Auto logout in seconds.

Continue LogoutBundled-payment programs are designed to incentivize providers to deliver value-focused care. They are encouraged to do so by advancing the coordination and efficiency of care while also improving quality and outcomes at lower costs. As with other health care initiatives, some providers are wondering: How does the bundled payment model work? And how can you earn financial incentives?

As a field sales rep, an account executive, a medical liaison, or a customer service manager, you need to understand the basics of bundled-payment programs, how providers can participate, and the challenges associated with bundled payments.

In part three of our five-part educational series, you’ll learn what bundled-payment programs are and get an introduction to the Bundled Payments for Care Improvement (BCPI) program, the BPCI Advanced program, and the Comprehensive Care for Joint Replacement (CJR) program.

Check out the below article to get a preview and download part three of our complimentary resource to learn more.

Infographic: Field Guide to Medicare Payment Innovation

What are bundled-payment programs?

Bundled-payment programs are two value-based programs designed to incentivize providers to deliver value-focused care. What makes these programs unique is that they hold providers financially accountable for the cost and quality of care for a particular “episode.” An episode of care is the entire course of treatment for a specific condition or medical event and includes all inpatient and outpatient care.

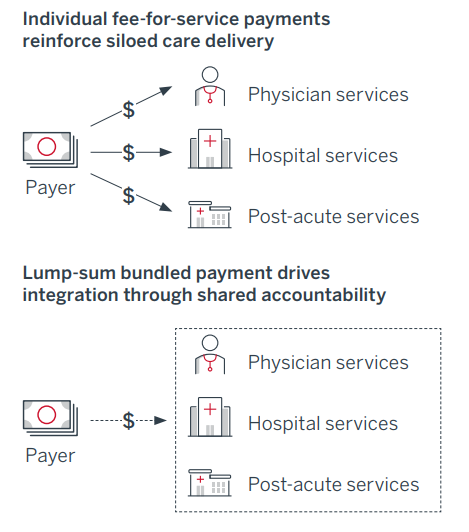

In a traditional fee-for-service (FFS) payment model, providers are reimbursed in a siloed manner. Physicians are paid for the services they deliver, hospitals for the services they deliver, and so on. Bundling, on the other hand, is a payment system in which a group of providers (e.g., hospitals, physicians, and post-acute care providers) are given a lump sum to cover the cost of care for an entire episode.

Bundled payments reduce overall costs by paying the group of providers responsible for an entire episode of care less than the sum of what the payer would have given to each individual provider under a fee-for-service model. This means that providers from all sites of care must coordinate and reduce the overall cost.

Bundled payments are fundamentally different from FFS

What are shared-savings programs? Learn more.

Participating health care providers can realize either a gain or loss through bundled-payment programs. The incentive for providers to participate comes in the form of gainsharing: if providers can efficiently deliver care for less than the target amount, they all share in the savings. On the other hand, bundled payments also expose providers to downside risk: if providers’ costs exceed the target amount, then they are financially responsible to cover the difference. This system incentivizes the entire group of providers to coordinate on total cost of care across an entire episode.

While there are only two active programs under the bundled payment umbrella, there have been three programs in total. Bundled Payments for Care Improvement (BPCI), was the first iteration that CMS implemented. However, that program is now inactive and BPCI Advanced has taken its place. The other active program is Comprehensive Care for Joint Replacement (CJR).

To learn more about the Bundled Payments for Care Improvement (BPCI) program, the Bundled Payment for Care Improvement (BPCI) Advanced program, and the Comprehensive Care for Joint Replacement (CJR) program, download part three of our complimentary resource, Medicare and the Transition to Value-Based Care.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.