, “I think it's fair to say that the advent of telehealth has been just completely accelerated, that it’s taken this crisis to push us to a new frontier, but there's absolutely no going back.”

The U.S. is on track for an estimated 1 billion telehealth visits in 2020, giving millions of consumers their first exposure to care delivery outside a clinical setting. That should stoke demand for telehealth services even beyond the Covid-19 pandemic, making telehealth “table stakes”—an essential component of even a basic patient engagement and retention strategy.

Advisory Board’s consumer research on virtual visits has consistently shown that, once patients try a virtual visit, they tend to be satisfied with both the care received and the clinician interaction. Moreover, they say that they are willing to use virtual visits to receive care in the future—and early findings on Covid-19 utilization are consistent with that. In a recent survey, 69% of consumers said they want their providers to offer more telehealth services as an alternative to in-person visits after the pandemic.

Consumer worries could also compound that demand: 34% of consumers recently said they don’t feel safe going to a hospital. If Covid-19 surges again before there’s a vaccine, telehealth will once again be essential for thosepatients as well as those who want to avoid clinical settings.

The recent pivot to telehealth from in-person visits will provide a wealth of new data and firsthand experience. This information will be needed to evaluate appropriate and creative uses of telehealth. To fully capture the value of telehealth, providers will need to do far more than simply launch a telehealth program and platform. They will have to integrate telehealth across the care continuum and into specific care pathways.

This requires providers to consider the necessary interactions upstream and downstream of the actual telehealth visit, including:

- Clear and easy access points to telehealth

- Integration of telehealth visits data into the EHR

- Patient connections to remote monitoring devices, labs, imaging, and referrals

Broad adoption of telehealth also opens the door to novel, digital-first applications of telehealth, including:

- Pre- and post-op visits

- “Exception-based” in-person visits, where telehealth is the dominant mode of patient-clinician interaction and in-person visits are limited to procedures and comprehensive physical examinations

- Hospital-at-home, including post-procedure observation and rehab

Existing telehealth platforms allow patients and providers to connect far beyond the geographic reach of a local health system or provider practice. In a world where almost every provider will need a telehealth platform—both to meet patient expectations and to maintain patient accessibility when another pandemic lockdown occurs—such extensive reach will no longer be limited to telehealth vendors and progressive health systems.

New technologies like 5G networks will further expand the services and diagnostics that are available remotely. This even includes specialties like radiology and dermatology, where visualization is essential and resolution demands of imaging are high.

Expanded use of telehealth may also require providers to reconsider their physical, brick-and-mortar footprints. Investment in physical assets in a world of widespread telehealth adoption may not be advantageous from a business development perspective. At the same time, a seamless, convenient integration of telehealth across the care continuum will require providers to think about how to use their physical locations as genuine complements to their telehealth services, and vice versa. This includes in-person interventions and interactions downstream of a virtual visit that are clinical (such as labs, imaging, and referrals) and supportive (such as navigation and counseling).

Across most health systems, telehealth delivery is patchy at best. Making forward progress requires completing an inventory of existing services.

- Where across your service lines could or should clinical services move to virtual channels?

- To what extent are different practices delivering telehealth services today?

- Across service lines and practice sites, do patients know when telehealth is available and how to access it?

First priority for providers is delivering some type of telehealth at all. But soon, they’ll be competing to provide the best services—especially as telehealth competitors can be local, national, or global.

- Where are you tracking patient experience for virtual visits? How are you tracking patient experience?

- Based on data collected, how will you address consumer needs and expectations?

As care moves virtual, organizations may need to rewire the connection points between new, virtual channels and existing, in-person access points.

- Across clinical services, what are the follow-up needs and interventions that cannot be addressed through virtual interactions?

- What kind of linkages do you need to establish to connect patients from virtual interactions to in-person visits or downstream services like labs, imaging, or referrals?

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.