Auto logout in seconds.

Continue LogoutA consistent pipeline for clinician talent has never been more important, and clinicians have more options for employment than ever. Healthcare leaders can’t afford to plan their recruitment and retention strategies based on outdated information or generic assumptions. Advisory Board and LocumTenens.com launched our clinician workforce survey to get an updated view into how physicians and advanced practice providers (APP) think about employment. Our findings challenge conventional wisdom about the clinician workforce and uncover opportunities to win the competition for talent.

Overview

Research questions

While healthcare leaders understand clinician workforce dynamics at a high level, they must often design recruitment and retention strategies based on outdated information and generic assumptions. Organizations would benefit from deeper analysis into understanding clinician job priorities, unpacking their perceptions, and analyzing why they choose certain employers over others.

To zoom in on these workforce dynamics, we set out to answer the following questions:

- What is the current state of clinician satisfaction and intent to leave?

- What do clinicians value, and how can employers better compete for talent?

- How do clinicians perceive different employers and their ability to meet clinician preferences?

What we did

Advisory Board and LocumTenens.com surveyed more than 730 physicians and advanced practice providers (APPs) nationally to learn about current job satisfaction, job preferences, compensation, and work environment. Respondents included W-2 employees and 1099 independent contractors across several employer types, including independent medical groups, health system-employed medical groups, corporate-owned medical groups, and other practice models, including locum tenens.

What we found

The conventional wisdom about satisfaction, preferences, and intent to leave is no longer certain.

- Satisfaction does not guarantee retention. This is true for clinicians at all stages in their careers — from those who recently graduated or completed residency to more tenured medical professionals.

- Compensation is the top priority for clinicians selecting a job. But non-pay factors, like schedule flexibility and work-life balance, can and do make up for lower pay.

- No one employer type emerges as the clear winner for all medical professionals. Each type of employer has strengths and weaknesses that make them “the best” for some clinicians, who have different priorities based on age, length of tenure, and other factors.

Clinicians prioritize the same five factors when selecting a job

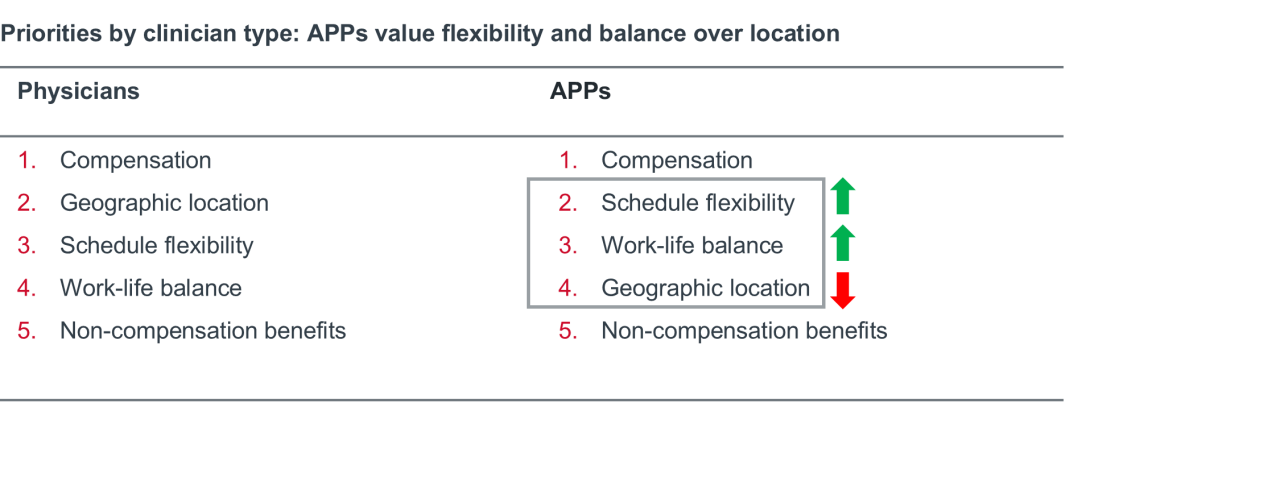

Across the board, clinicians consistently prioritized the same five factors: compensation, geographic location, schedule flexibility, work-life balance, and non-compensation benefits. Aside from compensation — which remained the top priority — those factors shifted slightly in relative importance depending on clinician role and age. As seen below, APPs valued schedule flexibility and work-life balance more and geographic location less, compared to physicians.

