Auto logout in seconds.

Continue LogoutMerging two major health systems can present daunting managerial and political obstacles, and increasingly, systems are navigating that "tightrope" by keeping both systems' CEOs on board—and asking them to split the CEO role, Alex Kacik writes for Modern Healthcare.

Learn 4 ways to unlock cost reduction through effective integration

Kacik spoke with health system CEOs and other industry experts to learn more about what works, and doesn't, in the dual-CEO model.

Why health systems are turning to dual CEOs

Dual-CEO models can work as a "bridge to completing a deal" between health systems that might otherwise be skeptical of a merger, and it can be a "potentially successful short-term solution," Kacik writes.

Still, most organizations view the arrangement as a short-term practice. Michael Buchanio, a principal at West Monroe Partners' health care practice, explained, "It's usually a temporary solution after a big merger."

If the arrangement goes on too long, he added, it may hinder the effectiveness of the merged entity. He said, "It really makes it difficult for departments to collaborate. It perpetuates the siloed culture."

For that reason, when Greenville Health System and Palmetto Health merged to become Prisma Health, co-CEOs Michael Riordan and Charles Beaman Jr. were given only one-year contracts. After that time period, the health system will select a new CEO to take over.

Similarly, while Hackensack Meridian Health had dual CEOs for about two years after it was created via a merger, that arrangement wound down when co-CEO John Lloyd retired in December 2018.

Robert Garrett, the system's current CEO, who previously served as co-CEO with Lloyd, said there was no power struggle between him and Lloyd, nor was there any ambiguity, as a succession plan had been created early in the merger.

Under Hackensack Meridian's model, the hospitals, physicians, and academic and research divisions reported to Garrett, while the ambulatory, population health, and post-acute departments reported to Lloyd. Meanwhile, departments like finance, human resources, and strategic planning reported to both.

Garrett and Lloyd would meet each Monday morning for overlapping areas, and according to Garrett, they agreed about 95% of the time. On the occasions when they disagreed, they were able to resolve their differences internally.

"It really didn't slow the decision-making process," Garrett said. "Looking at what we accomplished in the past two years, we were able to move quickly and complete some major initiatives. We had a good communication structure and didn't get caught up in bureaucracy."

One secret to success? Define roles carefully.

One key to operating a dual-CEO system successfully, according to Tom Giella, chair of health care services for Korn Ferry, is to define roles clearly from the beginning. Without such clear boundaries, the model can unravel—especially if the CEOs don't share mutual trust, according to Giella.

Advocate Aurora Health is able to operate under a dual-CEO model with executives Jim Skogsbergh and Nick Turkal because each has a defined role—with Skogsbergh overseeing the organization in Illinois and Turkal overseeing it in Wisconsin.

Similarly, CommonSpirit Health, the result of the merger between Catholic Health Initiatives and Dignity Health, also operates under a dual-CEO model with clearly-defined roles. Co-CEO Lloyd Dean oversees clinical, financial, and human resources departments while co-CEO Kevin Lofton oversees advocacy, compliance, IT, international business, legal, philanthropy, system partnerships, and governance.

Another key to success is communication, according to Paul Bohne, a managing partner and leader of executive search firm Witt/Kieffer's health care practice.

"Co-CEOs almost need to work double time around communication-related issues to prevent any internal challenges," Bohne said (Kacik, Modern Healthcare, 3/9).

Learn more: 4 ways to unlock cost reduction through effective integration

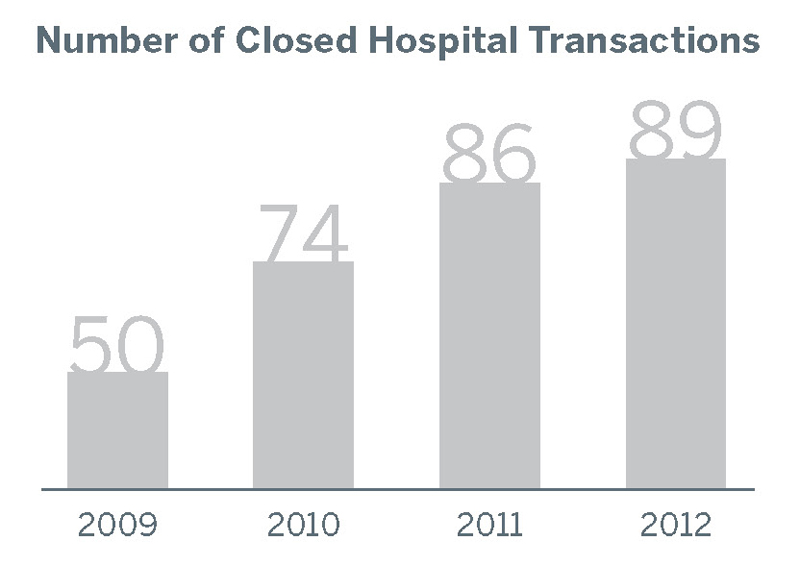

The pace of hospital merger and acquisition (M&A) activity is increasing in both deal count and total value. However, cost reduction is rarely the primary strategic objective of these deals. As a result, operational integration and cost reduction post-merger is falling well short of potential.

We’ve identified four principles for cost-focused integration that can help ensure that newly acquired organizations become part of the solution, rather than part of a bigger cost problem. These principles are illustrated through in-depth, action-oriented profiles of Cleveland Clinic, UPMC, and Kaleida Health.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.