Auto logout in seconds.

Continue LogoutIt's no surprise that patient volumes are moving away from the inpatient hospital setting and toward outpatient care settings such as hospital outpatient departments (HOPDs), ambulatory surgical centers (ASCs), and physician offices. We know that regulations, such as the removal of a procedure from CMS' IPO or addition of a procedure to the ASC payable list, are a precondition to rapid shift. But we wanted to better understand the timing and magnitude of site of care shifts following regulatory approval.

To do this, we analyzed national claims from CMS' Physician/Supplier Procedure Summary file and Optum's de-identified Clinformatics® Data Mart Database. We examined 27 procedures identified by Advisory Board researchers and members as current candidates for shift, such as total knee arthroplasty (TKA), percutaneous coronary intervention (PCI), and cervical spinal fusion.

What we found was large variation in how procedures shifted, even between those that fall under the same service line or treat similar patient populations. Overall, most procedures shifted to the outpatient setting slowly, and they didn't always follow our expected patterns.

Surprisingly, ASC approval often results in larger shifts to HOPDs than ASCs

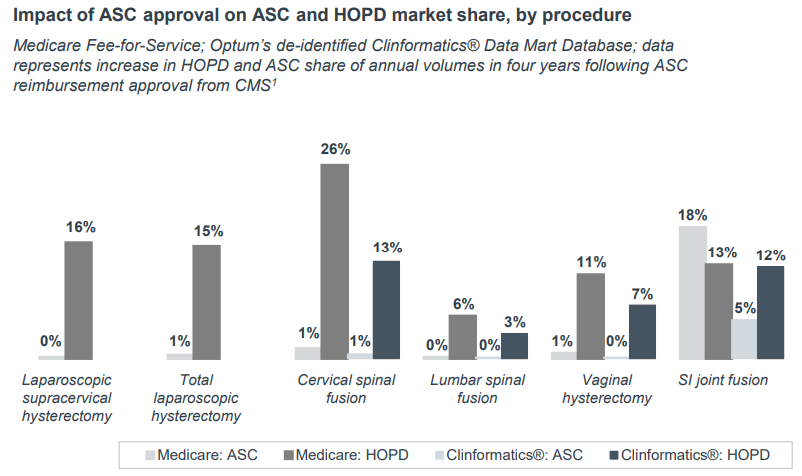

We expected that after procedures were added to the ASC payable list, we would see increased utilization in the ASC setting. However, what we found in our analysis was that this often isn't the case. We looked at the six procedures added to the ASC payable list from 2014 to 2019. For all but one, approval increased HOPD utilization more than ASCs.

The graph below shows four-year changes in utilization, with HOPD growth represented by the darker columns.

Our take

Why would adding a procedure to the ASC payable list drive more movement to the HOPD? While we don't know for sure, we have a few hypotheses. First, we know that market forces impacting outpatient shift are interconnected, and that ASC approval is a strong signal to the market that a procedure can be performed safely outside of the inpatient setting. As to why we didn't see a significant jump in ASC utilization, we can point to a few possibilities:

- Infrastructure: Today, existing ASCs may not have the infrastructure needed to perform certain procedures. For example, catheterization laboratory (cath lab) procedures are an emerging technology in an ASC. This type of infrastructure takes expertise, time, and resources to build, so ASC leaders may choose to take their time before deeming the investment worthwhile.

- Physician alignment: Degree of physician independence varies not only across service lines but markets too. We're less likely to see rapid ASC shift in markets where most physicians are employed or affiliated with hospital-based systems because there's no financial incentive to shift procedural care. However, those markets with a higher degree of physician independence from health systems and ownership stakes in freestanding sites stand to benefit financially from treating patients outside of the hospital because they will earn both the facility and the physician fee.

- Logistics: Adding another site of practice to physician workloads only makes sense if there are enough volumes to balance out schedule disruptions. Physicians may need to hit a threshold of procedures in an ASC to add another facility setting to their schedule.

A note of caution: although our analysis found that most site of care shifts happens gradually, this may not continue indefinitely. Change can happen rapidly. As the ASC payable list continues to expand, infrastructure, physician alignment, and logistic challenges may diminish as physicians, payers, and consumers take a more active role in steering volumes out of the inpatient hospital. Health care leaders need to monitor their local market forces along with regulatory news to anticipate change and make the right investments for current and future care settings.

For a deeper look into how procedures are shifting out of the inpatient setting, download the full quantitative analysis here.

Philips is a leading health technology company focused on improving people’s health and enabling better outcomes across the health continuum from healthy living and prevention, to diagnosis, treatment and home care. Guided and inspired by the purpose to improve 2.5 billion lives per year by 2030, Philips leverages advanced technology and deep clinical and consumer insights to deliver integrated solutions. Headquartered in the Netherlands, the company is a leader in diagnostic imaging, image-guided therapy, patient monitoring and health informatics, as well as in consumer health and home care.

This blog post is sponsored by Philips, an Advisory Board member organization. Representatives of Philips helped select the topics and issues addressed. Advisory Board experts wrote the post, maintained final editorial approval, and conducted the underlying research independently and objectively. Advisory Board does not endorse any company, organization, product or brand mentioned herein.

This blog post is sponsored by Philips. Advisory Board experts wrote the post, conducting the underlying research independently and objectively.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.