- Compensation

- Geographic location

- Schedule flexibility

- Work-life balance

- Non-compensation benefits

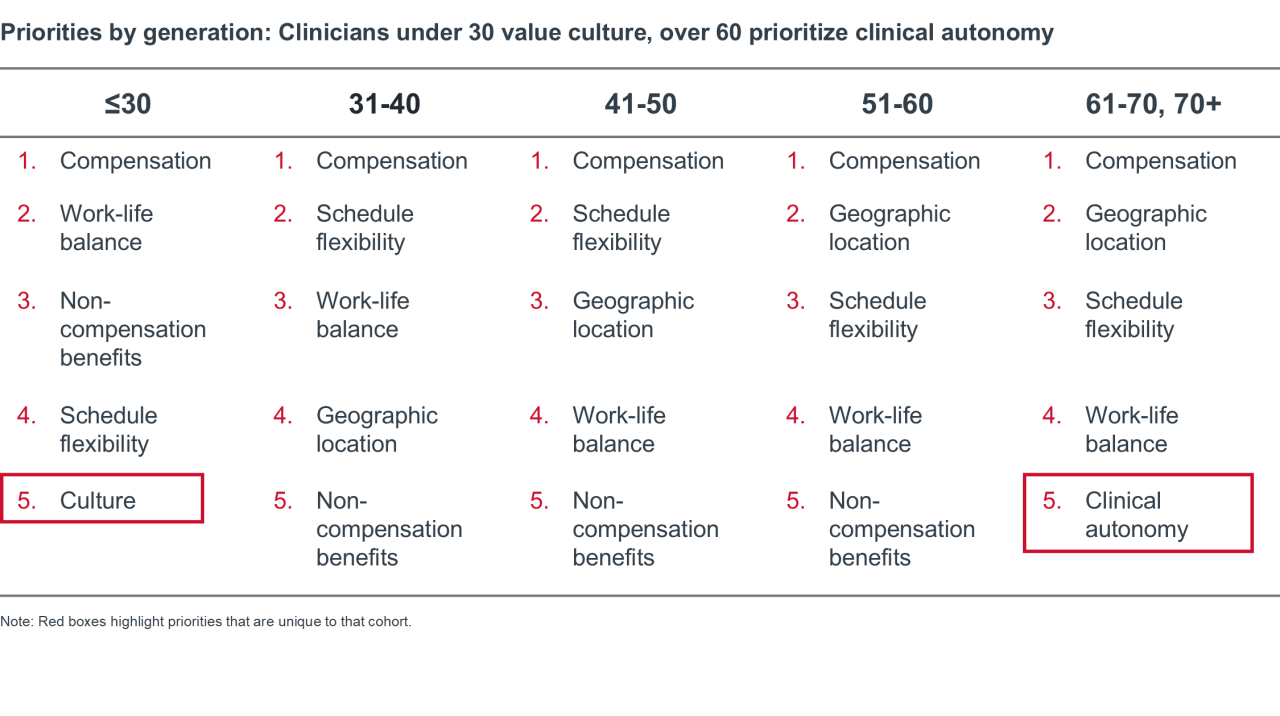

We see the same five factors rise to the top when broken out by generation, with two exceptions. First, for clinicians under 30, workplace culture replaced geographic location in their top five. Location rises in importance with each subsequent age cohort — ranking second only to compensation for clinicians over the age of 51.

Second, for clinicians over 61, clinical autonomy replaced non-compensation benefits in their top five. This isn’t surprising given that many older physicians started their careers in independent practice, where clinical autonomy is prized.

