Auto logout in seconds.

Continue LogoutEditor's note: This popular story from the Daily Briefing's archives was republished on Aug. 29, 2018.

By Scott Orwig, Senior Manager

The U.S. health insurance system is one of the most complex in the world, so we don't blame you if you need a refresher on the basics. Read this post to get an overview of all the different payers, methods of reimbursement, various forms of cost-sharing, and some of the most common types of plans on the market.

Want to learn more about health insurance? Join us for 30-minute webconferences on:

1. Who are the payers?

In the most basic sense, a "payer" is the party responsible for reimbursing the provider for the cost of services rendered. They can be broken down into a few different categories:

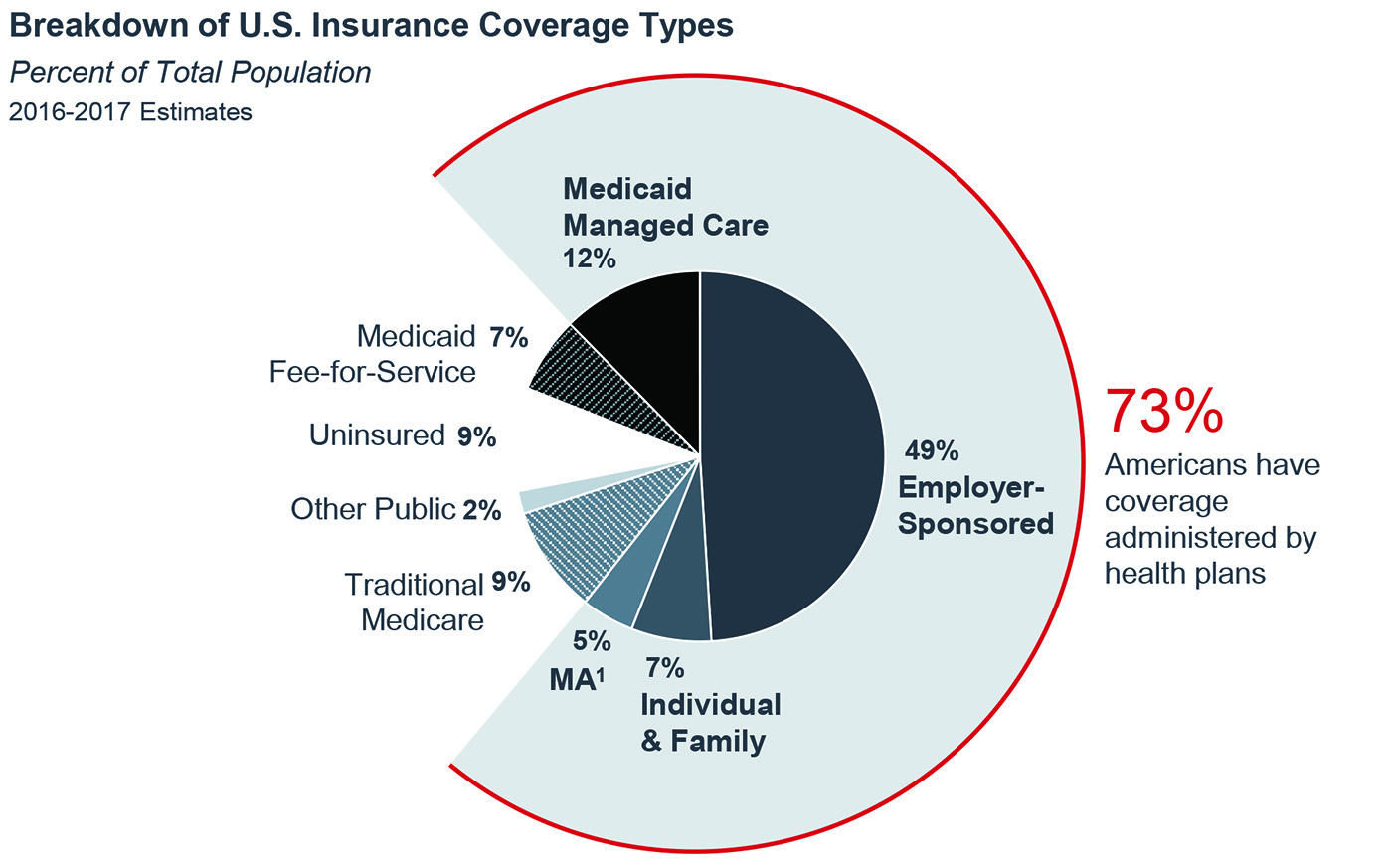

About 73% of Americans have coverage administered by commercial payers, or private health plans:

- 49% have employer-sponsored private coverage, in which members and sometimes their families receive health coverage as a tax-free benefit from their workplace;

- 17% of Americans receive public insurance administered by commercial payers through either Medicare Advantage (Medicare Part C) or Medicaid managed care; and

- 7% have individual and family private coverage on or off the Affordable Care Act's insurance exchanges.

