- What CEOS need to know about healthcare

- 9 data-driven insights on senior preferences

- The 10 major trends impacting health systems in 2023

- 12 technologies clinical workforce challenges

- Recommendations for stabilizing the RN workforce

- AI field guide

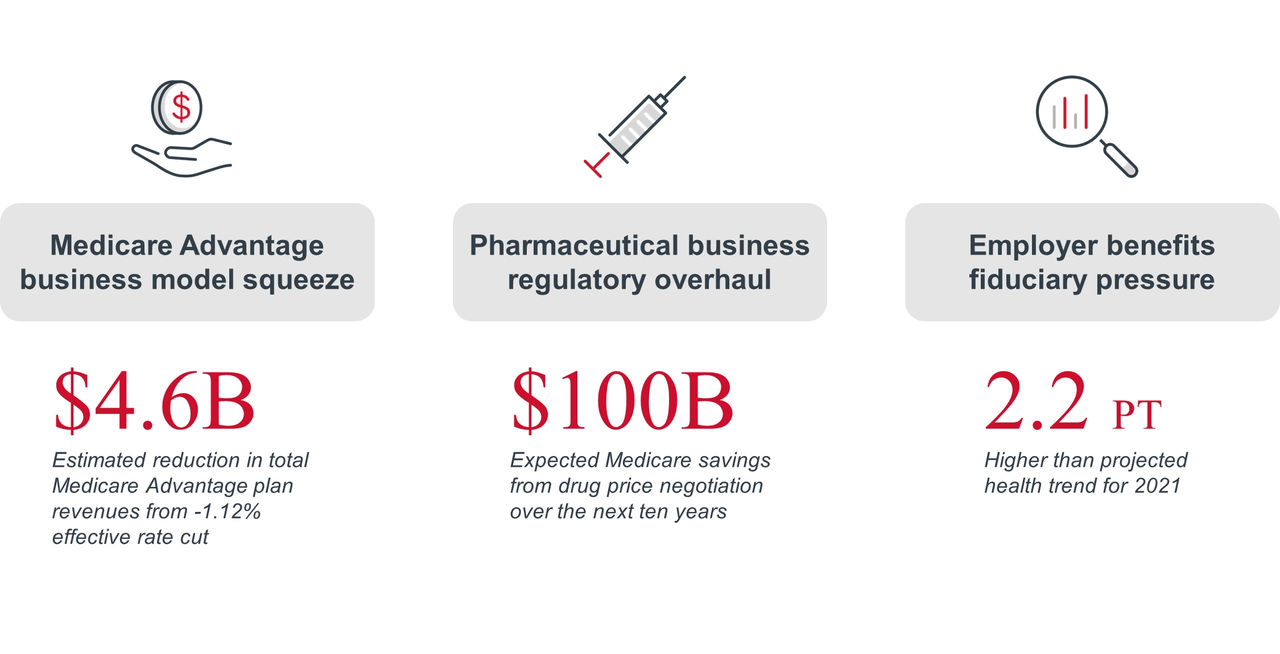

- Policy and payment

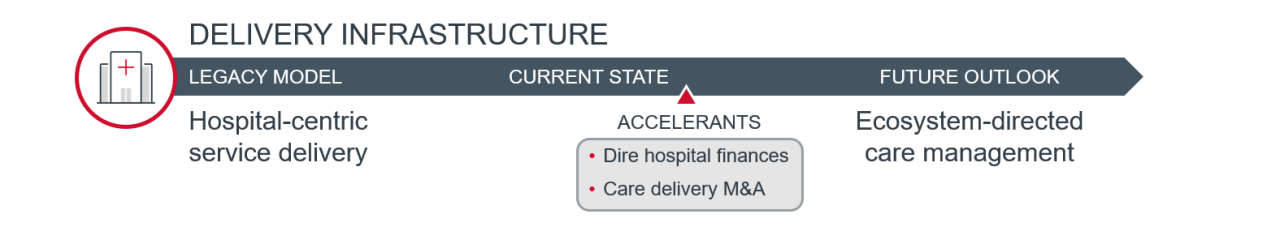

- Provider corporate strategy

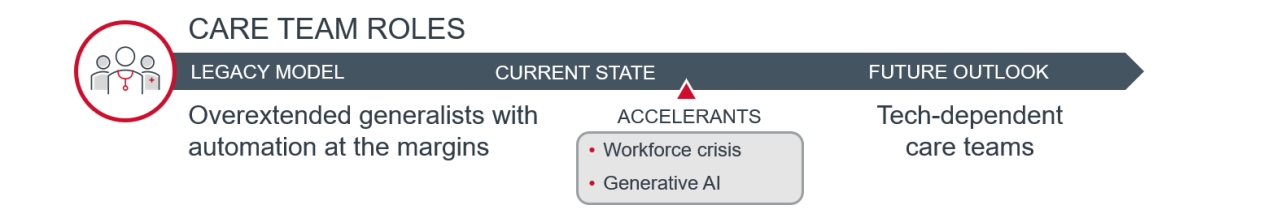

- Workforce and technology

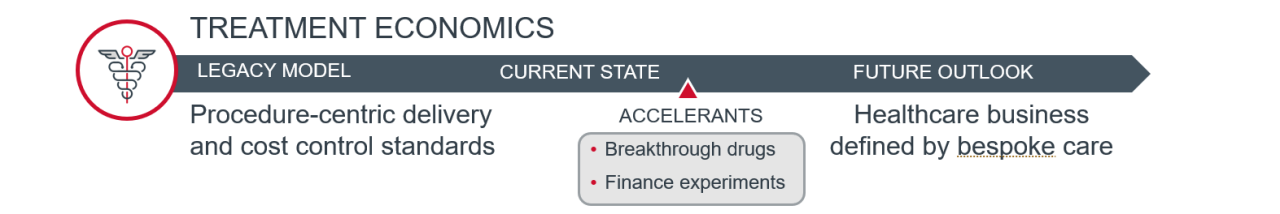

- Treatment economics

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

Unlimited access to research and resources

Member-only access to events and trainings

Expert-led consultation and facilitation

The latest content delivered to your inbox

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.Benefits include:

Unlimited access to research and resources

Member-only access to events and trainings

Expert-led consultation and facilitation

The latest content delivered to your inbox