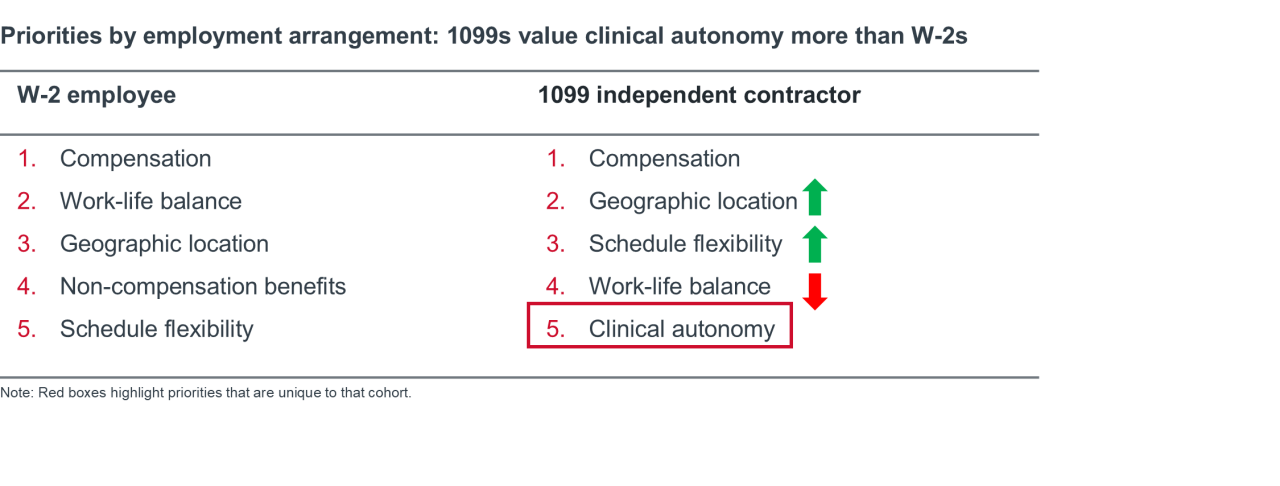

Clinical autonomy also replaced non-compensation benefits in the top five for 1099 contracted clinicians. This isn’t unexpected, since many clinicians prefer contracted models because they offer more independence. In addition, 60% of our 1099 survey respondents were over 50, so this prioritization likely reflects generational preferences.

While compensation consistently ranks first, organizations can outcompete on other factors

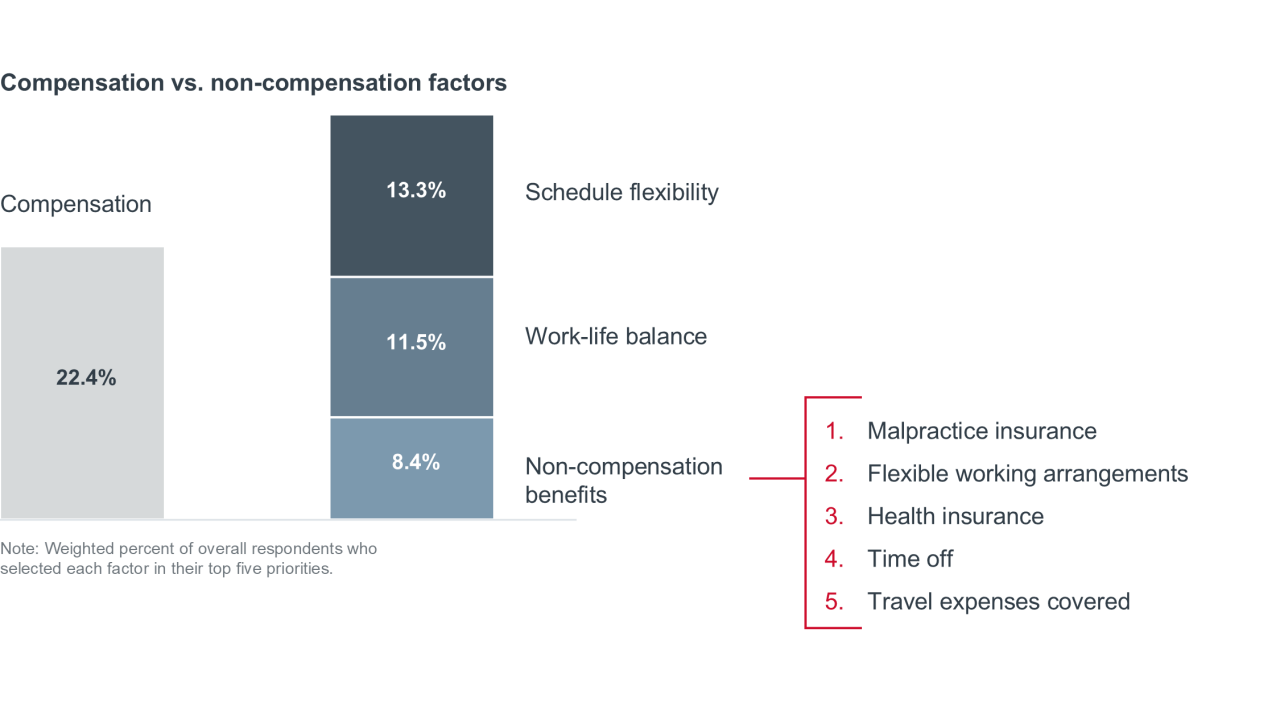

Clinicians across all roles, generations, and employment models consistently prioritized compensation above all other factors. However, when taken together, schedule flexibility, work-life balance, and benefits outweigh compensation alone. While organizations can’t control geographic location — the other non-compensation factor in the top five — they can inflect these three.

Individually, these factors may not be enough to win talent, but delivering effectively against all three in combination can outweigh preferences for compensation — and outcompete organizations that rely on compensation alone to attract candidates.