Public payers constitute 18% of the insurance market and are paid for and administered by the government. These payers including Medicare Parts A and B, Medicaid fee-for-service, Veterans Affairs, and TRICARE.

The uninsured currently comprise 9% of the population and pay for their care entirely out-of-pocket when possible, but their care often goes partially or fully uncompensated. In 2015, the American Hospital Association estimated the cost of uncompensated care at $35.7 billion.

Patients who have insurance are also increasingly becoming payers through co-payments, deductibles, and other forms of cost-sharing (more on this below).

2. How do the public and private payers pay?

Payers reimburse providers in a variety of ways. For years, fee-for-service has been the most common method of reimbursement, in which providers bill payers for individual services. A 2016 study published in Health Affairs showed that in 2013, 95% of all physician office visits were billed as fee-for-service.

The growing movement toward population health and value-based payment means an increasing number of providers are seeking to receive payment per patient, not service. To incentivize providers to operate on value instead of volumes, CMS and private payers have created a number of alternative payment models. These include:

- Pay-for-performance: Providers receive higher reimbursement for adhering to evidence-based practice and achieving improved outcomes;

- Bundled payment: Providers are reimbursed for the expected costs of the entire episode of care. This incentivizes efficiency by encouraging better throughput, supply utilization, and contract negotiation; and

- Shared savings: Providers receive payment for implementing chronic care management and disease prevention programs that are meant to promote population health and prevent future utilization of services.

3. How (and how much) do patients pay?

Even once they have insurance, many patients will still incur health costs in a variety of ways. To start, each commercial insurance product and some Medicaid plans have a monthly premium that is paid entirely by the individual, or through financial assistance from an employer. In 2017, the average individual private premium is $393 per month.

Next, each insurance policy dictates how much a patient will pay out-of-pocket for each service in an arrangement known as cost-sharing. Different types of consumer cost-sharing include:

- Deductible: The amount that must be met before insurance begins to pay for the remaining costs incurred. Across all plans, the average deductible in 2017 is $4,328. Plans with higher monthly premiums will typically have lower deductibles;

- Copayment: Commonly referred to as a "copay," this is a fixed amount a patient pays out-of-pocket for a covered health care service; and

- Co-insurance: Similar to copayment, this is the percentage of the cost of services that the patient must pay out-of-pocket.

