Auto logout in seconds.

Continue LogoutU.S. health care spending is projected to grow by an average 5.6 percent annually over the next decade, according to a CMS report released Wednesday, Modern Healthcare reports.

CMS made the spending projections under the assumption that the Affordable Care Act (ACA) would remain intact through 2025. The projections do not take into account any potential changes to the law being weighed by Republican lawmakers.

CMS said the spending growth projections for 2016 through 2025 are largely fueled "by changes in economic growth and population aging and not as much by changes in insurance coverage." According to the report, the largest effects from coverage expansions under the ACA occurred in 2014 and 2015.

Overall outlook

Overall, CMS projected that total health care spending for 2016 reached nearly $3.4 trillion, up 4.8 percent from 2015. According to CMS, U.S. health care spending is projected to reach nearly $5.5 trillion by 2025. The agency attributed the increase in large part to the United States' aging population and rising prices for health care services.

According to the report, national health care spending is projected to outpace growth in the United States' Gross Domestic Product (GDP) by 1.2 percentage points. As a result, CMS estimated that health care spending will account for 19.9 percent of GDP by 2025, up from 17.8 percent in 2015.

CMS predicted that the slowest periods of health spending growth will occur over the first two years of the decade. Specifically, the agency projected that health care spending will increase by 4.8 percent in 2016 and 5.4 percent in 2017, as the result of:

- Slower growth in spending on Medicaid and prescription drugs;

- Slower growth in spending by private insurers; and

- Relatively low Medicare spending.

However, CMS predicted that health care spending will increase at an accelerated pace beginning in 2018, particularly because of higher spending on Medicaid and Medicare.

Medical, hospital price growth projections

CMS estimated that medical price inflation increased from a historically low rate of 0.8 percent in 2015 to 1.2 percent in 2016. The agency projected that medical price growth will accelerate from an average of 2.4 percent from 2018 to 2019 to an average of 2.7 percent for 2020 to 2025.

CMS said the projected growth reflects increases in both economy-wide and medial specific prices. However, the agency said the higher spending could be partially offset by slower growth in the use and intensity of such services.

CMS also said hospital price growth remained modest in 2016, at 1.2 percent. However, CMS predicted that hospital prices will increase between 2018 and 2019 because of rising input costs, as well as projected growth in the use and intensity of hospital services by Medicare beneficiaries.

Further, CMS projected that home health care spending growth will average 6.7 percent largely because of growth in Medicare as the baby boomer population ages and uses home health care services more often.

Medicare spending projections

CMS predicted that Medicare spending growth will increase from an average of 5 percent in 2016 to 5.9 percent in 2017. The agency estimated that Medicare spending growth will "peak in 2020 at 8 percent and grow at an average rate of 7.6 percent" for 2020 to 2025. CMS attributed the projected increase to "continued strong enrollment growth from baby boomers ... and the aging of the existing Medicare population." CMS wrote in the report, "Both of these effects contribute to increases in growth in the use and intensity of medical services."

For example, CMS said it expects spending on Medicare:

- Physician and clinical services to grow by 5.3 percent in 2017, compared with 3.9 percent in 2016; and

- Hospital services to grow by 4.9 percent in 2017, compared with 4.2 percent in 2016.

CMS wrote, "Higher growth in the use of Medicare hospital services is expected in part as the downward pressure on growth attributable to the readmission penalties and the two-midnight rule that occurred during 2011–[20]15 is not expected to continue."

Medicaid spending projections

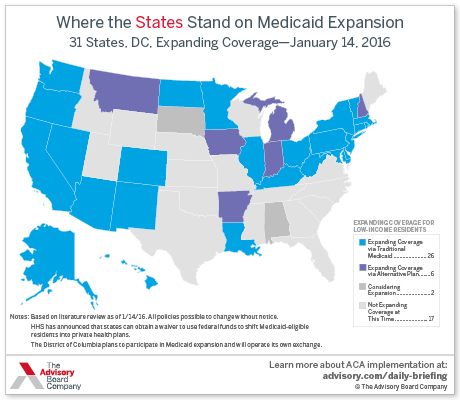

According to CMS, Medicaid spending growth slowed significantly from 9.7 percent in 2015 to a projected 3.7 percent in 2016. CMS said the slowdown largely resulted from slower Medicaid enrollment growth. The agency predicted that Medicaid enrollment growth declined from an average of 8.4 percent from 2014 to 2015 to an average of less than 2 percent by 2017.

CMS also attributed the slowdown in Medicaid spending to slower growth in hospital spending under the program. CMS predicted that Medicaid hospital spending growth fell from 9.5 percent in 2015, when many states had implemented higher Medicaid reimbursement rates, to 4.5 percent in 2016.

However, CMS projected that Medicaid spending will accelerate over the coming years, growing by an average of 5.9 percent from 2018 to 2019, largely because of increased intensity and use of care.

Private health insurance spending projections

CMS estimated that private health insurance spending growth slowed from its peak of 7.2 percent in 2015 to 5.9 percent in 2016.

However, CMS projected that private health plan spending growth will average 6.5 percent in 2017, compared with 5.9 percent in 2016. CMS said factors contributing to the projected increase include:

- Higher expected spending on prescription drugs;

- Acceleration in premium growth for ACA exchange plans, which stemmed from insurers "underpricing" premiums in previous years; and

- The elimination of the ACA's risk corridors program.

Prescription drug spending projections

CMS estimated that prescription drug spending growth slowed from 9 to 5 percent between 2015 and 2016. CMS said the slowdown largely stemmed from lower use of costly drugs to treat hepatitis C.

However, the agency projected that prescription drug spending growth will accelerate to 5.7 percent in 2017, mostly because of an increase "in the number of prescriptions dispensed." CMS predicted that prescription drug spending growth will increase to an average of 7 percent from 2018 to 2019, "driven by faster price growth as a result of fewer brand-name drugs losing patent protection" (Castellucci, Modern Healthcare, 2/15; Keehan et al., Health Affairs, February 2017; Yasmeen, Reuters, 2/15; Firth, MedPage Today, 2/15; Johnson, "Wonkblog," Washington Post, 2/15; AP/Sacramento Bee, 2/15; CMS release, 2/15).

Eight ways to raise your margins

Hospital finance executives are facing pricing pressures, transitions in patient coverage, and the emergence of new competitors. We've taken a look at all the forces at play and distilled eight mandates you must address. Make sure your to-do list contains these must-dos—and read the infographic to explore each mandate's details, impact, and difficulty.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.