This is good news for employers. As it becomes increasingly hard to out-pay competitors, this data reinforces that non-compensation factors can and do make up the difference. Instead, organizations should turn their focus to schedule flexibility, work-life balance, and benefits to differentiate themselves.

You can see the top five benefits that clinicians value in the graphic above. Next, we dive deeper into what it looks like to deliver on schedule flexibility and work-life balance.

Clinicians don’t want to work less. They want increased flexibility around when they work

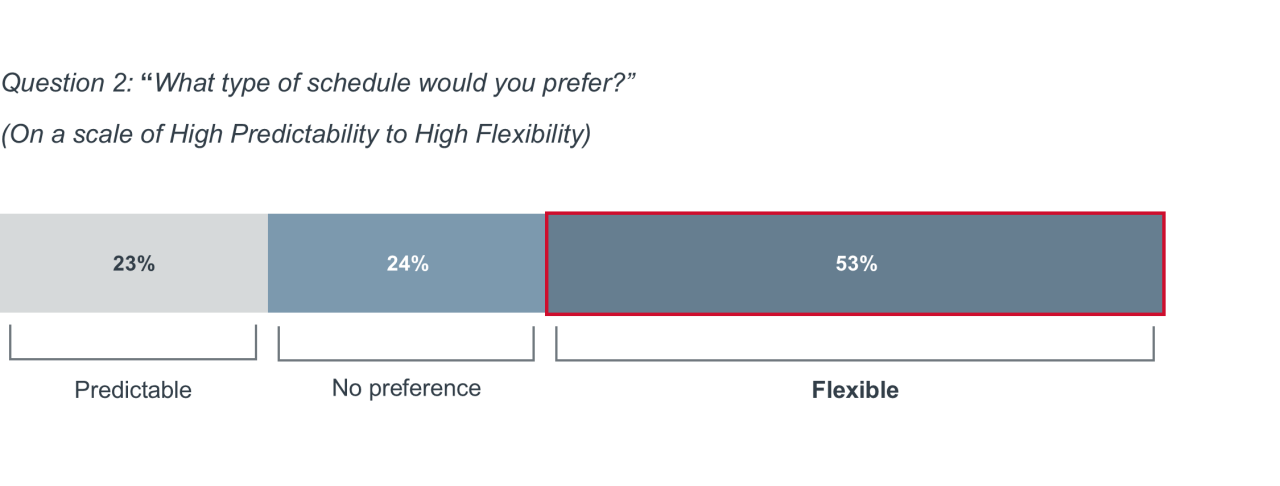

Leaders have anecdotally reported a growing interest in part-time work, but our survey found that W-2 employed clinicians overwhelmingly preferred a full-time schedule. However, most clinicians — employed and contracted alike — preferred a more flexible schedule to a predictable one.

These responses show what schedule flexibility means to clinicians. It isn’t about working less. It’s about more flexibility around when they work.

Question 1: “What type of work schedule do you prefer?”

Top three responses

- Full-time, fixed schedule

- Flexible, variable shifts

- Part time

Note: Responses only collected from W-2 employees

To clinicians, work-life balance means more time

When it comes to work-life balance, clinicians are most concerned with time. Four of the top five work-life balance components ranked by clinicians (listed below) are about time — and the other is flexible scheduling. Organizations should implement proven workflow interventions to save time in clinician schedules in addition to offering paid time off.

“What work-life balance components are most important to you?”

- Adequate time for family commitments

- Flexible scheduling options

- Paid time off

- Coverage when taking time off

- Adequate time for rest and relaxation

Finances and flexibility also motivators for clinicians with a second job

We saw similar preferences among clinicians with a second job. More than one-third (36%) of respondents had a second job, and 75% of those second jobs were 1099 independent contractor positions. In line with our other findings, financial reasons and schedule flexibility were the top motivations for seeking a second job.

- Financial reasons

- Schedule flexibility

- Personal interest or passion

- Skill diversification

- Professional development

Action: Meet the market on compensation. Outperform on schedule flexibility, work-life balance, and benefits.

Regardless of age or role, clinicians consistently prioritized the same five factors when selecting a job. While organizations must meet baseline market expectations for compensation to effectively compete for talent, a recruitment strategy anchored around pay is unsustainable. Instead, differentiate yourself in other areas that clinicians value: schedule flexibility, work-life balance, and benefits. |

No employer type is the definitive “winner"

Clinicians today have more practice options than ever before. To assess clinician experience by employer type, we compared data across four categories: compensation, work-life balance, clinician loyalty and work environment. Ultimately, corporate and independent medical groups “tie” for best employer, with each ranking highest in two of four categories. Health systems were consistently in the middle of the pack — except for compensation, where they ranked lowest.

