Auto logout in seconds.

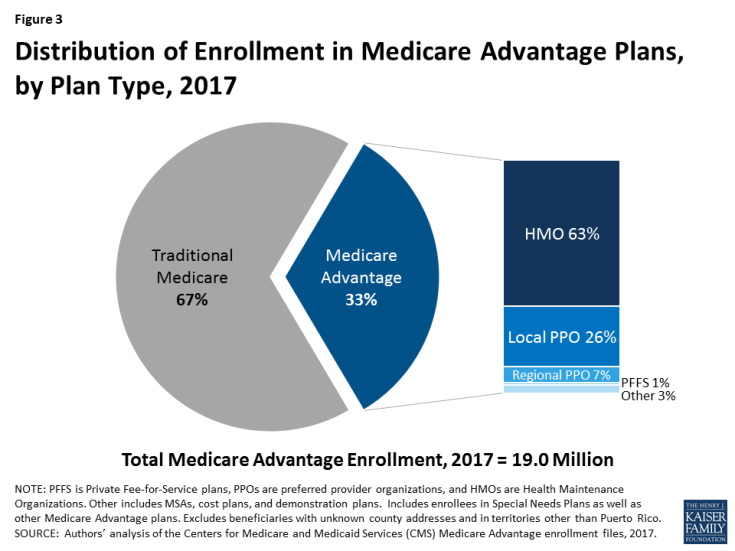

Continue LogoutMedicare Advantage (MA), also known as Medicare Part C, covers 33% of all Medicare beneficiaries—and it is poised to grow even more over the next 10 years. But the program's public-private hybrid approach to health insurance is not always well understood by patients or providers.

Keep reading to learn what Medicare Advantage is, how it works, and how it will affect providers' population health efforts under MACRA's Quality Payment Program. Then, join our experts on Dec. 4 for a webconference that will take a deep dive into Medicare Advantage's role in the health insurance business.

Register Now

What is Medicare Advantage?

Medicare Advantage allows Americans who are eligible for traditional Medicare (Parts A and B for hospital and medical coverage) to receive their health insurance benefits through a plan administered by a commercial insurer, rather than the government.

In 2017, 19 million Americans receive their health insurance through an MA plan, the majority of which are HMO plans.

MA plans must cover all of the services included with Parts A and B of traditional Medicare, but may offer additional services such as dental, hearing, and vision. Prescription drug coverage under Medicare Part D is also available through MA-PD plans, which make up 89% of all MA plans, according to 2017 KFF data.

How does Medicare Advantage work?

Patients enrolled in an MA or MA-PD plan will typically pay their standard Part B premium, just like other Medicare beneficiaries. For those with individual incomes under $85,000 or household incomes under $170,000, the standard 2017 Part B premium is $134 per month.

In addition, MA or MA-PD beneficiaries pay a monthly premium for their MA plan. In 2017, the average premium for MA-PD plans is $36 per month. Some plans offer $0 premiums but require the beneficiary to be responsible for additional cost-sharing in the form of deductibles, copays, and coinsurance. 81% of eligible Medicare beneficiaries have access to a $0 premium MA-PD plan in 2017, but 50% choose plans that require them to pay a monthly premium.

Out-of-pocket costs vary based on the chosen MA plan and whether or not Part D prescription drug coverage is included. Since 2011, CMS has required that all MA plans limit patients' total out-of-pocket costs for in-network hospital (Part A) and medical (Part B) services to $6,700, but has recommend a limit of $3.400 and under. The average out-of-pocket limit for MA-PD plans in 2017 is $5,219.

Medicare pays insurers a fixed amount for MA plans, determined by county benchmarks, enrollees' risk scores, and the plan's quality and performance star rating. Plans must spend at least 85% of the revenue on patient care.

How does Medicare Advantage tie into broader health reform efforts and the shift toward population health?

Insurers in Medicare Advantage receive a fixed amount for each beneficiary they enroll—a capitated payment—regardless of how much care that patient utilizes. That means they face more of a financial incentive to deliver high-value, rather than high-volume, care.

As CMS seeks to shift the health care system toward one focused more on population health and value-based care, MA presents a unique opportunity for providers to boost their reimbursement. MA plans and providers can establish risk-based contracts to share the financial gains if they successfully provide high-value, low-volume care (and to share financial losses if patient care winds up costing more than expected).

