Auto logout in seconds.

Continue LogoutWe are in the midst of the most significant period of provider consolidation in the last 30 years.

Hospitals, physician practices, and integrated health systems have seen periodic flurries of dealmaking in the past, but rarely has the American health care provider sector experienced such sustained increases in mergers and acquisitions (M&A) activity as it has in recent years.

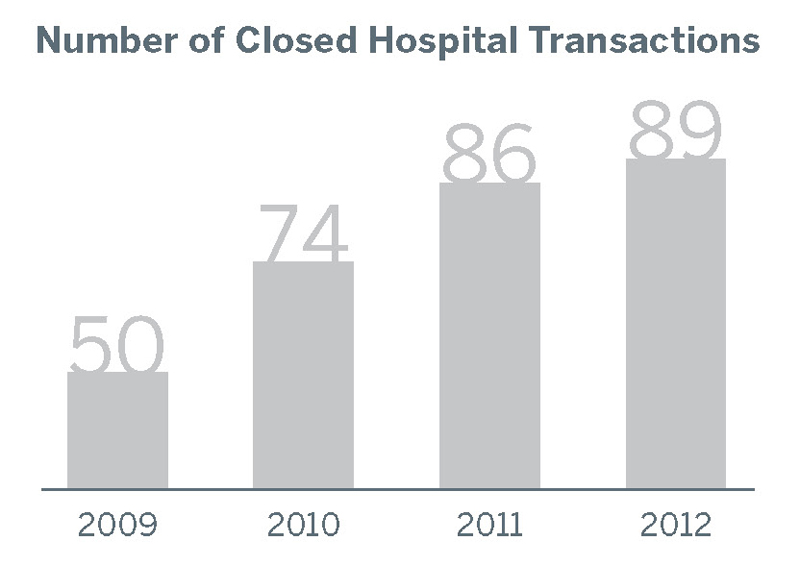

Over the last four years, the number of announced hospital and health system M&A transactions has almost doubled—a tally that grows even more if you include deals that failed before they were concluded.

Add this to massive shifts toward physician practice acquisition and employment, and the recent consolidation becomes even more remarkable.

88% of provider executives plan to pursue M&A within the next 12 months

The consolidation trend may be only just beginning. Interviews with hospital and health system executives, as well as our own analyses, suggest that hospital and health system M&A activity will continue to accelerate in 2014. Our findings square with a recent GE Capital survey of provider executives: 88% plan to pursue a merger or acquisition within the next 12 months.

However, executives must proceed with caution. We see a fundamental shift in the value associated with M&A that should change the way leaders vet prospective partners and the upside expectations they communicate to internal and external stakeholders.

Success in the market will no longer be derived from higher prices.

Over the past few years, many health care providers have been pursuing mergers and acquisitions in an effort to consolidate their competitive position in local markets, securing richer referral streams, and acquiring greater price leverage.

These benefits of scale are increasingly hard to come by as the health care industry evolves and matures. Still, we see boards and management teams, from the smallest private practices and community hospitals to the largest for-profit chains, continuing to narrowly focus on scale as the primary motivation for M&A. They are asking each other, and asking us: "How big is big enough?"

But these days, "How big is big enough?" is a worthy but insufficient question. Size alone, and size’s legacy benefits, will not be enough for health systems to grow profitably.

Emerging limitations to traditional benefits of scale in health care industry

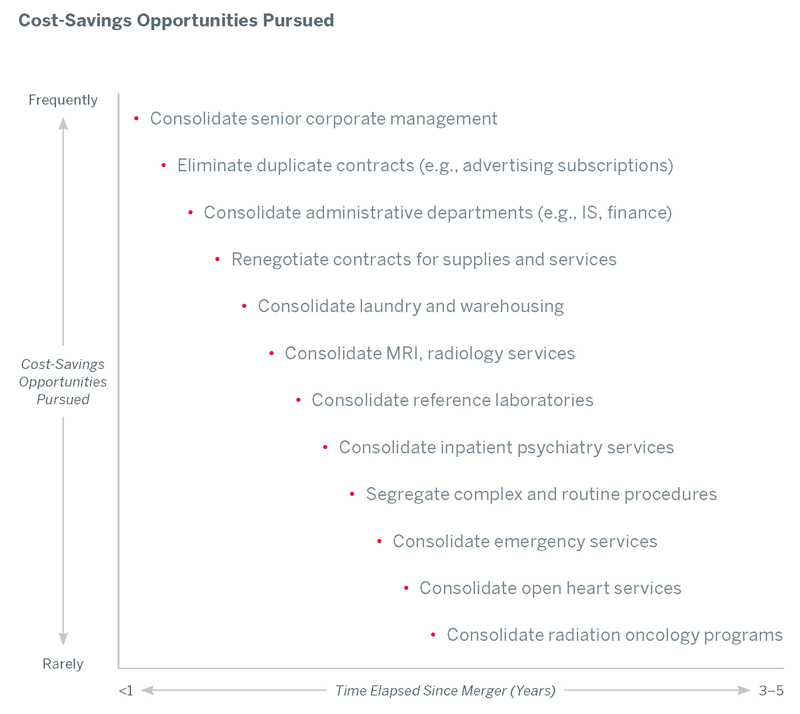

It has been difficult—and rare—for health systems to get significant economies of scale from M&A.