Clinician experience: Top ranked employer type by category

Determining the “best” type of employer is also difficult when breaking out responses by age group. However, two notable trends emerged. First, independent medical groups almost exclusively ranked highest on work environment, claiming the top spot in five out of six age groups. Second, clinicians under 30 were the only age group with a different winner compared to all clinicians combined across every single category, highlighting the unique experiences of early career clinicians relative to those in the middle or late stages of their careers.

Clinician experience by generation: Top ranked employer type by age group

| Age cohort | Compensation | Work-life balance | Clinician loyalty | Work environment |

|---|---|---|---|---|

| ≤30 | Hospital/health system | Independent | Hospital/health system | Corporate |

| 31-40 | Corporate | Corporate | Independent | Independent |

| 41-50 | Corporate | Hospital/health system | Hospital/health system | Independent |

| 51-60 | Independent | Corporate | Independent | Independent |

| 61-70 | Independent | Hospital/health system | Independent | Independent |

| 71+ | Corporate | Corporate/Independent | Hospital/health system | Independent |

Ultimately, this data suggests that the “best employer” is in the eye of the beholder. All employer types have strengths and weaknesses. Depending on their age and unique priorities, individual clinicians may perceive different employers as being the best for them.

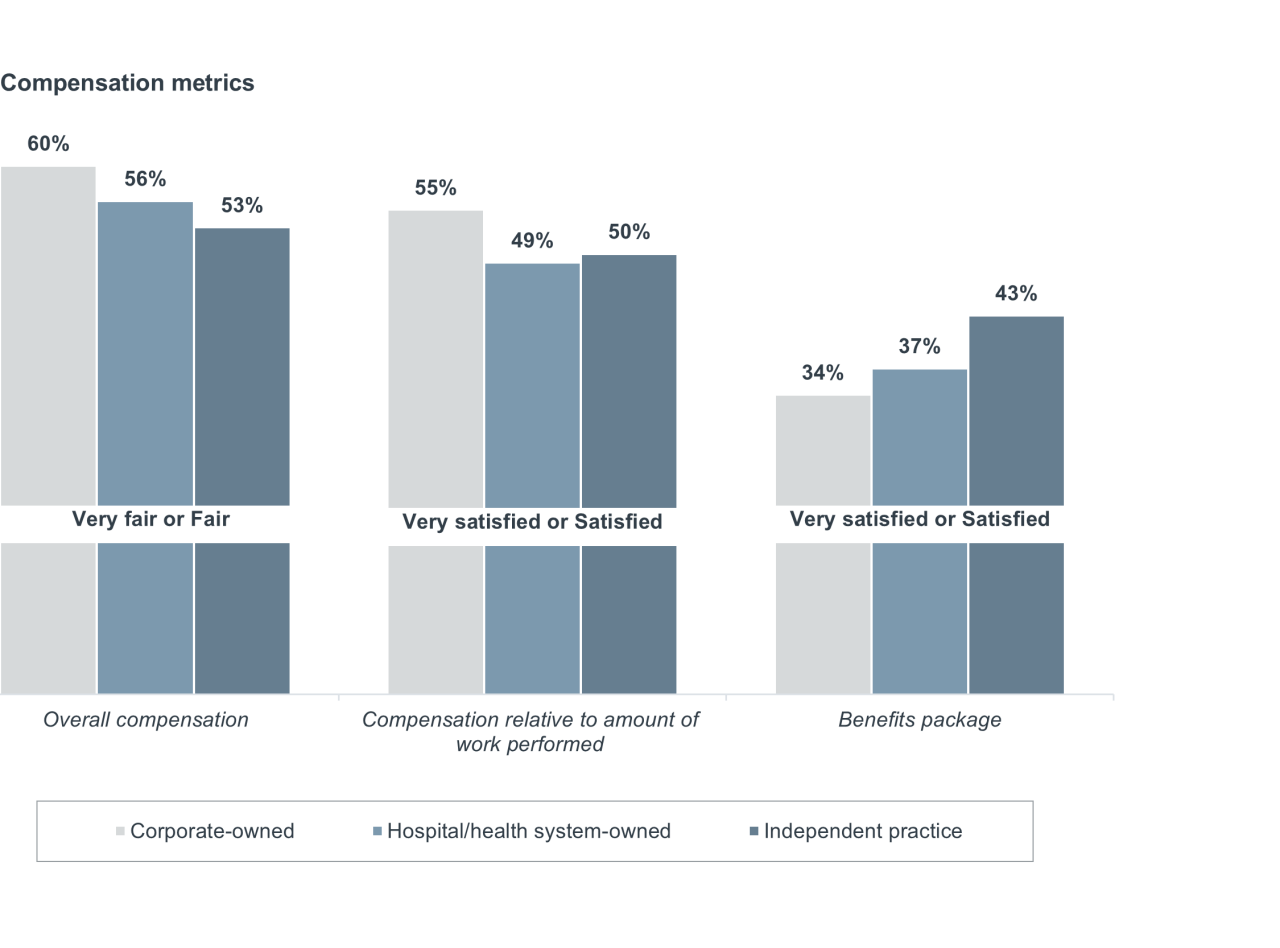

Compensation winner: Corporate medical groups

Health systems and independent medical groups should focus on benefits rather than trying to outcompete on compensation

Corporate medical groups rank highest for both overall compensation and compensation relative to amount of work performed. While competing with corporate-backed medical groups on compensation is difficult for health systems and independent practices, these employers have an advantage when it comes to non-compensation benefits. They perform better than corporate medical groups on benefits, and that is important given satisfaction with benefits is fairly low across the board, ranging from 34% to 43%, relative to the other metrics in our analysis. This means there is more opportunity for improvement on benefits than compensation. Rather than trying to outcompete with corporate medical groups on compensation, health systems and independent practices should leverage their upper hand on non-compensation benefits to differentiate themselves.