4. What are the different types of insurance plans, and how do they work?

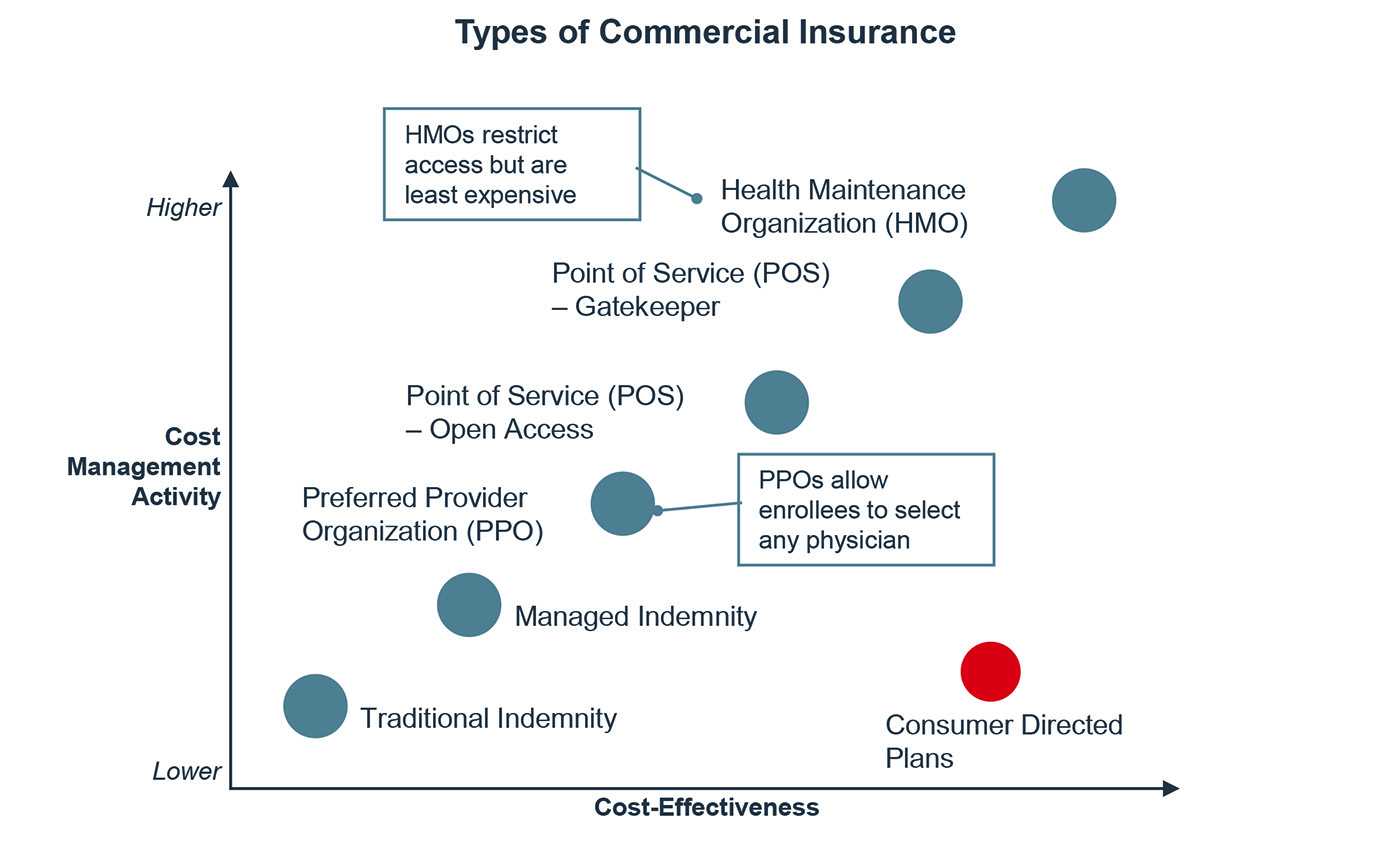

Payers have created a variety of health insurance products designed to appeal to a broad array of consumers. These products are differentiated by the amount of freedom they offer consumers in terms of access to care versus the cost-effectiveness for both the payer and consumer.

Preferred provider organization (PPO) plans have networks of providers contracted at favorable rates. Members can see any provider they like, but pay less for "in-network" providers. These often have higher premiums to offset the lower out-of-pocket costs for members. Historically, PPOs have been the most popular group insurance product, enrolling 48% of covered workers in 2016.

Health maintenance organization (HMO) plans restrict which providers members may access, usually by requiring referrals in order to access specialty services. HMOs are often more cost-effective than PPOs for both payers and consumers, but members may dislike the lack of choices. As of 2016, 15% of patients on employer-sponsored health plans was enrolled in an HMO.

Consumer-directed health plans are an emerging category of health insurance products that aim to motivate members to make more cost-efficient health care decisions. These typically come in the form of a high-deductible health plan (HDHP), in which premiums are low, but the patient takes on a higher cost-sharing burden. To offset the additional out-of-pocket costs, HDHPs are often paired with a spending account:

- Health savings accounts (HSAs): Employees can contribute funds to these individually owned accounts to pay for qualified medical expenses. Patients receive a 100% income tax deduction on annual contributions, capped at $3,400 for individuals and $6,750 for families in 2017; and

- Health reimbursement account (HRA): Unlike HSAs, HRAs are funded exclusively by employers and provide reimbursement for out-of-pocket expenses incurred by the patient.

Consumer-directed health plans are the fastest-growing type of insurance product, with enrollment increasing from 20% in 2014 to 29% in 2016.

5. How do insurers choose covered benefits and providers?

When designing a product, insurance companies must first ensure that the plan is compliant with federal regulations, such as the ACA's essential health benefits requirement. They then try to strike a balance between offering compelling features and setting a price that patients are able to afford.

Insurers may design benefits to get people to act in a certain way, like value-based benefit design in which copays are waived for office visits with a PCP or when choosing generic prescription drugs. They may also attempt to direct patients to specific providers, as with tiered networks where preferred providers have a lower copay than non-preferred providers.

In the case of group insurance policies, insurers often consult with the purchaser about which benefits are most important to cover for the employees. Benefits such as bariatric surgery or fertility treatment are typically negotiated at this stage.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.