That’s not to say that size is unimportant—far from it. Economies of scale do continue to exist in the health care provider industry, but to capture them, health systems need to maintain a relentless focus on cost savings and make numerous difficult operational decisions—ambitions that often dissolve in the face of institutional inertia, pressure from stakeholders, and the sheer magnitude of the task.

So executives ought to view deals that promise significant cost savings, immediately or even over the long haul, with an abundance of skepticism.

Few networks even attempt to pursue full range of cost savings

Defensive deals remain sometimes unavoidable, but they are particularly risky.

In many recent cases, provider consolidation has really been a way to play defense. With new market entrants and expanding regional competitors threatening traditional volumes, many health care providers feel compelled to merge with another organization for financial stability.

Moreover, many institutions fear getting shut out of future deals by staying on the sidelines. In an active M&A environment, they worry that if they don’t make a deal, their competitors will, and they will no longer have the option to acquire assets, competencies, or revenue streams down the road.

“We’re stronger than ever, but with every satellite clinic our competitors open I feel a little less bullish... So we’re shopping for a regional partner who can help us level the playing field financially without diluting what makes us great.”

—Health system CEO in Upper Midwest

“I spent the last 3 months negotiating with myself to acquire a medical group that has done business with us for 15 years. There’s no celebration dinner after you close a deal where the only clear outcome is that we are guaranteeing the income of our 'partners.'”

—Health system CEO in Southwest

These are rational concerns, and valid reasons to pursue consolidation. However, the urgency associated with defensive M&A often means that executives proceed too rapidly, without evaluating all options or completing the planning necessary to integrate successfully.

And even if the transaction was the best possible strategic decision at the time, the consolidation and its aftermath will inevitably distract key executives at a time when the margin for error in strategy and operations remains razor-thin.

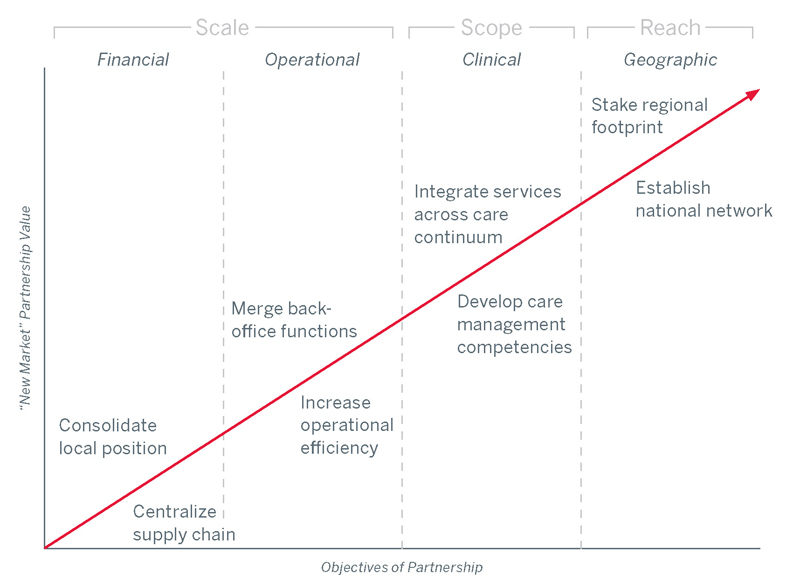

Increasingly, health systems see M&A as a way to gain scope and reach, not just scale.

Over the past few years, we have seen more and more health systems considering mergers, acquisitions, and affiliations that complement or extend their capabilities or geographies, not just their overall size. For example, we’ve seen organizations merging to get access to health plan capabilities, population health management assets, or even marketing prowess.

This is a natural evolution for provider strategy, since the entire hospital and health systems industry needs to become proficient at population health and cross-continuum management, among other important transformations. And all signs suggest that this trend will continue.

The caution to bear in mind, though, is that the returns on these “scope and reach” deals can take longer to realize than simpler “scale” mergers. It’s hard enough to get two similar organizations to work together; it’s much harder to integrate two organizations with fundamentally different orientations or operational domains.

Priorities of acquisitive health systems

No matter what their intent, ill-conceived mergers and acquisitions end poorly.

Many studies of M&A both inside and outside of health care show that a majority of deals fail to create value, and what’s more, far too many actually destroy value. According to a recent Booz and Company review, about one in five hospitals start to lose money within two years of the transaction.

There is also a huge opportunity cost: CEOs from some of the most acquisitive health systems over the last few years report that they spend a disproportionate share of their time distracted by operational crises rather than pursuing new growth opportunities.

“Building a 'super-regional' footprint across 2012 has bought us a massive turnaround project for 2014. Sure we kept our competition at bay, but now we’re fixing last year’s mistakes instead of going after new opportunities with real upside.”

—Health system CEO in the Mid-South

Successful deals result from intentional, not reactive, corporate strategy.

The health systems that are most successful in M&A are committed to intentional corporate strategy. They judge the value of potential affiliations, mergers, and acquisitions based on how they help deliver a better product to patients and purchasers—not how effectively they insulate the system from competition.

Keep reading to explore five characteristics of intentional corporate strategy.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.