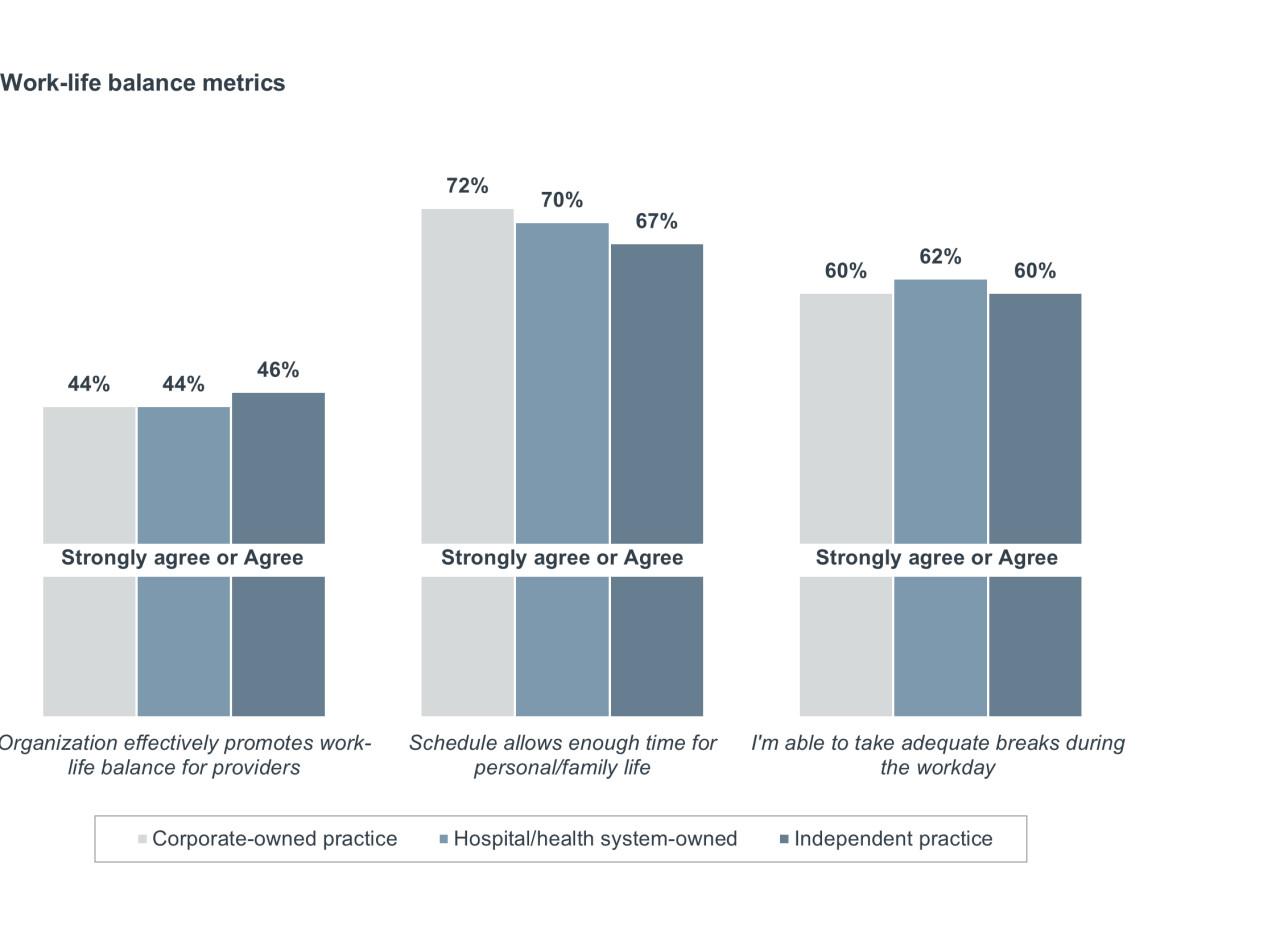

Work-life balance winner: Corporate medical groups

While corporate medical groups lead on work-life balance today, the ultimate winner is still to be determined

On work-life balance, corporate medical groups held a slight edge over other employer types. That said, no one crossed the 50% threshold on the statement, “My organization effectively promotes work-life balance among providers.” Independent medical groups ranked highest at just 46%. All employers have room for improvement on work-life balance which, as discussed earlier in this report, is a top five priority for clinicians. While corporate medical groups lead on work-life balance today, their position is tenuous, presenting an opportunity for health systems and independent medical groups to differentiate themselves in this area.

