Auto logout in seconds.

Continue LogoutCovid-19 has revealed critical shortcomings in the health care supply chain. Shortages of personal protective equipment (PPE), ventilators, and other vital supplies have hindered the U.S. health care system‘s response to this crisis, and additional waves of shortages are likely in coming months.

This crisis has exposed an acute need for leaders across the health care supply chain – from manufacturers to distributors to provider organizations (purchasers) – to re-evaluate legacy strategies that have prioritized efficiency over resiliency. For a more sustainable, reliable supply chain to emerge, all parties must seek opportunities to increase transparency, enhance flexibility, and facilitate greater collaboration.

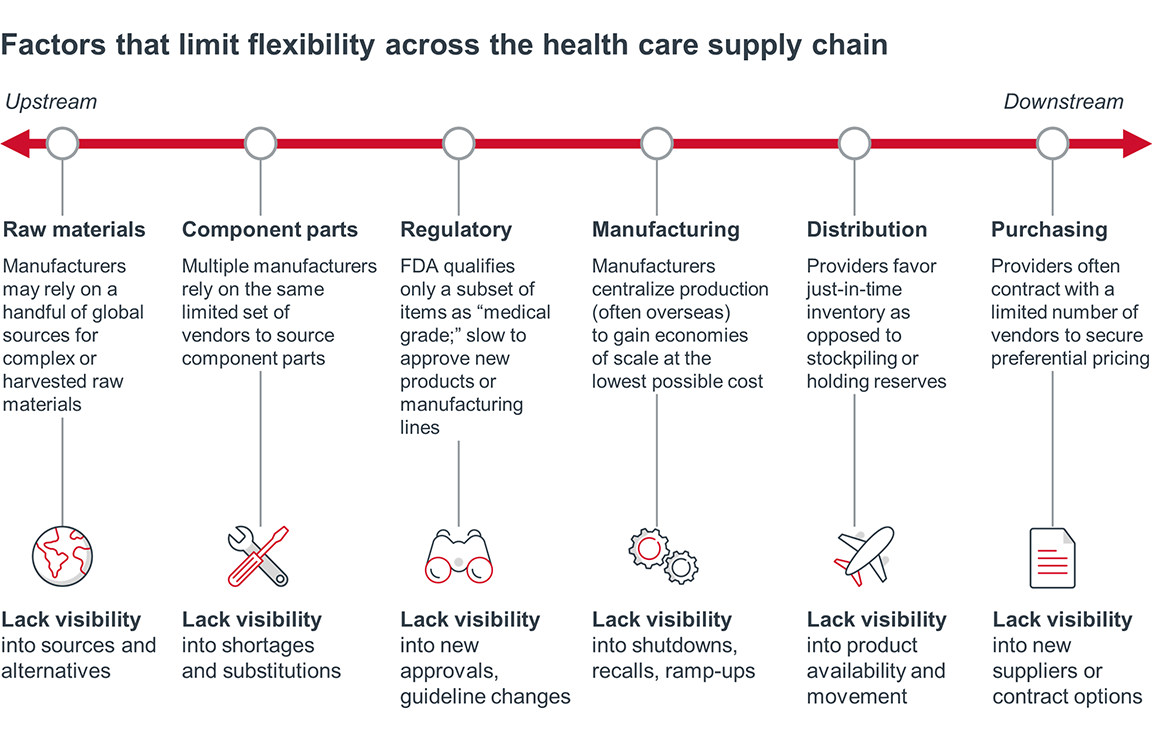

The global health care supply chain is designed to maximize efficiency. At every step of the supply chain, from sourcing raw materials and manufacturing of final products to purchasing, distribution, and ultimate use of those products at medical facilities nationwide, stakeholders aim to eliminate redundancies. In practice, this takes the form of common strategies such as geographic concentration of production, sole-sourced contracts, and “just-in-time” inventory management, all of which aim to cut costs.

To date, these efforts to build efficiency and eliminate costs have been quite successful, but this financial success comes at the expense of supply chain resilience. In pursuit of maximum efficiency, the health care industry created a fragile, inflexible system that was uniquely susceptible to market shocks, be they natural disasters or global pandemics.