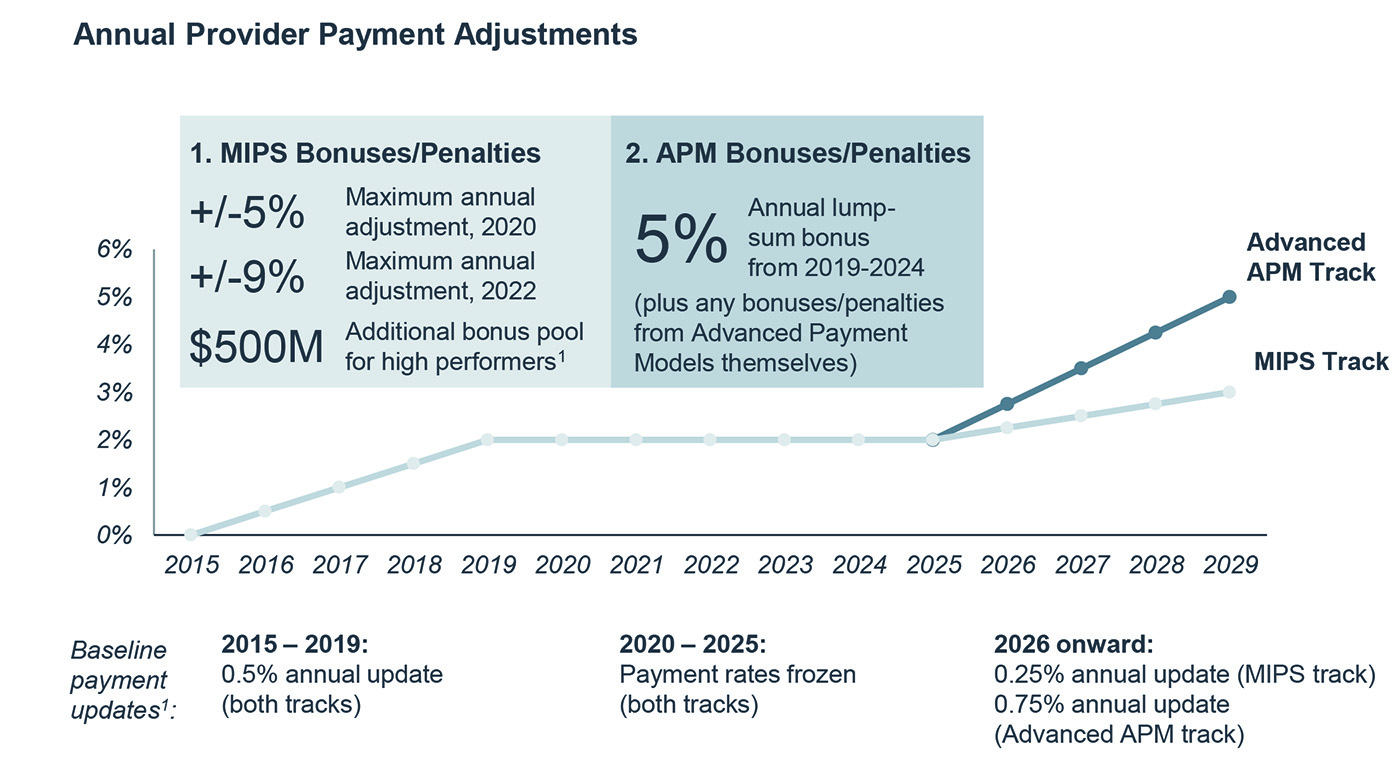

Another factor that is increasingly causing providers to make Medicare Advantage a larger part of their population health strategies is the 2015 Medicare payment reform law known as MACRA. As CMS implements the law, it's exploring options to allow providers to use their Medicare Advantage contracts to qualify for MACRA's Alternative Payment Model track – potentially earlier than anticipated and without the inclusion of traditional fee-for-service Medicare contracts—which could help providers qualify for bonus payments of 5% on their Medicare reimbursements.

To learn more about how providers can make Medicare Advantage part of their risk strategy, read our research report. To learn more about the 2018 MACRA final rule and MA's role in population health, download our white paper and register for our upcoming webconference on the 2018 MACRA final rule.

More about Medicare Advantage

Join us on Dec. 4 for an in-depth review of the Medicare Advantage program, highlighting some of the current policy shifts within the MA industry.

If you missed the first three sessions of our webconference series, you can catch up now with on-demand presentations on health plan basics, commercial insurance, and Medicaid managed care.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.