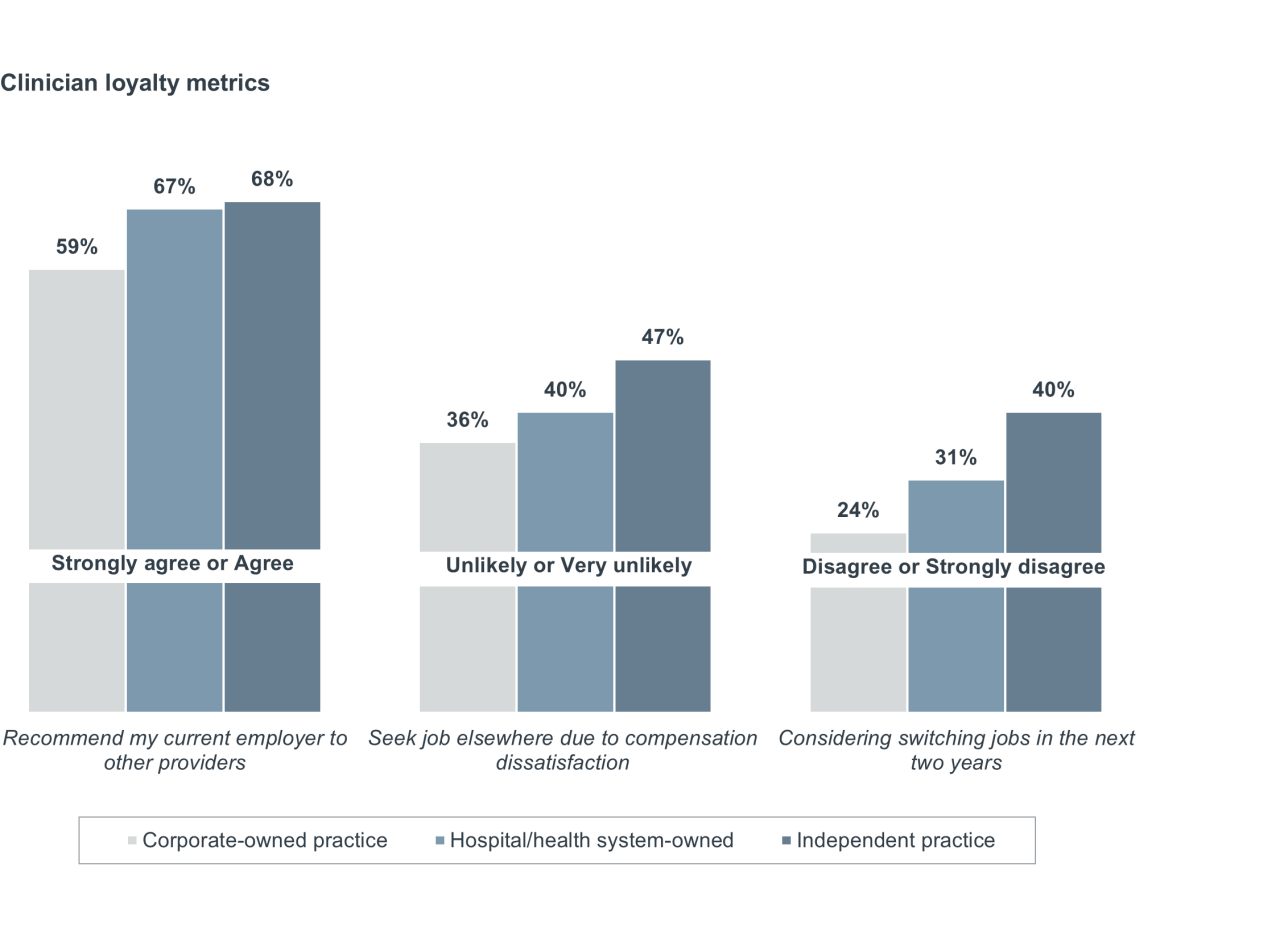

Clinician loyalty winner: Independent medical groups

Though independent clinicians are most loyal, all organizations must strengthen retention efforts

Clinicians at independent medical groups are most loyal to their employer. Interestingly, despite being the least satisfied with their overall compensation, independent clinicians were still the least likely to seek a job elsewhere due to dissatisfaction with compensation. This means factors other than compensation are what keep independent physicians loyal. While independent medical groups took the lead on clinician loyalty rankings, intent to leave remains high across the board. Sixty percent of clinicians at independent medical groups reported that they agreed, strongly agreed, or were neutral about considering switching jobs in the next two years — and an even higher percentage of clinicians from the two other employer types reported the same. As outlined earlier in this report, organizations must break the assumption that satisfied, and even “loyal,” clinicians are guaranteed to stay. All employer types must remain laser focused on retention.

Work environment winner: Independent medical groups and staffing firms

Staffing firms consistently help candidates find work environments that are a better fit

In our analysis, independent medical groups consistently performed highest on work environment metrics, followed by health systems, then corporate-owned medical groups. However, across all practice settings, W-2 employed clinicians who used a staffing firm for their current job scored their work environment an average of 14% higher than clinicians who didn’t use a staffing firm. In other words, staffing firms help clinicians find places to work that they like. While organizations traditionally rely on staffing firms for short-term needs, employers should begin to view these agencies as strategic partners who can support long-term clinician satisfaction and retention.

Average difference in positive response for clinicians who used a staffing firm vs. those who did not use a staffing firm

| Work environment metrics | Used a staffing firm |

|---|---|

| I feel empowered to make decisions that affect my work | + 19% |

| I experience positive recognition for my work | + 18% |

| My workplace promotes cultural competency | + 18% |

| My job handles grievances effectively | + 16% |

| I feel comfortable bringing my whole self to work | + 11% |

| My job's values align with my personal values | + 10% |