The irony here is, of course, that the products with the most volatile demand in a medical crisis are precisely those products health care leaders normally think of as commodities, such as PPE, painkillers, sedatives, and diagnostic testing supplies. For years, stakeholders across the value chain have found more and better ways to squeeze upstream costs in order to produce high quantities of low priced goods for global clinical consumption. In a typical year, provider executives pay little attention to those items, instead focusing on high priced clinical innovations that drive up medical supply budgets, such as specialty pharmaceuticals and implantable devices. Covid-19 exposed the flaw in those priorities: the supply chain for commodity supplies most critical to everyday care lacked the flexibility necessary to adapt to the emerging surge in demand.

However, if manufacturers, distributors, GPOs, and providers had greater supply chain visibility — with more transparency upstream, downstream, and within their own organizations — disaster may have been avoided. Such visibility could enable stakeholders to identify overreliance on individual sources of raw materials or component parts, design high-impact contingency plans, anticipate potential shortages, and proactively shift operations in order to prevent widespread scarcity of critical supplies.

The legacy strategies and business operations that enabled such systemic fragility run through the entire health care supply chain. As a result, all stakeholders must critically assess their contingency plans, their upstream and downstream visibility, and their partner requirements in order to prioritize the changes that enable a resilient supply chain – one truly able to respond in times of crisis.

Contingency planning

Provider organizations must mitigate their supply chain risk by revamping purchasing, contracting, inventory management, and appropriate use guidelines. State and federal governments may mandate some of these changes by requiring minimum inventory levels or local sourcing for essential medical products. Such mandates would inevitably increase costs. But even without government mandates, health systems must adapt their supply chain processes and priorities within the broader context of immense margin pressures, thus requiring a delicate balancing act between efficiency and resiliency.

Manufacturers and distributors should anticipate heightened customer demand for evidence of redundancy and flexibility in all aspects of operations. Many will try to pass these added costs onto their customers – especially if the government requires them to regularly report on supply risks and contingency plans. Regardless of who ultimately absorbs these costs, competition will require manufacturers and distributors to bolster resiliency as cost-effectively as possible and to articulate precisely how their investments will lower customers’ risk of shoddy products or shortages. Risk mitigation will quickly become a customer service differentiator.

Supply chain visibility

Supply chain stakeholders will struggle to build and act on contingency plans without adequate upstream and downstream visibility. Manufacturers, distributors, and providers will need to identify data gaps and inconsistencies that hinder their ability to anticipate and respond to shortages. Existing third party platforms, innovative analytic tools, and new-in-kind collaborations will emerge to fill these gaps, streamline information exchange, and enable the transparency required to optimize both efficiency and resiliency.

Potential responses from stakeholders to build a resilient supply chain

Manufacturers, suppliers, distributors

- Build greater redundancy and contingency plans into manufacturing capabilities

- Consider local sourcing and manufacturing options

- Invest in data infrastructure that enhances supply chain visibility

Governments

- Stockpile critical supplies

- Mandate manufacturer contingency plan reporting

- Remove regulatory barriers to innovation and flexibility in times of crisis

- Enable centralized views into product need and availability

Provider organizations

- Assess supply chain risk during purchasing process

- Include contingency guarantees in contracts

- Stockpile critical supplies

- Invest in infrastructure that provides greater supply chain visibility

Health system leaders cannot solve their supply chain problems alone. They must ask more of their suppliers, distributors, and GPOs – and they must be share more with those partners in return. Below, we outline three requirements for providers and their trading partners seeking a more modern, resilient health care supply chain.

Across industries, manufacturers and distributors have long employed practices to increase efficiency and minimize redundancy, with purchasers and end users reaping the benefits of lower priced goods and services. But cost-saving practices such as geographically concentrated manufacturing or exclusive sourcing agreements come at the expense of supply chain resiliency.

Health care isn’t like other industries. When providers confront medical product shortages, they don’t just risk losing revenue, they risk losing lives. The Covid-19 pandemic illuminated the need for health care product sourcing, manufacturing, distribution, and inventory management to function differently, with a greater emphasis on flexibility and adaptability, even if doing so increases costs.

The need to mitigate supply chain risk does not just apply to critical products like PPE. Many experts predict waves of shortages for supplies including anesthetics and even over-the-counter painkillers throughout 2020 and 2021. As such, all medical suppliers should anticipate customer pressure to showcase their “in case of emergency” contingency plans. Purchasers will hold pandemic-essential suppliers to higher standards of guaranteed availability, but all suppliers should respond to heightened demands for risk mitigation.

Adding redundancy and flexibility into the supply chain inevitably increases costs, the magnitude of which will vary by product and practice. In some instances, adding higher-cost U.S. manufacturing sites may be warranted, but in other cases, suppliers may be able to increase overseas production capacity or diversify raw material sources without adding significant costs.

We don’t yet know how much this added resilience will cost, or who will bear the burden of these added expenses. Most likely, manufacturers, providers, and federal/state governments will all have to shoulder some of this increased financial burden.

Pressure from the government

Legislative and regulatory bodies will put pressure on manufacturers to mitigate future risk. The federal government, via the CARES Act, mandates that certain pharmaceutical companies develop contingency plans, and that other suppliers report discontinuations or interruptions in production. Since the Covid-19 crisis first emerged in Spring 2020, federal lawmakers have introduced over 20 bills to overhaul the drug supply chain. In August, President Trump signed an executive order that will mandate federal agencies purchase US-made pharmaceuticals defined as essential. However, increased production costs in addition to massive pushback from PhRMA and environmental activists makes such mandates unlikely to carry much weight for the foreseeable future.

At the same time, state governments are tasking providers to build contingency plans. For example, New York’s Governor Cuomo will require all New York hospitals to maintain a 90-day supply of PPE. We expect other governors to follow suit.

Pressure from provider organizations

Purchasers will also scrutinize manufacturers’ and distributors’ logistics transparency as well as their delivery performance even more than before the pandemic. Providers already track supply chain performance metrics such as shortages, backorders, on-time delivery, and recalls, but the importance of such metrics will increase. At the same time, many providers will likely favor supply chain partners that can demonstrably flex up production, shift their own suppliers, and move product quickly in the event of a demand surge or supply shock. The importance of price isn’t going away, but a supplier’s transparency, flexibility, and reliability will factor into customers’ “total cost” equations.

At the same time, providers must use a new supply chain playbook to mitigate future risks. But the Covid-19 crisis leaves most providers scrambling to make up significant revenue shortfalls while anticipating a deteriorating payer mix, both of which will constrain their ability to absorb increased costs of added supply chain resiliency. Providers walk a tightrope as they attempt to:

- Revisit established supply chain strategies

- Invest in stockpiles and expanded vendor relationships for critical supplies

- Ferret out savings in other categories or purchasing processes

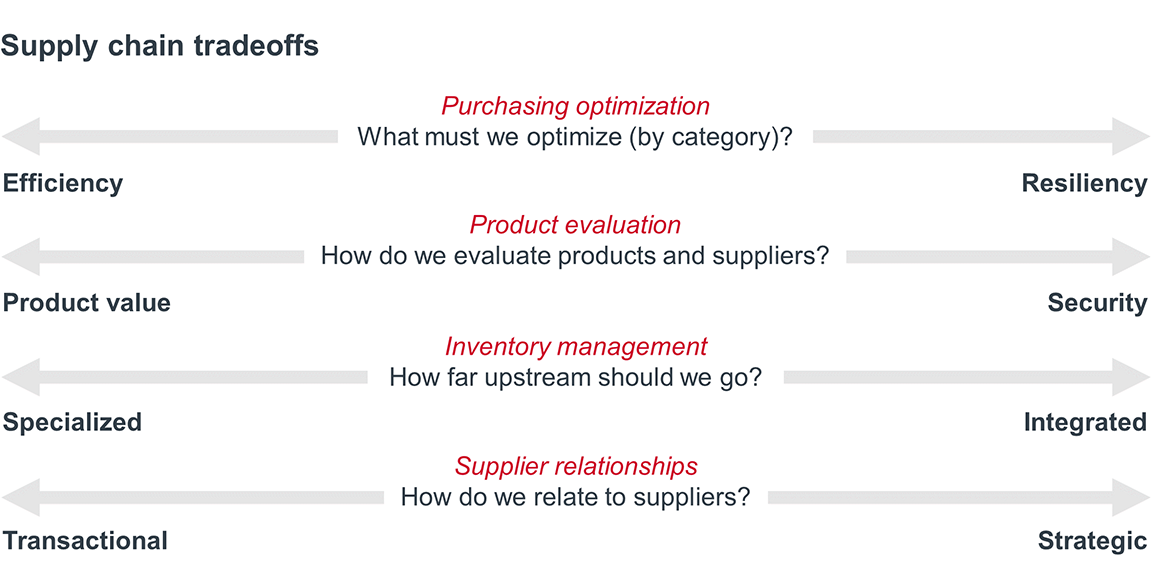

To manage new procurement realities, provider supply chain leaders must make tough tradeoffs, largely guided by their answers to the four key questions.