| My job encourages collaboration and knowledge sharing among clinicians | + 9% |

| I feel supported by my colleagues | - 4% |

Action: Know yourself, know your competitors.

No employer type is “the best.” Depending on the metric, some employers perform better or worse relative to one another. All organizations should assess their unique strengths and weaknesses as well as the strengths and weaknesses of their competitors to understand their competitive standing. Use this information both to strengthen your own value proposition and to counter your competition. This is especially important for health systems which were in the middle to back of the pack for the metrics in our analysis. |

Methodology

In February 2025, Advisory Board and LocumTenens.com surveyed 739 physicians and advanced practice providers (APPs) about current satisfaction, job preferences, compensation, and work environment. Respondents were W-2 employees and 1099 contractors across independent medical groups, health system-employed medical groups, corporate-owned medical groups, and other practice models including locum tenens.

Descriptive statistics

n = 739

Clinician type

| Practice setting

|

Age

| Employment arrangement

|

Gender

| Geographic distribution

|

LocumTenens.com specializes in optimizing healthcare staffing operations. With a presence in 90% of the nation’s top healthcare facilities and placing more than 7,000 clinicians annually, we are the largest locum tenens agency. Through our suite of innovative staffing solutions, we are committed to helping facilities provide exceptional and uninterrupted patient care. For more than 30 years, LocumTenens.com has been a strategic partner connecting medical professionals with the facilities that need them most.

Learn more about LocumTenens.com

This report is sponsored by LocumTenens.com, an Advisory Board member organization. Representatives of LocumTenens.com helped select the topics and issues addressed. Advisory Board experts wrote the report, maintained final editorial approval, and conducted the underlying research independently and objectively. Advisory Board does not endorse any company, organization, product or brand mentioned herein.

To learn more, view our editorial guidelines.

This report is sponsored by LocumTenens.com. Advisory Board experts wrote the report, maintained final editorial approval, and conducted the underlying research independently and objectively.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.