Purchasing optimization

Provider supply chain executives have to consider which categories warrant increased investment to ensure adequate stockpiles and contingency plans, and which categories can withstand greater standardization in SKUs or vendors in order to reduce costs.

Spending on PPE and other supplies critical to pandemic-related care delivery will almost certainly increase, leaving providers with rapidly declining funds from which to purchase all other supplies. We anticipate that many health systems will accelerate efforts to standardize physician preference items, such as implantable devices, in order to offset spending growth in other areas.

Product evaluation

No value analysis or purchasing committees will willingly sacrifice clinical quality. Instead, progressive providers will likely expand their definitions of value to include key supply chain logistical and reliability metrics, such as shipment accuracy, on-time delivery, percentage of shipments with damaged goods, and percent of backorders; these metrics will be particularly important for emergencyessential categories such as PPE, respiratory products, IV equipment, and dialysis supplies.

Progressive providers and suppliers will also likely seek out trading partners open to more transparent, collaborative arrangements. When managed well, such partnerships can significantly mitigate risk for both parties – guaranteeing prices or product for the purchaser, while guaranteeing volumes for the supplier. Such agreements – which often involve shared investments, shared data, and/or shared risk – require a level of trust, transparency, and effort that fundamentally limits the number of partnerships any one party can successfully manage. As a result, providers and suppliers must choose their strategic partners carefully, while managing their transactional relationships as efficiently as possible.

There is no single right answer for providers seeking to gain resiliency without breaking their budgets. When deciding what to purchase, from whom, in what quantities, and where to store it all – providers must understand the full range of choices available and then navigate tradeoffs based on organizational priorities and local market conditions.

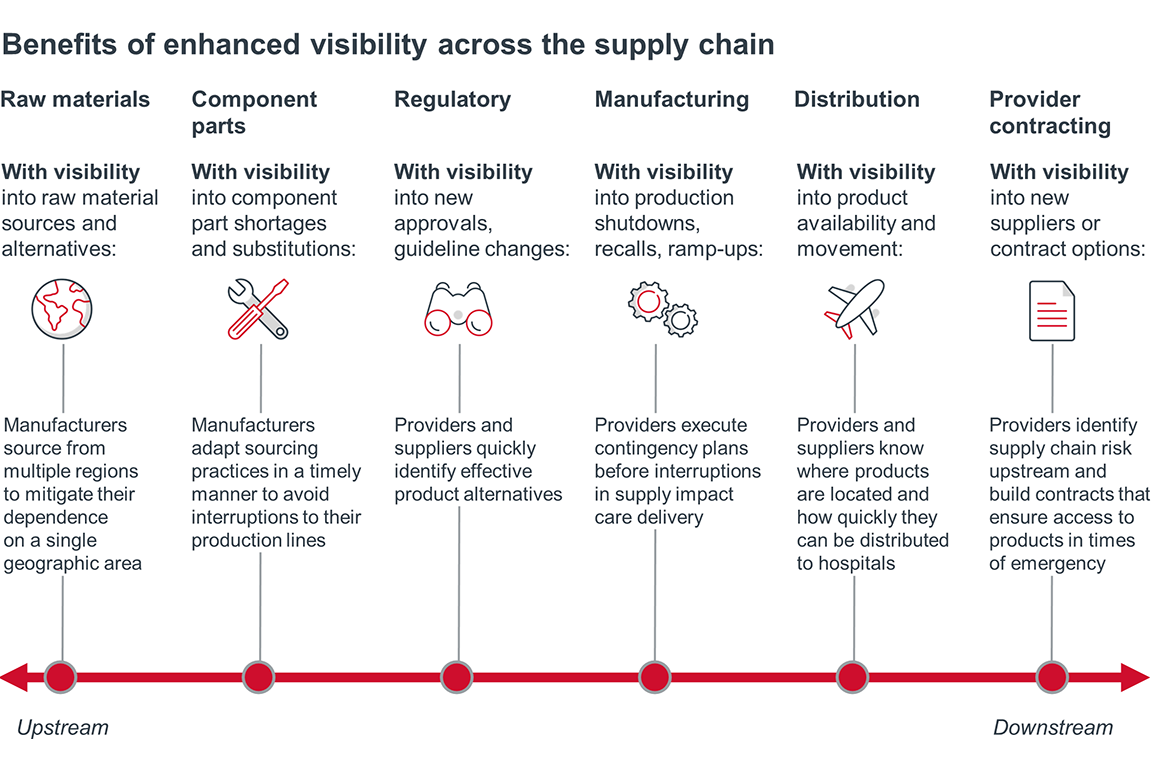

Finally, effective supply chain risk mitigation requires greater upstream and downstream visibility. Health care leaders will fail to build a resilient supply chain without investments in tools enabling greater data visibility and analytics; those tools must function both within organizations and across stakeholders.

If supply chain executives had greater upstream and downstream visibility, they could have identified alternative sources, they could have predicted shortages by monitoring demand spikes, and they could have proactively re-allocate resources to mitigate, or even avoid, catastrophic storages.

Internally, provider organizations should build clear lines of communication between supply chain and IT departments. This enables both groups to understand current capabilities and determine new analytic requirements.

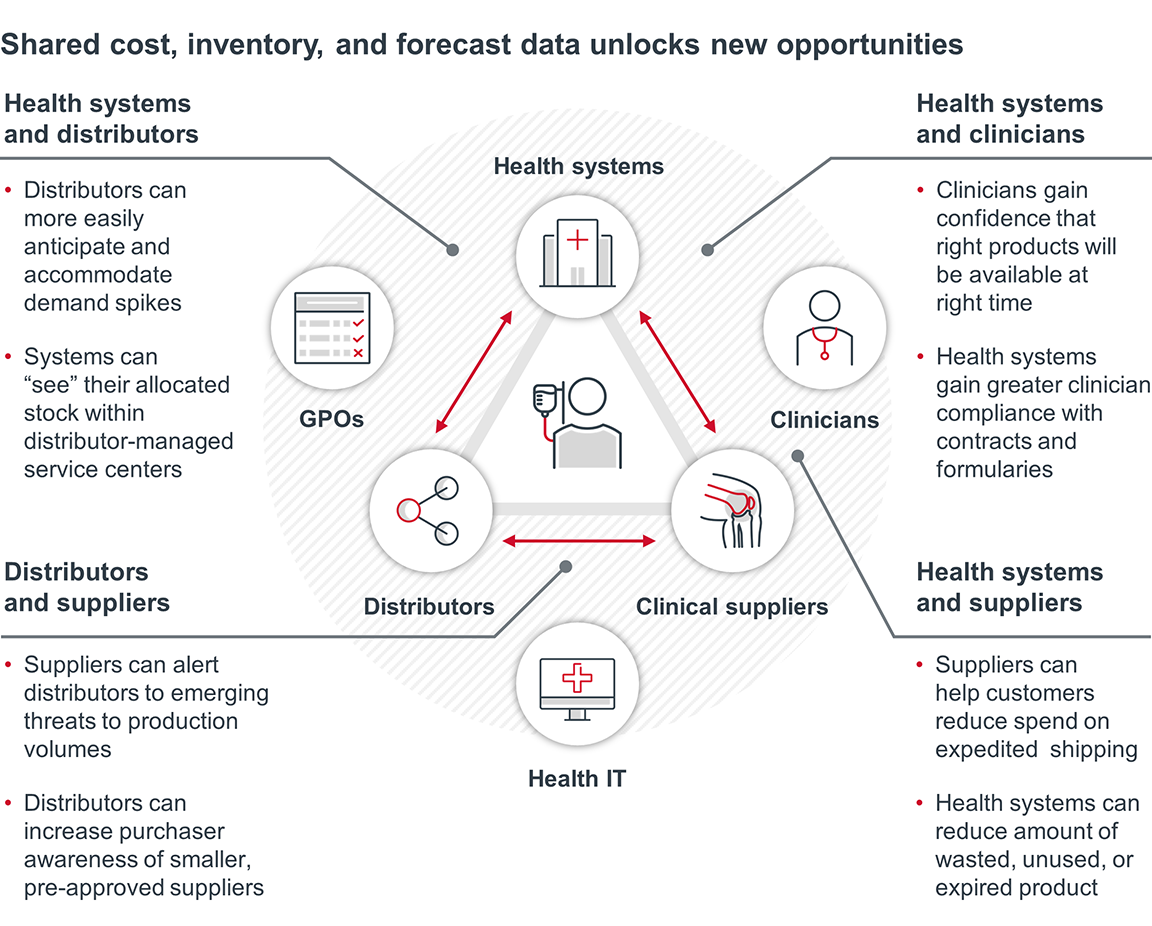

Stakeholders also need visibility into other parties’ supply and demand in order to effectively balance flexibility and efficiency. Providers need access to a wider range of suppliers; suppliers and distributors need real-time insight into providers’ demand and use rates in order to appropriately allocate goods.

Increasingly, supply chain stakeholders are likely to rely on third parties to create objective sources of truth about supply, demand, and even quality. Platforms such as GHX or IBM’s Rapid Supplier Connect can help purchasers find and vet suppliers. Value and evidence assessment services, such as Lumere and ECRI, can help supply chain teams compare similar products in order to identify appropriate alternatives.

A more transparent supply chain will optimize both flexibility and efficiency by providing stakeholders with broad insight into available sources of goods and services, the locations of those goods and services, the buyers with the greatest need for those goods and services, and viable alternatives to those goods and services before interruptions occur. For providers and purchasing coalitions alike, including GPOs, enhanced data visibility fundamentally increases the likelihood that supply efficiently meets demand– even during a natural disaster or global crisis.

Achieving such transparency in the U.S. will not be easy. Competing health systems may not be eager to share data on available equipment or anticipated need; competing suppliers may be hesitant to disclose the locations of their manufacturing sites and intricate product sourcing networks. In the absence of self-disclosure, purchasers and manufacturers will find no shortage of third-party exchange platforms and analytics vendors offering enhanced data visibility. The market is ripe for disruptive innovators and creative collaborations that aggregate and illuminate manufacturing, distribution, and purchasing data across the health care supply chain.

Case in point: New York teamed up with six other states to form a Northeast regional purchasing consortium, outside the bounds of any GPO, that is committed to pooling information on both supply and demand. It represents hundreds of hospitals and over $5B in purchasing power.

While initially focused on PPE, respiratory equipment, and testing supplies, the consortium plans to expand the range of supplies it purchases over time. They also plan to pool their information on supplier quality, reliability and integrity.

State leaders developed this model in response to the Covid-19 crisis. With greater purchasing power and enhanced supplier vetting, participating providers have added security that they will have the supplies they need to care for patients during Covid-19 surges or other unforeseen medical shocks.

The size, scope, and ambition of this regional purchasing consortium raises interesting questions about the value of systemness and the role of third party intermediaries during national crises. Will former competitors continue sharing data post-Covid-19? Will the partnership extend deeply into non-Covid-19 related products? Will the coalition’s massive scale afford participants greater inventory visibility, volume guarantees, or prices than large systems could achieve on their own? And, perhaps most critically, will such regional coalitions and data exchanges threaten the currently stable position of GPOs? Only time will tell.

Health care provider organizations will almost certainly adapt their supply chain strategies, priorities, processes, and partnerships in the short-term. But true resiliency requires longer-term solutions. The supply chain shortcomings illuminated by Covid-19 will likely catalyze a data revolution, enabling providers and their trading partners to more thoroughly assess risk and more regularly track both supply and demand. Only through such increased visibility can all of the essential stakeholders build a more resilient health care supply chain.

Questions providers should be asking:

- Which of our supply chain strategies are non-negotiable and must remain in place post-crisis? Which strategies can we adjust to build resilience?

- Where might we consider moving further “upstream” to have greater control of our own supply chain (e.g., storage, distribution, production, assembly)?

- How can we elevate the role of supply chain leaders to enhance oversight and manage long-term purchasing strategy?

Questions suppliers should be asking:

- How much are we willing to invest in our contingency plans? How will supply chain resilience impact the perceived value of our products and partnerships?

- Which parts of our own supply chain are most vulnerable to shocks in weather, labor, transportation, regulation, or production?

- To what extent is it feasible to source and manufacture products locally? How much of our production should we do domestically?

Questions everyone should be asking:

- What strategies can we employ to offset the increased costs of supply chain resiliency?

- What data infrastructure do we need to gain greater visibility into the supply chain, both upstream and downstream?

- What platforms or software vendors may help us “see” our own performance – and our partners’ performance – more clearly?

For more takes on how Covid-19 is reshaping the future of the U.S. health care industry, please visit www.advisory.com/covid-19impact

How will Covid-19 impact…

Demand

+ …the health status of the U.S.?

+ …telehealth?

+ …behavioral health?

+ …senior care?

Purchaser Landscape

+ …payer enrollment mix?

+ …employers’ health benefits strategies?

+ …the government’s role in health care?

+ …the future of value-based care?

Competition & Innovation

+ …disruptive market entrants?

+ …public perception of the industry?

+ …health system philanthropy?

+ …the health care innovation pipeline?

Operating Models

+ …”systemness” efforts?

+ …capacity expectations?

+ …the structure of the U.S. supply chain?

+ …the future of the clinical workforce?

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.